Allentown, Pennsylvania-based PPL Corporation (PPL) is a utility company that delivers electricity and natural gas to millions of customers through its regulated utility operations. Valued at a market cap of $26.8 billion, the company focuses on providing reliable, affordable, and sustainable energy while investing in grid modernization and cleaner energy initiatives to support the transition toward a low-carbon future.

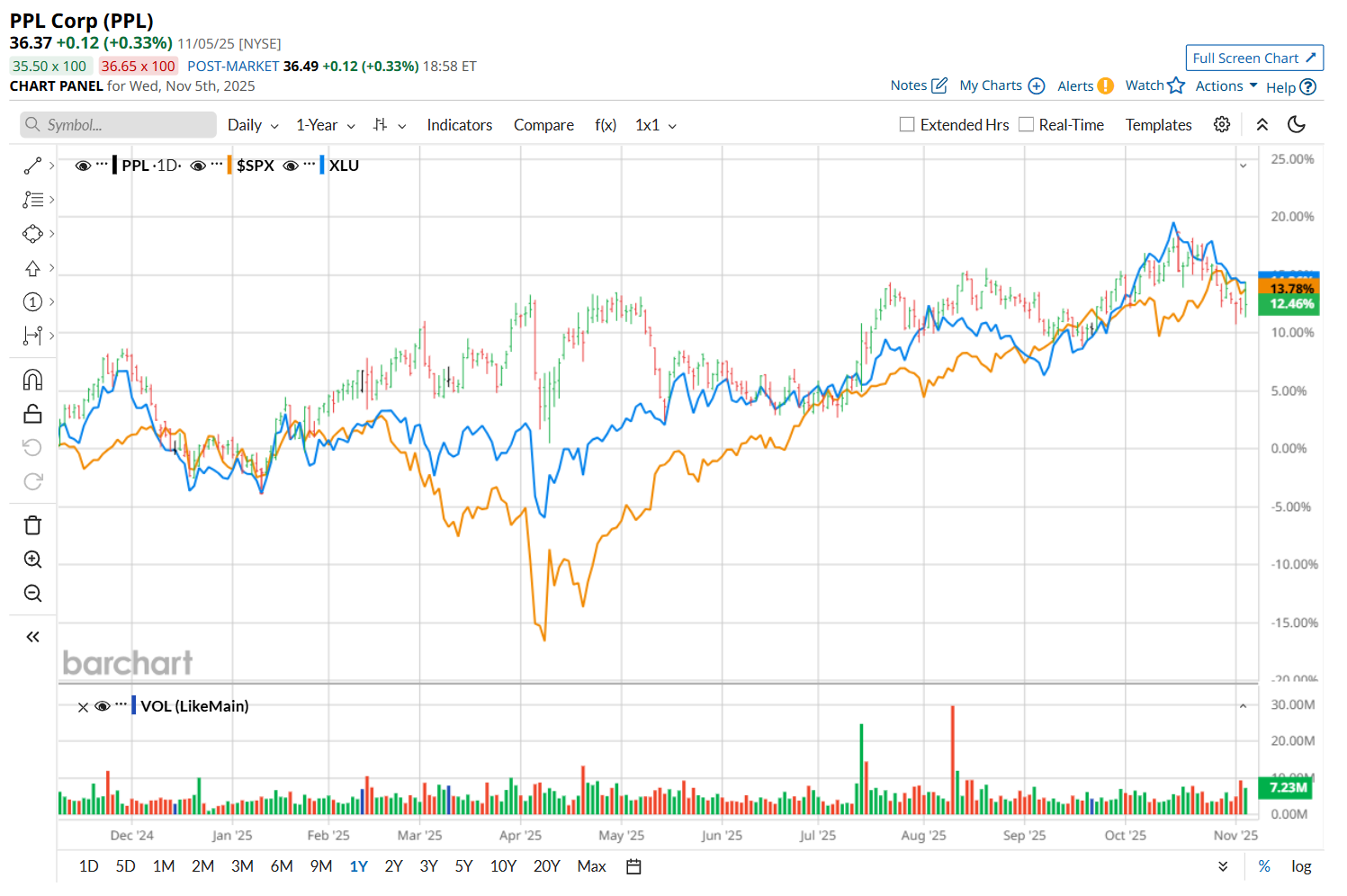

Shares of this utility company have lagged behind the broader market over the past 52 weeks. PPL has gained 11.6% over this time frame, while the broader S&P 500 Index ($SPX) has soared 17.5%. Moreover, on a YTD basis, the stock is up 12.1%, compared to SPX’s 15.6% uptick.

Narrowing the focus, PPL has also underperformed the Utilities Select Sector SPDR Fund’s (XLU) 13.4% return over the past 52 weeks and 17.4% rise on a YTD basis.

