Growth stocks lately have rebounded, and many investors use Cathie Wood’s ARK Innovation ETF (ARKK) as a proxy for those stocks.

But even those who don't would find it hard to deny the recent strength in various stocks in the sector. Stocks like Shopify (SHOP), Uber (UBER), Roku (ROKU), DigitalOcean (DOCN), SoFi (SOFI) and others have been trading much better for the longs.

While plenty of pessimism persists out there, we’re starting to see more constructive price action in growth stocks.

Don't Miss: How Far Can SoFi Stock Rally? Chart Provides a Clue.

The ARKK ETF recently made its first close over its 50-week moving average since September 2021.

That said, just like the rotation into small-cap stocks, we don’t know how long this strength will last. If the recent momentum is short-lived, growth names could soon run out of steam.

But if we see continued strength in the group, there’s a lot of room to the upside given the pain these stocks suffered in the bear market.

How High Can ARKK Go?

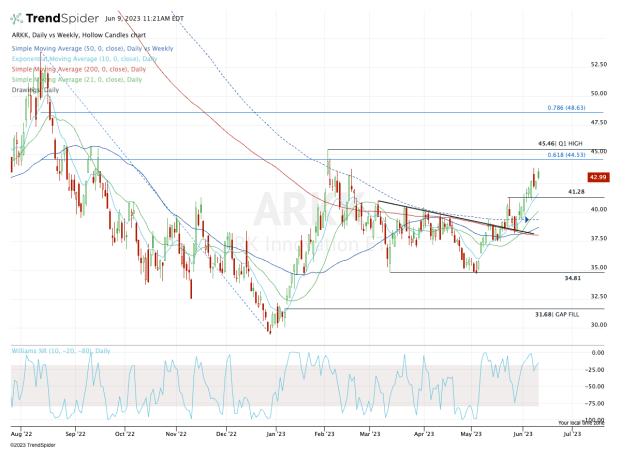

Chart courtesy of TrendSpider.com

On Friday shares of the ARKK ETF were pressing this week’s high up at $43.83. But they're fading from the highs amid a mixed broad market.

From here the bulls need to keep a close eye on this $43.83 area. A move over this level opens the door up to the 61.8% retracement and the first-quarter high up near $44.50 and $45.50, respectively.

If the ARKK ETF really catches fire and rips higher through this zone, then the 78.6% retracement is in play up near $48.50, followed by a potential push up through $50.

On the flip side, this stock has been trending quite nicely. That should put buyers in control on a dip — at least initially.

Don't Miss: CVS Health and Walgreens: Go Short or Go Long?

Notice how well the $41 level has held as support now that ARKK has broken above it. It helps that the 10-day moving average comes into play near this level.

A further breakdown could thrust $40 into the spotlight, which marks the 21-day and the 50-week moving averages. From a technical perspective, it would be quite unhealthy to see this level fail.

However, buyers would have one more chance if the stock tested down into the $38 area. That’s where they’d find the 200-day moving average and the topside of prior downtrend resistance.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.