/Northrop%20Grumman%20Corp_%20phone%20and%20logo-by%20T_Schneider%20via%20Shutterstock.jpg)

Valued at a market cap of $99.7 billion, Northrop Grumman Corporation (NOC) is an aerospace and defense technology company based in Falls Church, Virginia.

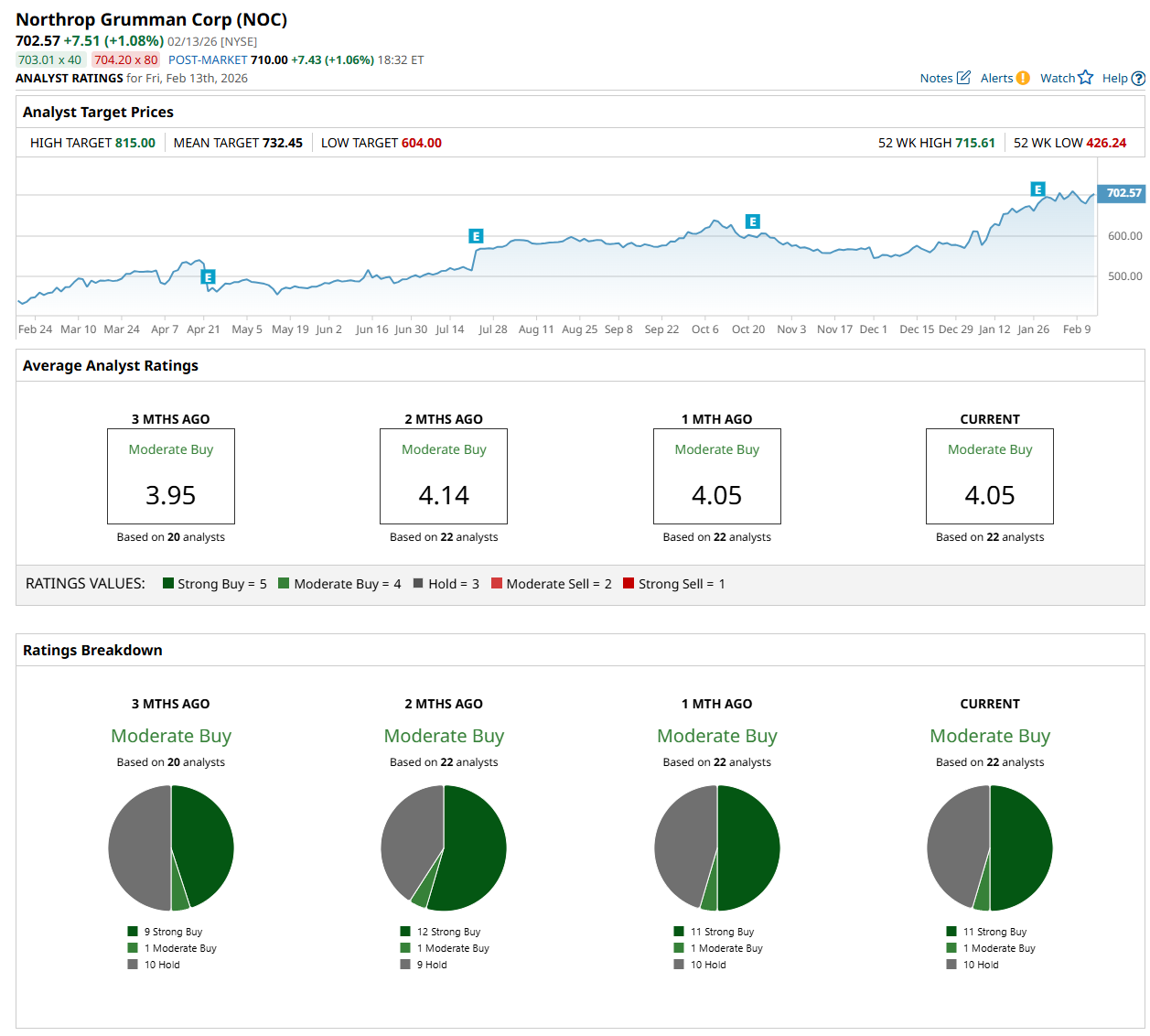

This aerospace and defense company has considerably outpaced the broader market over the past 52 weeks. Shares of NOC have surged 54.4% over this time frame, while the broader S&P 500 Index ($SPX) has gained 11.8%. Moreover, on a YTD basis, the stock is up 23.2%, compared to SPX’s marginal downtick.

However, narrowing the focus, NOC has lagged behind the State Street SPDR S&P Aerospace & Defense ETF’s (XAR) 59.2% rise over the past 52 weeks. Nonetheless, it has outperformed XAR’s 12.2% YTD uptick.

On Jan. 27, NOC shares soared 2.7% after it delivered stronger-than-expected Q4 results. Due to robust growth in revenue across all its reportable segments, the company’s net sales increased 9.6% year-over-year to $11.7 billion, surpassing consensus estimates by a slight margin. Moreover, due to a strong rise in its aeronautics, mission, and space systems operating income, its adjusted EPS reached $7.23, up 13.1% from the year-ago quarter and 3.3% ahead of analyst expectations.

For fiscal 2026, ending in December, analysts expect NOC’s EPS to grow 6.5% year over year to $28.05. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in three of the last four quarters, while missing on another occasion.

Among the 22 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 11 “Strong Buy,” one “Moderate Buy,” and 10 "Hold” ratings.

The configuration is less bullish than two months ago, with 12 analysts suggesting a “Strong Buy” rating.

On Feb. 10, Argus maintained a "Buy" rating on NOC and raised its price target to $785, indicating an 11.7% potential upside from the current levels.

The mean price target of $732.45 represents a 4.3% premium to its current price levels, while its Street-high price target of $815 suggests a 16% potential upside from the current levels.