/Unitedhealth%20Group%20Inc%20%20phone%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

UnitedHealth Group Incorporated (UNH), headquartered in Minnetonka, Minnesota, owns and manages organized health systems. With a market cap of $293.7 billion, the company provides employers with products and resources to plan and administer employee benefit programs serving customers worldwide.

Shares of this health insurance giant have significantly underperformed the broader market over the past year. UNH has declined 46.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 12.7%. In 2025, UNH’s stock fell 35.9%, compared to the SPX’s 14.4% rise on a YTD basis.

Narrowing the focus, UNH’s underperformance is also apparent compared to the iShares U.S. Healthcare Providers ETF (IHF). The exchange-traded fund has declined about 11.9% over the past year. Moreover, the ETF’s marginal gains on a YTD basis outshine the stock’s double-digit dip over the same time frame.

UNH's struggles stem from Medicare funding cuts and higher healthcare costs. The company expects margin recovery in 2026, although Medicaid margin pressure is expected to persist.

On Oct. 28, UNH shares closed up marginally after reporting its Q3 results. Its adjusted EPS of $2.92 exceeded Wall Street expectations of $2.75. The company’s revenue was $113.2 billion, falling short of Wall Street forecasts of $113.4 billion. UNH expects full-year adjusted EPS to be $16.25.

For the current fiscal year, ending in December, analysts expect UNH’s EPS to decline 41% to $16.31 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters while missing the forecast on two other occasions.

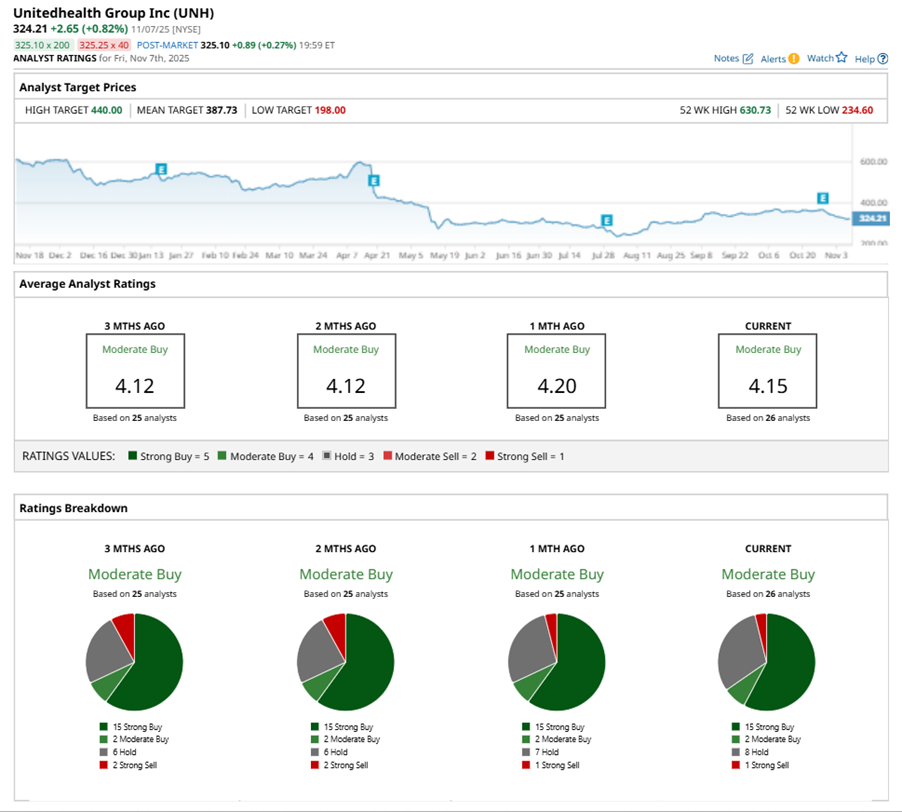

Among the 26 analysts covering UNH stock, the consensus is a “Moderate Buy.” That’s based on 15 “Strong Buy” ratings, two “Moderate Buys,” eight “Holds,” and one “Strong Sell.”

This configuration is less bearish than two months ago, with two analysts suggesting a “Strong Sell.”

On Nov. 3, Andrew Mok CFA from Barclays PLC (BCS) maintained a “Buy” rating on UNH with a price target of $386, implying a potential upside of 19.1% from current levels.

The mean price target of $387.73 represents a 19.6% premium to UNH’s current price levels. The Street-high price target of $440 suggests an ambitious upside potential of 35.7%.