May has been a resounding positive for stocks as they rebounded with gusto from April weakness to make new all time highs just above 5,300 for the S&P 500 (SPY).

Since then, there have been some economic reports which show inflationary pressures still being too high which likely further delays the first Fed rate cut. However, it seems that bullish investors don’t want to lose their grip on stock prices.

The net result appears to be a consolidation around 5,300. What does that mean? And what comes next?

Those topics and more will be the focus of this week’s Reitmeister Total Return commentary.

Market Commentary

A consolidation typically means that stocks trade in a narrow range around a target. In this case, 5,300 with movements a little above...and a little below.

On the surface this seems to be a calm set of affairs. Yet under the surface there is often great turnover and volatility.

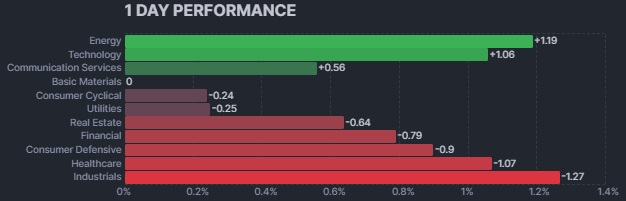

That is why consolidation periods are often coincide with heavy sector rotation. Where some groups are enjoying ample gains while others are getting beat up.

This 1 day sector performance chart from Tuesday gives you a picture of that disparity even though the overall market barely moved at all:

Do not be fooled into thinking the above chart shows you any kind of trend. Because the very nature of consolidation and sector rotation periods is that today’s winners are tomorrows losers (and vice versa).

Another term for these periods can also be helpful; a rolling correction.

In a rolling correction the overall market stays pretty well level. Yet under the surface is great turmoil as each sector eventually finds its way into the doghouse leading to a series of rough sessions.

Think of it as each group seeing a round of profit taking. But since happening at different times...then it doesn’t harm the level of the overall market.

To be clear...THIS IS HEALTHY

This is a normal and natural part of investing in a bull market. You never go up, up and up without some kind of pause.

Thus, over the course of time there are ample pullbacks, corrections, consolidations, sector rotations etc to take profits off the table and shake off complacency that often builds up in investors who may be thinking that investing is a bit too easy.

From here investors are awaiting fresh signals to tell them about the state of inflation and likely timing of the first Fed Rate cut. These upcoming economic reports hold some of those clues. Here is an update review from what I shared with you folks last week:

5/31 PCE: This is the Fed’s favorite measure of inflation. If it corresponds with improvements found in last week’s CPI report, then could provide a nice boost for stocks. On the flip side, bad news here will have stocks pulling back from recent highs.

6/3 ISM Manufacturing: The first of the big three economic reports that kick off each month. This area has been weak for a long time. Oddly, investors would not want this to heat up as it would signal inflationary pressure. So, a 50 or below reading would be the most welcome news. Unfortunately, the PMI Flash report from last week was far too strong which led to a mid week stock correction. If the economic strength displayed there winds up in this more widely followed report, that would most certainly lead to stock market weakness.

6/5 ISM Services: This large swath of the economy has been heading lower for 3 straight readings with the first sub 50 showing in early May which helped propel stocks higher (because it equates with lower inflationary pressure). So here the goldilocks reading would be around 50 to not stoke fears of sinking into recession nor heating up to push inflation higher. Yet, just like shared above for ISM Manufacturing...the strength found in the PMI Flash report would not be a welcome sign here.

6/6 Government Employment Situation: No one is worried about unemployment at this time. The main fixation from this monthly report will be the results for Average Hourly Earnings (aka wage inflation). This aspect has been far too sticky, which the Fed watches carefully. Gladly there were signs of easing in the early May report and the hope is that continues in this early June reading.

We are still in a long term bull market. Unfortunately, investors keep getting too optimistic about the timing of the first Fed rate cut only to sell off when it gets pushed further back.

I believe odds are fairly high that investors are being too optimistic once again. Especially if the strength found in the PMI Flash report flows through with too hot of readings in the economic releases noted above.

So, I think that short term risk is a bit more to downside than upside. Yet still would stay fully invested given that it is a bull market. When that is the case, it can charge forward at any time for any reason.

The key is the mix of stocks and ETFs you own to best carve out profits in that unique market environment. That is precisely what we have done in the Reitmeister Total Return portfolio.

More on that in the next section...

What To Do Next?

Discover my current portfolio of 11 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999)

Plus 2 specialty ETFs that are benefiting from some of the hottest investment trends.

These hand selected picks are all based on my 44 years of investing experience seeing bull markets...bear markets...and everything between.

If you are curious to learn more, and want to see these lucky 13 trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

SPY shares fell $0.03 (-0.01%) in after-hours trading Tuesday. Year-to-date, SPY has gained 11.81%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

Are Stocks Stuck @ 5,300? StockNews.com