With a market cap of $42.4 billion, Diamondback Energy, Inc. (FANG) is an independent oil and gas company focused on the acquisition, development, and production of unconventional resources in the Permian Basin. The company targets the prolific Spraberry, Wolfcamp, and Bone Spring formations across the Midland and Delaware basins.

Shares of the Midland, Texas-based company have underperformed the broader market over the past 52 weeks. FANG stock has fallen 17.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.1%. Moreover, shares of the company are down 9.6% on a YTD basis, compared to SPX's 16.4% gain.

Looking closer, shares of the energy exploration and production company have lagged behind the Energy Select Sector SPDR Fund's (XLE) 2.9% decline over the past 52 weeks.

Despite reporting stronger-than-expected Q3 2025 adjusted EPS of $3.08 and revenue of $3.92 billion on Nov. 3, Diamondback Energy shares fell 1.3% the next day as investors focused on weaker oil pricing, with the company’s realized oil price down 11.7% to $64.60 per barrel amid a 13% drop in Brent crude. The management signaled plans to keep oil volumes flat rather than expand output, prioritizing debt reduction and cash returns over growth.

For the fiscal year ending in December 2025, analysts expect FANG's adjusted EPS to dip nearly 24% year-over-year to $12.60. However, the company's earnings surprise history is strong. It beat the consensus estimates in the last four quarters.

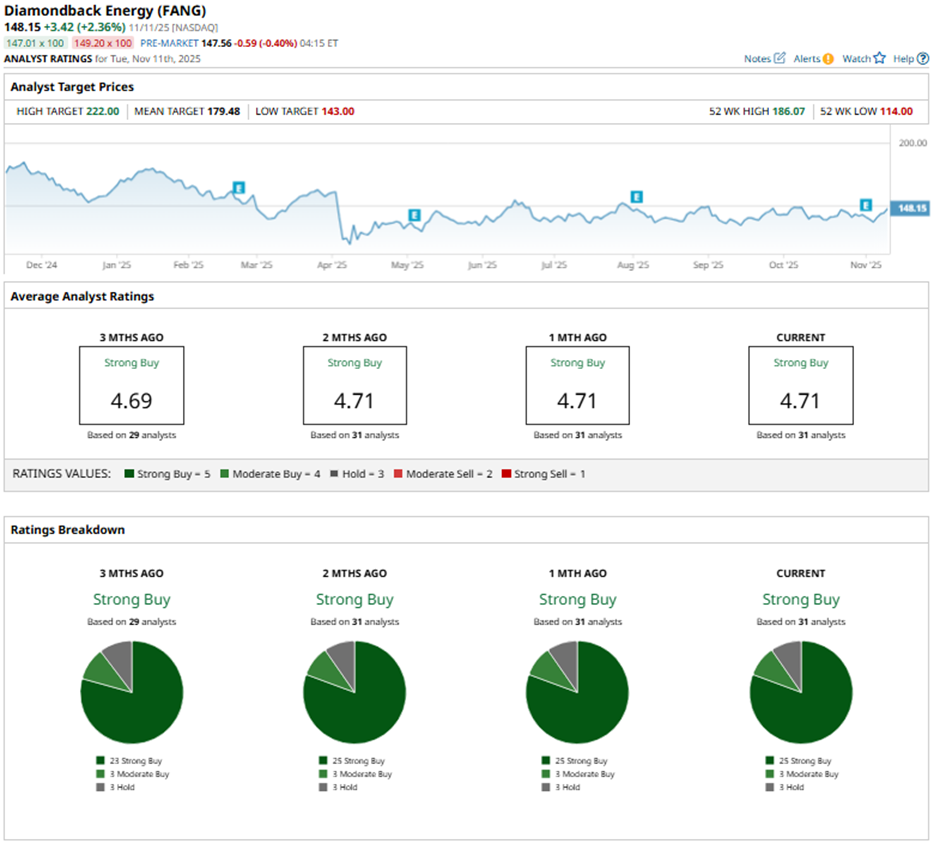

Among the 31 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 25 “Strong Buy” ratings, three “Moderate Buys,” and three “Holds.”

This configuration is more bullish than three months ago, with 23 “Strong Buy” ratings on the stock.

On Nov. 11, UBS raised its price target on Diamondback Energy to $174 and maintained a “Buy” rating.

The mean price target of $179.48 represents a 21.1% premium to FANG’s current price levels. The Street-high price target of $222 suggests a 49.8% potential upside.