On Nov. 5, shares of PPL gained marginally after its stronger-than-expected Q3 earnings release. The company’s operating revenue increased 8.4% year-over-year to $2.2 billion, surpassing consensus estimates by 3.2%. Meanwhile, due to earnings growth across all its reportable segments, its overall adjusted EPS reached $0.48, up 14.3% from the same period last year and 4.3% ahead of analyst expectations. Additionally, PPL reaffirmed its long-term annual EPS and dividend growth targets of 6% to 8% through at least 2028 and expects to deliver results toward the upper end of this range, signaling continued confidence in its financial outlook.

For the current fiscal year, ending in December, analysts expect PPL’s EPS to grow 7.1% year over year to $1.81. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in two of the last four quarters, while surpassing on two other occasions.

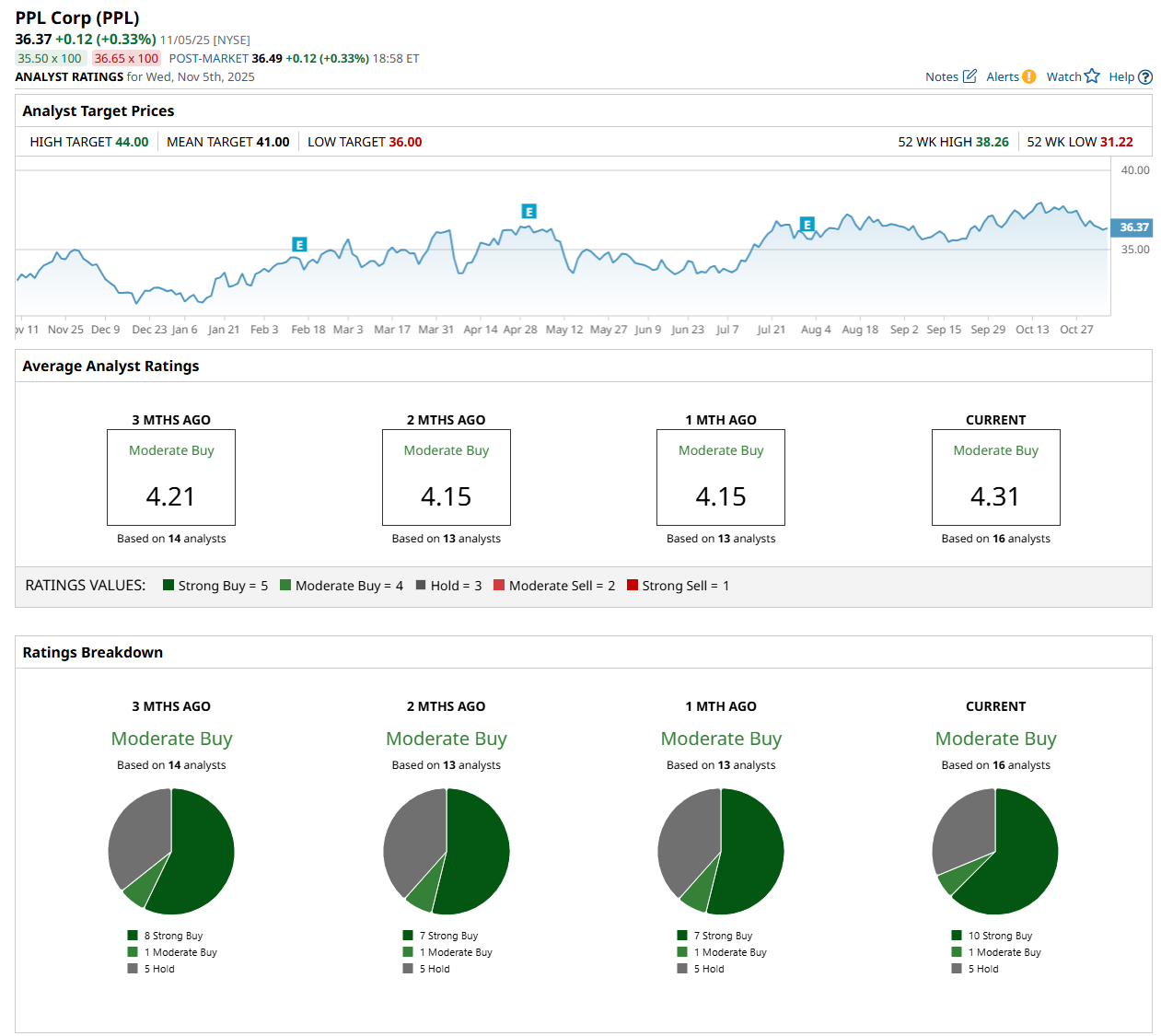

Among the 16 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 10 “Strong Buy,” one “Moderate Buy,” and five "Hold” ratings.

This configuration is notably more bullish than a month ago, with seven analysts suggesting a “Strong Buy” rating.

On Oct. 27, Wells Fargo initiated coverage of PPL with an “Overweight” rating and $43 price target, which indicates an 18.2% potential upside from the current levels.

The mean price target of $41 represents a 12.7% premium from PPL’s current price levels, while the Street-high price target of $44 suggests an upside potential of 21%.