With a market cap of $55.3 billion, Baker Hughes Company (BKR) is a global energy technology firm that provides a broad portfolio of products and services across the oil, gas, and industrial value chains. Operating through its Oilfield Services & Equipment and Industrial & Energy Technology segments, the company supports customers from upstream to downstream with advanced equipment, digital solutions, and lifecycle services.

Shares of the Houston, Texas-based company have outperformed the broader market over the past 52 weeks. BKR stock has increased 22.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 15.4%. Moreover, shares of the company are up 27.4% on a YTD basis, compared to SPX's 1.1% gain.

Looking closer, shares of the oilfield services company have also outpaced the State Street Energy Select Sector SPDR ETF's (XLE) 17.2% return over the past 52 weeks.

Shares of Baker Hughes soared 4.4% following its Q4 2025 results on Jan. 25. The company posted stronger-than-expected adjusted EPS of $0.78 and revenue of $7.39 billion. The rally was further supported by confident forward commentary, as management guided to mid-single-digit organic adjusted EBITDA growth in 2026, sustained strength in IET with margins targeting 20%, and continued robust LNG, power systems, and gas infrastructure demand.

For the fiscal year ending in December 2026, analysts expect Baker Hughes' adjusted EPS to rise 1.5% year-over-year to $2.64. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

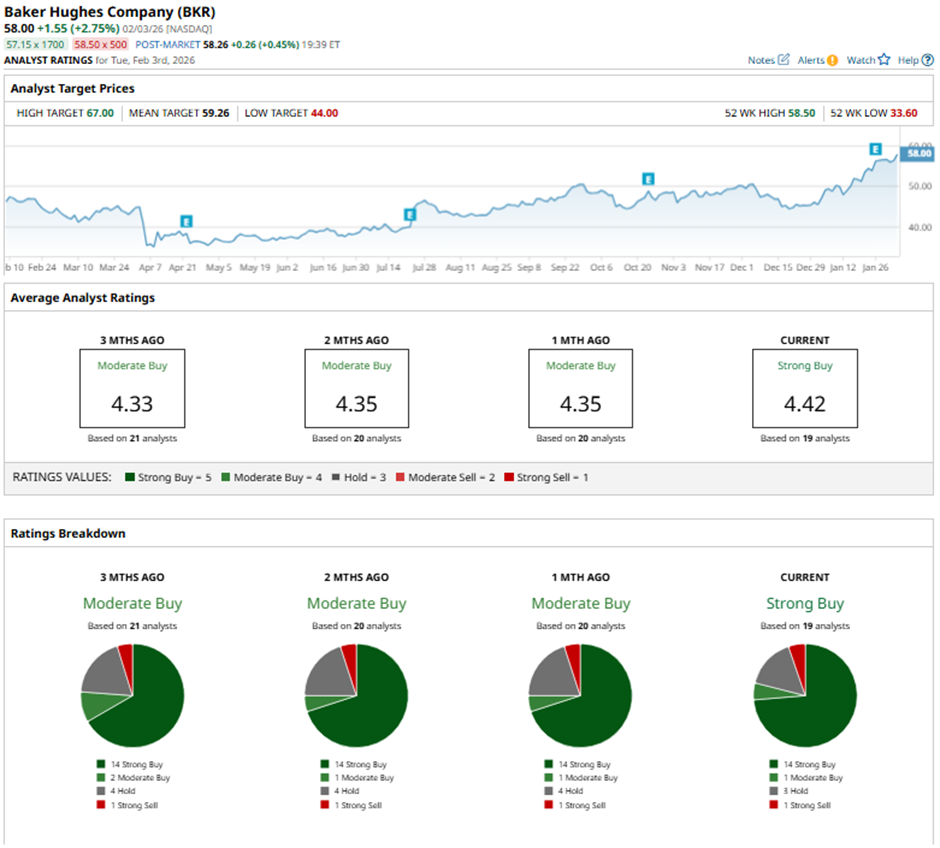

Among the 19 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 14 “Strong Buy” ratings, one “Moderate Buy,” three “Holds,” and one “Strong Sell.”

On Feb. 2, BofA Securities raised its price target on Baker Hughes to $65 and maintained a “Buy” rating.

The mean price target of $59.26 represents a premium of 2.2% to BKR's current price. The Street-high price target of $67 suggests a 15.5% potential upside.