/Fiserv%2C%20Inc_%20logo%20and%20chart%20on%20phone-by%20IgorGolovniov%20via%20Shutterstock.jpg)

With a market cap of $32.5 billion, Fiserv, Inc. (FISV) is a global provider of payments and financial services technology solutions. The company operates through two segments: Merchant Solutions and Financial Solutions, offering services such as merchant acquiring, digital commerce, mobile payments, fraud protection, card processing, and digital banking solutions.

Shares of the IT giant have underperformed the broader market over the past year and in 2026. FISV stock has declined 74.5% over the past 52 weeks and has declined 13% on a YTD basis. In comparison, the S&P 500 Index ($SPX) has returned 12.2% over the past year but has dropped marginally in 2026.

Narrowing the focus, FISV has also underperformed the State Street Technology Select Sector SPDR Fund’s (XLK) 15.8% surge over the past 52 weeks and its 5.8% decline this year.

In late January, Fiserv rolled out a series of high-impact partnerships that underscored its push for global expansion and digital innovation. Most recently, on Jan. 28, it strengthened its alliance with ServiceNow, Inc. (NOW) to scale AI-driven tools across financial and IT operations, boosting efficiency and system resilience. Days earlier, on Jan. 26, Fiserv teamed up exclusively with Affirm Holdings, Inc. (AFRM) to bring pay-over-time features to debit cards, helping banks meet rising demand for flexible payments. Similarly, on Jan. 21, it partnered with Sumitomo Mitsui Card Company to launch its Clover platform in Japan by 2026, targeting small businesses and supporting the country’s cashless goals.

For FY2025 that ended in December, analysts predict FISV’s EPS to decrease 2.8% year over year to $8.55. Moreover, the company has surpassed analysts’ consensus estimates in three of the past four quarters, while missing on another occasion.

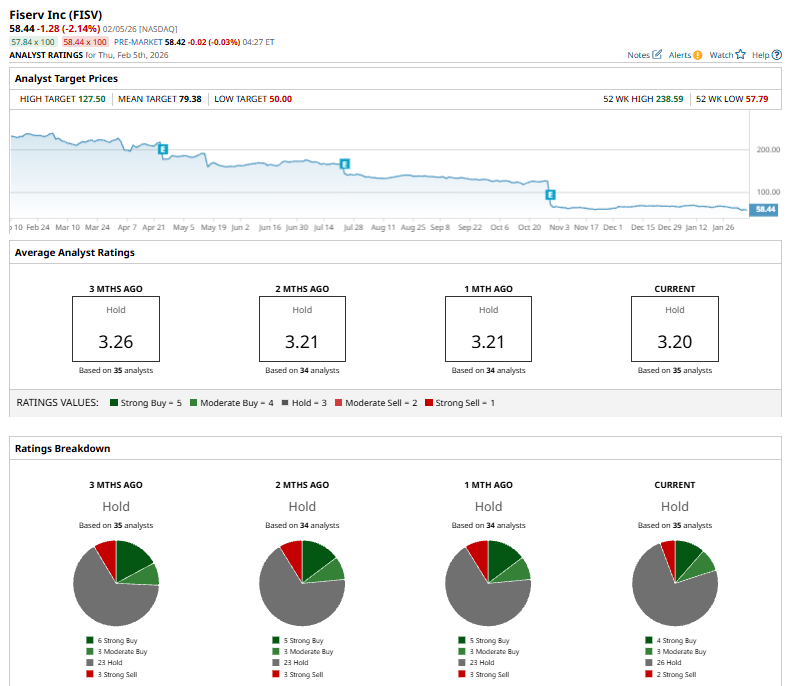

Among the 35 analysts covering the stock, the consensus rating is a “Hold.” That’s based on four “Strong Buy” ratings, three “Moderate Buy,” 26 seven “Holds,” and two “Strong Sell.”

The configuration is slightly bearish than a month ago, when five analysts gave the stock a “Strong Buy.”

In November, Susquehanna International Group sharply cut its price target on Fiserv to $99 from $220 while maintaining a “Positive” rating, noting that the new target still implied upside from the stock’s depressed level near its 52-week low. The firm pointed out that Fiserv appeared undervalued based on fair value estimates, but warned that recent growth had slowed meaningfully.

FISV’s mean price target of $79.38 indicates a premium of 35.8% from the current market prices. Its Street-high target of $127.50 suggests a robust 118.2% upside potential from current price levels.