Yes, a nearly 20% rally to start 2023 is a lot more fun for investors than the current pullback. Unfortunately, those kind of rallies are never built to last.

Now may not be as much fun...but it is more realistic.

So let’s focus on the current realities, and what happens next for the stock market in this week’s Reitmeister Total Return commentary...

Market Commentary

After a long bull run we are enduring a classic pullback to digest previous gains. My belief is that we will emerge into a new trading range where we will hang out for a while before the next leg higher.

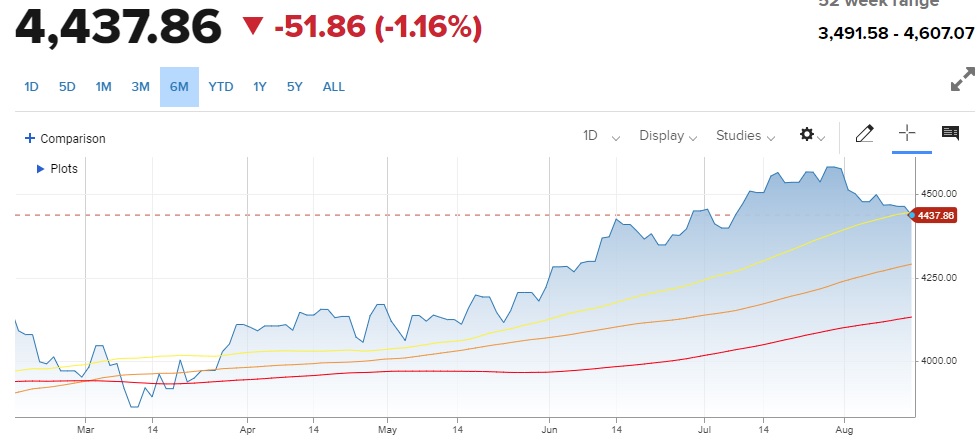

Moving Averages: 50 Day (yellow), 100 Day (orange), 200 Day (red)

4,600 for the S&P 500 (SPY) appears to be the top end of the range. Now we are trying to find the bottom.

As you can see Tuesday was the first test of the 50 day moving average since late May where we closed about 10 points below. Quite possible that support is found shortly and stocks bounce higher...but what if that is not the case?

I suspect that 4,400 could be ample area of support just 1% below the Tuesday close. That gives stocks a comfy 5% trading range to play in as we await the next catalyst.

Unfortunately, anything is possible and we could keep cutting lower to really clear out some of the complacency that comes with extended bull rallies. Yet, I don’t think that a test of the 200 day at 4,122 is in the cards. We would need some seriously negative events to emerge, like increased recession risk, to give that idea credence.

I suspect that 4,400 is likely as low as we need to go on this pullback. But if worse comes to worst, maybe a more serious washout down to the 100 day moving average at 4,284 is in the offing. That would not be so terrible given that the year started just a notch above 3,800.

Trading ranges are a time when investors have not fully made up their mind on what to do next. This makes stock prices very susceptible to the future crop of headlines.

Meaning that more positive/bullish events will have stocks bolting higher. Whereas more negative/bearish events will have the reverse effect, pushing stocks further lower.

This makes it important for us to review the upcoming events calendar to see what could be the next big move catalyst:

First, a backdrop that the last GDP reading was +2.4% for Q2. And the current Atlanta GDP Now estimate stands at +5.0% for the Q3. There is no way it will end up that high. Yet it does explain why the long term outlook is primarily bullish.

Point being that right now the view of the economy is positive. Thus, these upcoming announcements could either further bolster that notion...or call that rosy outlook into question.

8/16 FOMC Minutes: The Fed did finally start their “dovish tilt” at the late July meeting. Now investors will pour through the minutes for more clues of the likelihood of future rate hikes. Right now investors are betting on much greater likelihood they are done raising rates. The key question being when they start lowering rates. That event will be a bright green light for stock investors.

8/23 PMI Flash: This report rarely makes headlines, but is a strong leading indicator of the trends found in the next round of ISM Manufacturing & Services reports the first week of the new month. Thus, always beneficial to review this announcement to appreciate if odds of recession are going higher or lower.

9/1 Government Employment Situation: This continues to ebb lower as the Fed rate hikes slow down the economy. But gladly has not tipped over into negative territory that would raise the unemployment rate...and risk of recession. Right now the forecast calls for 180,000 jobs added which would be a very “Goldilocks” outcome where the unemployment rate would stay low. On the other hand, not so many jobs created as to heat up wage inflation that would concern the Fed.

9/1 ISM Manufacturing: This has been the weakest part of the economic picture with 9 straight readings in contraction territory (below 50). Right now, it seems that June may be the worst of these readings with July a notch higher...and the August reading on 9/1 expected to be another step in the right direction.

9/6 ISM Services: This is the larger, and healthier part of the economy leading to the positive GDP readings. It is currently expected to be somewhat in line with last month’s 52.7 reading, which is modestly in expansion territory. However, Tuesday’s impressive Retail Sales report may have estimates for this report moving higher in the days ahead.

9/13 Consumer Price Index (CPI): Inflation reports are the most telling of what the Fed will do with future rate hike decisions. Gladly this key inflation report has been moderating faster than expected for quite some time. Thus, that positive trend staying in place will be key to reignite bullish sentiment.

Trading Plan

As shared above, I think we are enduring a long overdue pullback to take the ripe early 2023 profits off the table. The main question is how low we need to go to find the bottom?

From the outset I had my eyes set on 4,400 as a logical bottom...but who says the stock market is logical?

The point is that I am using this pullback to stock up on the best trades for the eventual rise back to the top of the range...and likely flirting with the all time highs of 4,818 by the time we close the books on 2023.

One always feels foolish buying stocks early in a pullback as these new trades will just show red arrows for a while. But since this pullback is only temporary before the next leg higher...and perfect timing is nearly impossible...then it’s better to be too early, than too late.

Meaning that now is as good of a time as any to load up on the best stocks. Which are those? That is what the next section will discuss...

What To Do Next?

Discover my current portfolio of 6 stocks packed to the brim with the outperforming benefits found in our POWR Ratings model.

Plus I have added 4 ETFs that are all in sectors well positioned to outpace the market in the weeks and months ahead.

This is all based on my 43 years of investing experience seeing bull markets...bear markets...and everything between.

If you are curious to learn more, and want to see these 10 hand selected trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

SPY shares rose $0.03 (+0.01%) in after-hours trading Tuesday. Year-to-date, SPY has gained 16.68%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

Are Stock Investors Losing that Loving Feeling? StockNews.com