/Goldman%20Sachs%20Group%2C%20Inc_%20logo%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

New York-based The Goldman Sachs Group, Inc. (GS) is a financial institution that provides a range of financial services for corporations, financial institutions, governments, and high-net worth individuals. With a market cap of $278.6 billion, the company specializes in investment banking, trading and principal investments, asset management and securities services.

Shares of this leading global investment banking, securities, and asset and wealth management firm have outperformed the broader market over the past year. GS has gained 41.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14%. In 2026, GS stock is up 5.7%, surpassing the SPX’s 1.3% rise on a YTD basis.

Zooming in further, GS’ outperformance is also apparent compared to the iShares U.S. Broker-Dealers & Securities Exchanges ETF (IAI). The exchange-traded fund has gained about 12.9% over the past year. Moreover, GS’ single-digit returns on a YTD basis outshine the ETF’s marginal dip over the same time frame.

Goldman Sachs' strong performance is driven by robust investment banking, record asset and wealth management inflows, and progress in narrowing its strategic focus. The firm's leading M&A advisory franchise, gains in equity and fixed income financing, and successful transition of the Apple Card portfolio have all contributed to its success. With a four-year high deal backlog and record inflows, GS is optimistic about continued strength in M&A and capital markets, and further expansion in asset and wealth management.

On Jan. 15, GS shares closed up by 4.6% after reporting its Q4 results. Its EPS of $14.01 beat Wall Street expectations of $11.77. The company’s revenue net of interest expense was $13.5 billion, falling short of Wall Street forecasts of $13.6 billion.

For the current fiscal year, ending in December, analysts expect GS’ EPS to grow 10.3% to $56.62 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

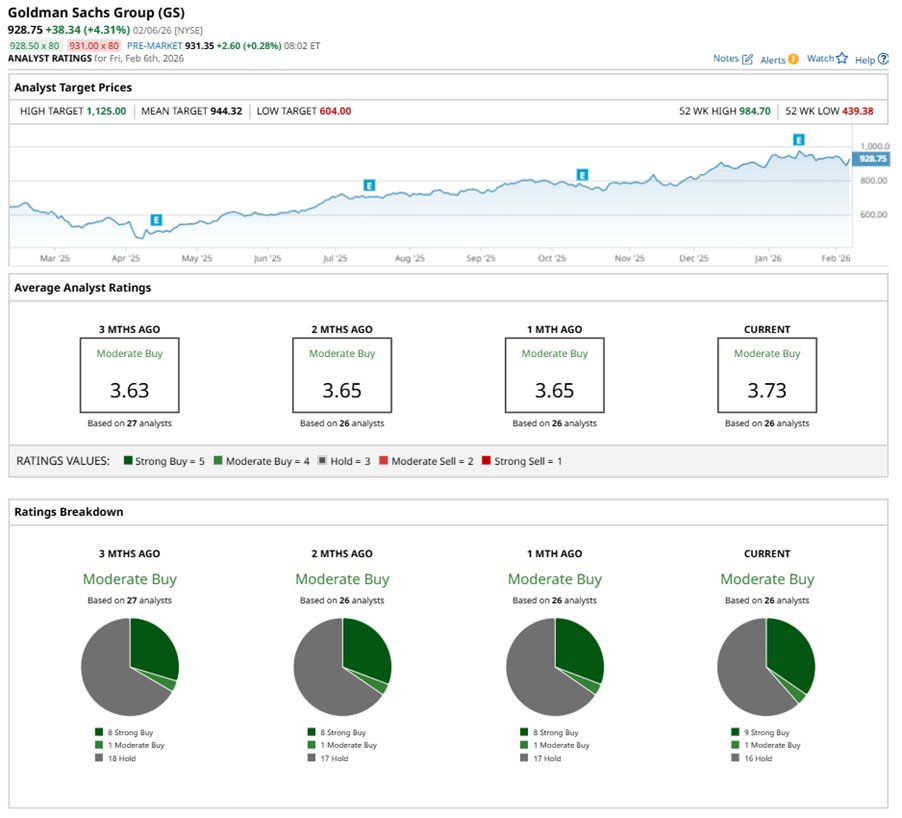

Among the 26 analysts covering GS stock, the consensus is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, one “Moderate Buy,” and 16 “Holds.”

This configuration is more bullish than a month ago, with eight analysts suggesting a “Strong Buy.”

On Feb. 4, UBS kept a “Neutral” rating on GS and raised the price target to $990, implying a potential upside of 6.6% from current levels.

The mean price target of $944.32 represents a 1.7% premium to GS’ current price levels. The Street-high price target of $1,125 suggests an upside potential of 21.1%.