/Elevance%20Health%20Inc%20laptop-by%20monticello%20via%20Shutterstock.jpg)

With a market cap of $72.1 billion, Elevance Health, Inc. (ELV) is one of the largest health insurance and managed care companies in the United States. Based in Indiana, it operates through a broad portfolio of health plans, including commercial, Medicaid, and Medicare offerings. The company also delivers pharmacy, behavioral health, and care management services through its Carelon division.

Shares of ELV have fallen behind the broader market. ELV stock has declined 19% over the past 52 weeks and has dipped 12% on a YTD basis. In comparison, the S&P 500 Index ($SPX) has returned 12.3% over the past year and 12.5% in 2025.

Narrowing the focus, ELV has also lagged behind the Health Care Select Sector SPDR Fund’s (XLV) 7.5% fall over the past 52 weeks and a 10.9% rise on a YTD basis.

Elevance Health released its third-quarter earnings on Oct. 21, and its shares dipped 1.3%. The company posted operating revenue of $50.1 billion and adjusted diluted EPS of $6.03, both ahead of expectations. However, operating cash flow totaled $4.2 billion year-to-date, just 0.8x net income and $0.9 billion lower than last year, mainly due to the Provider Settlement Agreement payment tied to the multi-district BCBSA litigation, which weighed on investor sentiment.

For the current year ending in December, analysts expect ELV’s EPS to decline 9.2% year over year to $30. Moreover, the company has surpassed or met analysts’ consensus estimates in three of the past four quarters, while missing on another occasion.

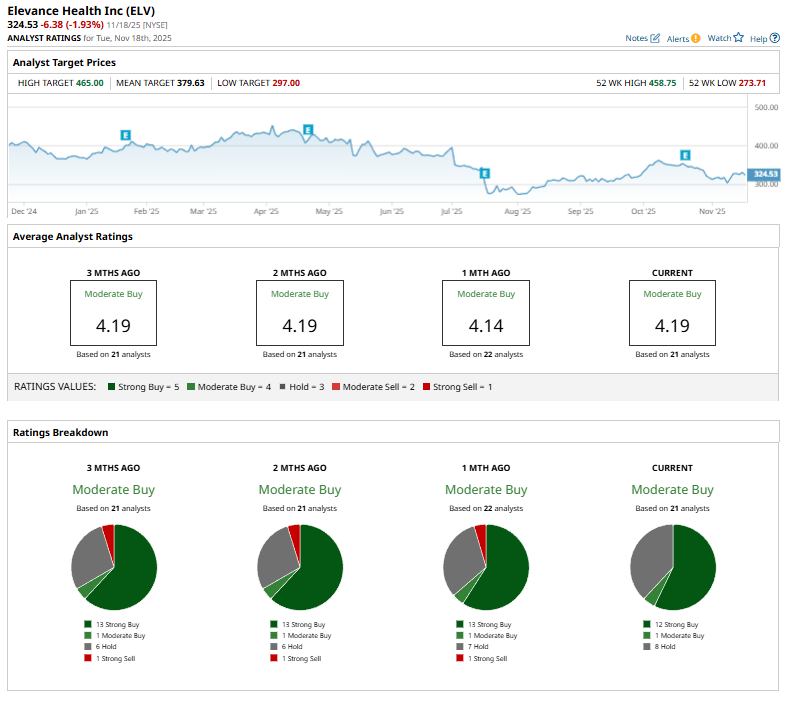

Among the 21 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” and eight “Holds.”

The current configuration is bearish than a month ago when the stock had 13 “Strong Buy” suggestions.

On Oct. 17, Bernstein analyst Lance Wilkes maintained his “Buy” rating on Elevance Health and set a $420 price target.

ELV’s mean price target of $379.63 indicates a premium of 17% from the current market prices. Its Street-high target of $465 suggests a robust 43.3% upside potential from current price levels.