Boca Raton, Florida-based SBA Communications Corporation (SBAC) is a real estate investment trust (REIT) that owns and operates wireless communications infrastructure, including towers, rooftops, distributed antenna systems and small-cell networks. Valued at a market cap of $21 billion, the company serves major wireless carriers and broadband providers.

This specialty REIT has considerably underperformed the broader market over the past 52 weeks. Shares of SBAC have declined 9.7% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.2%. Moreover, on a YTD basis, the stock is down 3.2%, compared to SPX’s 14.5% uptick.

Narrowing the focus, SBAC has also underperformed the Pacer Benchmark Data & Infrastructure Real Estate ETF’s (SRVR) 4.3% drop over the past 52 weeks and 2.4% YTD loss.

On Nov. 3, SBAC delivered better-than-expected Q3 results, sending its shares up 1.4% in the following trading session. Due to higher site leasing and site development revenues, the company’s total revenue improved 9.7% year-over-year to $732.3 million, surpassing consensus estimates by 3.9%. Additionally, while its AFFO declined marginally from the year-ago quarter to $3.30, it handily topped analyst expectations of $3.19.

For the current fiscal year, ending in December, analysts expect SBAC’s FFO to decline 8.8% year over year to $12.19. The company’s FFO surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

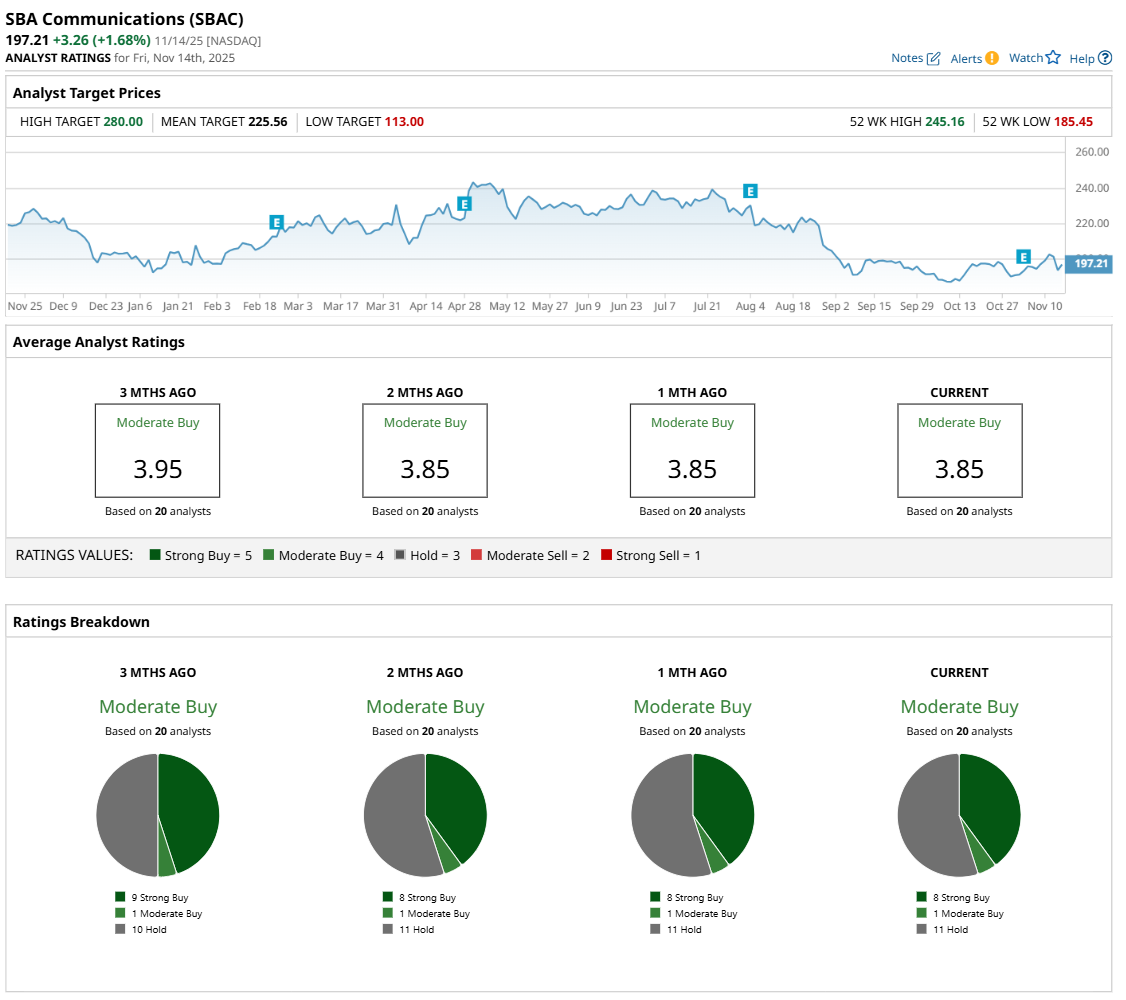

Among the 20 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on eight “Strong Buy,” one "Moderate Buy,” and 11 "Hold” ratings.

This configuration is slightly less bullish than three months ago, with nine analysts suggesting a “Strong Buy” rating.

On Nov. 10, RBC Capital maintained an "Outperform" rating on SBAC but lowered its price target to $232, indicating a 17.6% potential upside from the current levels.

The mean price target of $225.56 represents a 14.4% premium from SBAC’s current price levels, while the Street-high price target of $280 suggests an ambitious 42% potential upside from the current levels.