/PNC%20Financial%20Services%20Group%20Inc%20bank%20sign-%20by%20Adam%20McCullough%20via%20Shutterstock.jpg)

The PNC Financial Services Group, Inc. (PNC), based in Pittsburgh, Pennsylvania, is a premier financial services powerhouse. Boasting a market cap of around $89.9 billion, it offers deposit accounts, lending solutions, mortgages, credit cards, and extends into investment and wealth management, retirement planning, insurance, and cash management.

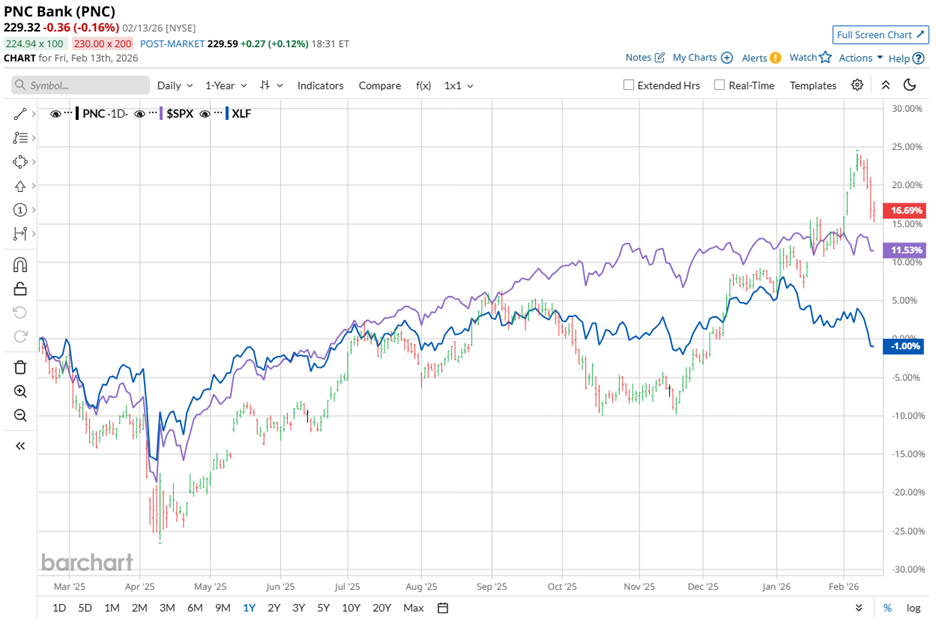

Over the past 52 weeks, investors have cheered as PNC Financial’s shares climbed 17.3%, decisively outpacing the S&P 500 Index's ($SPX) 11.8% rise. Year-to-date (YTD), the stock continues its upward march, up 9.9%, while the broader index lags with a slight decline.

Sector comparisons further validate the outperformance. The State Street Financial Select Sector SPDR ETF (XLF) has marginally stumbled over the last 52 weeks and plunged around 5.7% YTD, leaving PNC stock in a league of its own.

On Jan. 16, the stock surged 3.8% intraday after PNC Financial reported Q4 fiscal 2025 results that exceeded analyst expectations. Revenue jumped 9.1% year over year to $6.07 billion, surpassing Street’s projections of $5.97 billion, while EPS soared 29.4% to $4.88 from last year, handily topping analysts’ $4.21 estimate.

Management attributed the robust performance to stronger loan growth, solid noninterest income, and disciplined expense control. Looking ahead, PNC’s guidance is anchored by the integration of FirstBank, strategic investments in technology, and a focus on capitalizing on steady economic expansion.

Analysts expect diluted EPS for fiscal year 2026, ending in December, to climb 10.6% year over year to $18.35. Notably, PNC has exceeded EPS estimates in each of the last four quarters, signaling consistent execution.

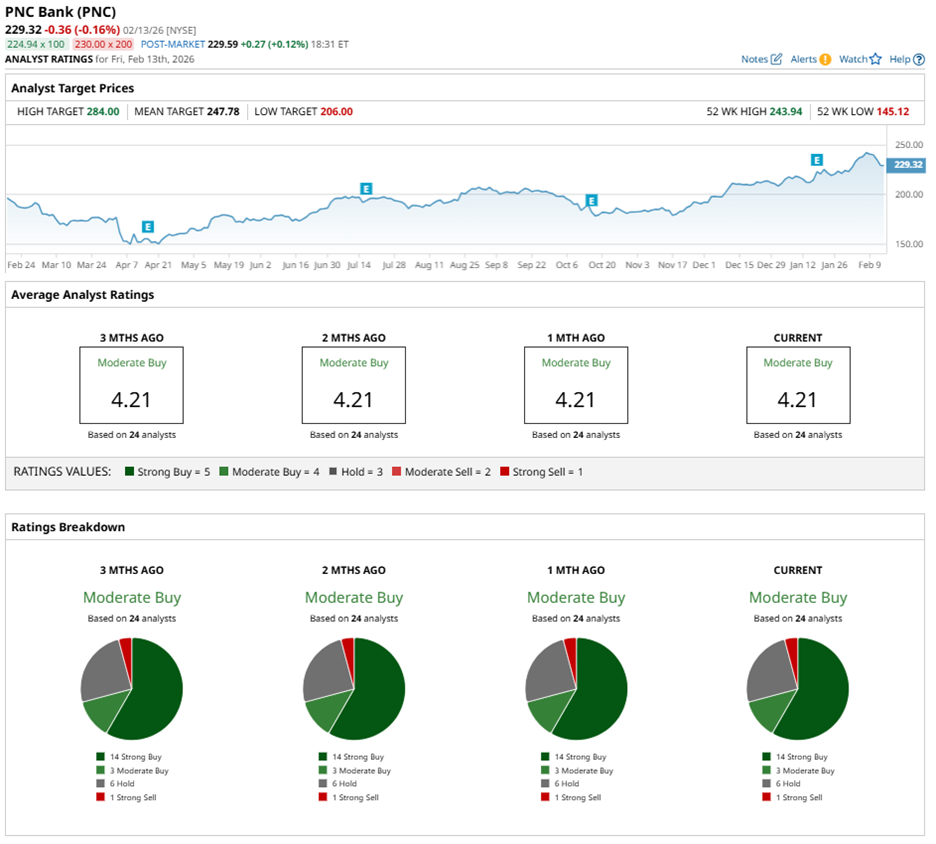

Wall Street currently assigns PNC stock an overall rating of “Moderate Buy.” Among 24 analysts covering the stock, 14 recommend “Strong Buy,” three offer “Moderate Buy,” and six suggest “Hold,” while one flags a “Strong Sell.”

Analyst sentiment has remained broadly stable over the past three months, when 14 analysts also assigned “Strong Buy” ratings to PNC Financial.

On Jan. 20, Wells Fargo & Company’s (WFC) Mike Mayo reinforced his “Overweight” rating and raised the price target from $252 to $264, highlighting optimism after the earnings beat. The same day, Oppenheimer Holdings Inc. (OPY) lifted its target from $268 to $284 while maintaining an “Outperform” rating, citing strong year-end momentum and organic tailwinds for 2026.

That said, the mean price target of $247.78 implies potential upside of 8%, while Oppenheimer’s Street-high target of $284 represents a gain of 23.8% from current levels.