Wilmington, Delaware-based DuPont de Nemours, Inc. (DD) provides technology-based materials and solutions. With a market cap of $16.7 billion, the company offers a diverse range of products, such as construction materials, adhesives, electronics, fabrics, fibers, home garden, medical devices, resins, printing, and consumer products.

Shares of this chemical giant have outperformed the broader market over the past year. DD has gained 14.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14%. In 2025, DD’s stock rose 26.1%, surpassing the SPX’s 16.2% rise on a YTD basis.

Zooming in further, DD’s outperformance is also apparent compared to the Materials Select Sector SPDR Fund (XLB). The exchange-traded fund has declined about 8.3% on a YTD basis. Moreover, DD’s double-digit returns on a YTD basis outshine the ETF’s 3% gains over the same time frame.

On Nov. 6, DD shares closed down more than 1% after reporting its Q3 results. Its revenue stood at $3.1 billion, up 7.3% year-over-year. The company’s adjusted EPS came in flat year-over-year at $1.09.

For the current fiscal year, ending in December, analysts expect DD’s EPS to decline 53.8% to $1.88 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

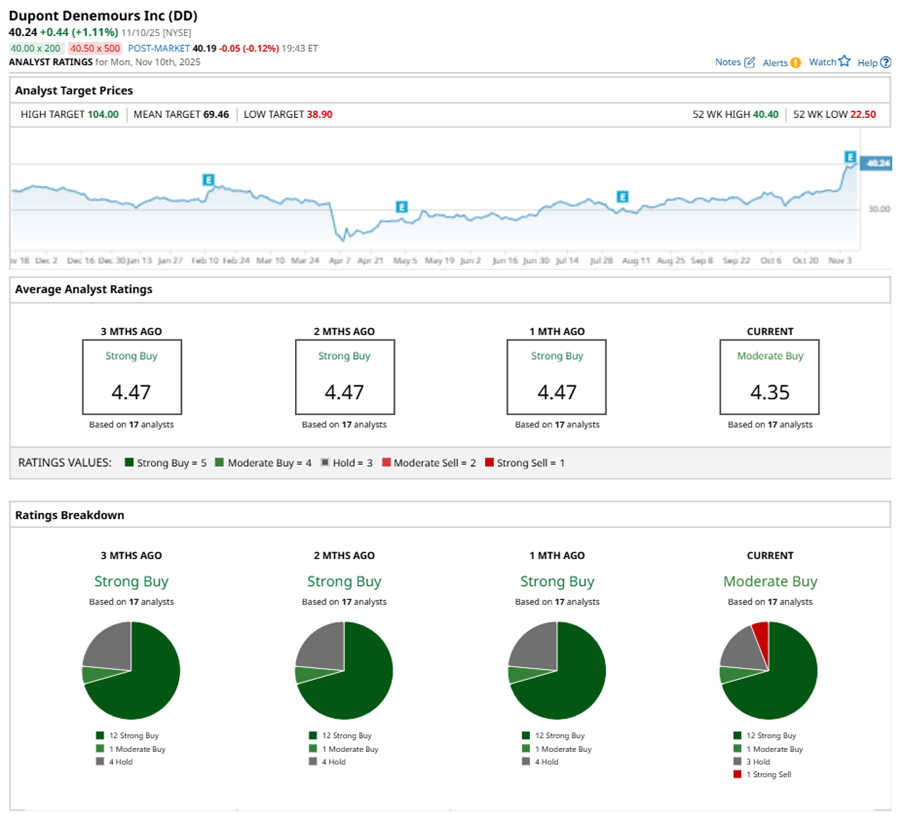

Among the 17 analysts covering DD stock, the consensus is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” three “Holds,” and one “Strong Sell.”

This configuration is less bullish than a month ago, with a “Strong Buy” rating overall.

On Nov. 6, BMO Capital analyst John McNulty maintained a “Buy” rating on DD and set a price target of $50, implying a potential upside of 24.3% from current levels.

The mean price target of $69.46 represents a 72.6% premium to DD’s current price levels. The Street-high price target of $104 suggests an ambitious upside potential of 158.4%.