/Travelers%20Companies%20Inc_%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $66.3 billion, The Travelers Companies, Inc. (TRV) is a leading provider of commercial and personal property and casualty insurance, serving businesses, government entities, and individuals in the United States and internationally. It operates through three main segments: Business Insurance; Bond & Specialty Insurance; and Personal Insurance, offering a broad portfolio of risk and insurance solutions.

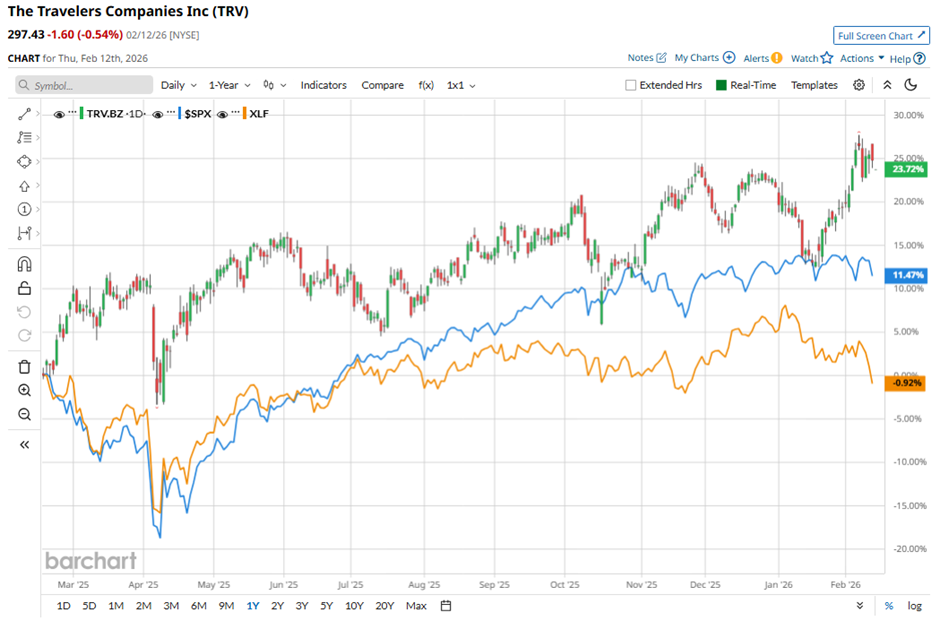

Shares of the New York-based company have surpassed the broader market over the past 52 weeks. TRV stock has soared 23.6% over this time frame, while the broader S&P 500 Index ($SPX) has returned 12.9%. Moreover, shares of the company are up 2.5% on a YTD basis, compared to SPX’s marginal decline.

Focusing more closely, shares of the insurer have outpaced the State Street Financial Select Sector SPDR ETF’s (XLF) slight rise over the past 52 weeks.

Shares of Travelers rose 1.1% on Jan. 21 after the insurer delivered Q4 2025 results, reporting better-than-expected adjusted EPS of $11.13. The upside was driven by strong underwriting performance, with the underlying combined ratio improving 1.8 points to 82.2%, net written premiums rising 1% to $10.86 billion, low catastrophe losses of $95 million pre-tax, and net investment income up 10% after tax to $867 million.

For the fiscal year ending in December 2026, analysts expect Travelers’ adjusted EPS to decrease 1.9% year-over-year to $27.07. However, the company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

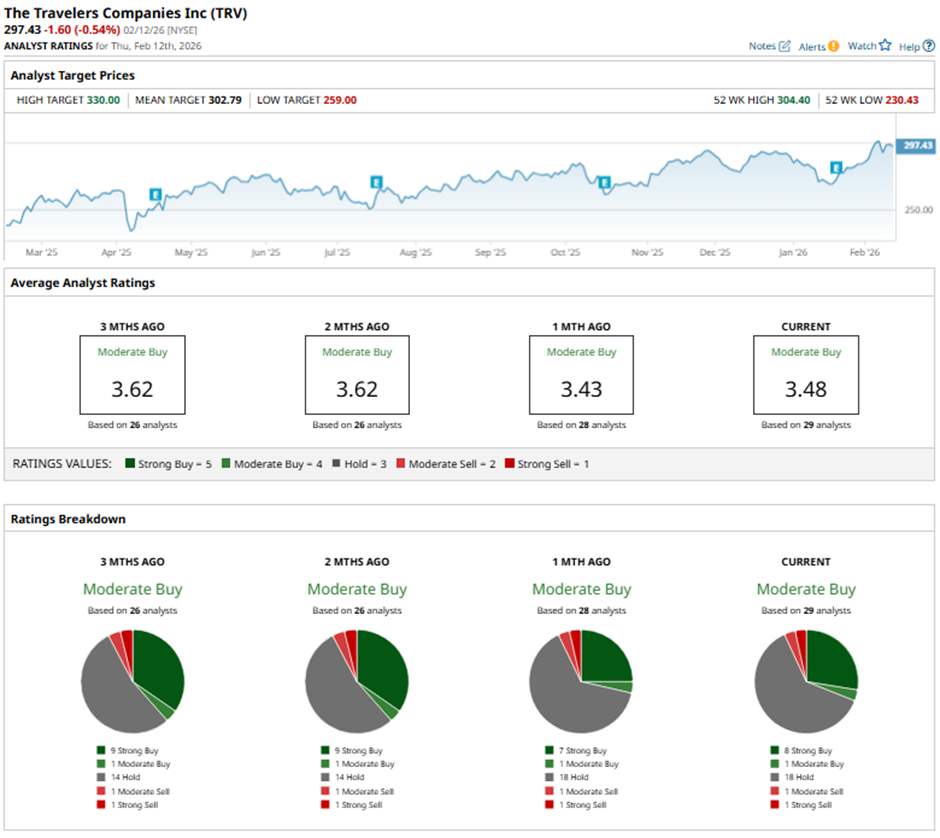

Among the 29 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, one “Moderate Buy,” 18 “Holds,” one “Moderate Sell,” and one “Strong Sell.”

On Feb. 2, UBS raised its price target on Travelers to $298 while maintaining a “Neutral” rating.

The mean price target of $302.79 represents a 1.8% premium to TRV’s current price levels. The Street-high price target of $330 suggests a nearly 11% potential upside.