Headquartered in Chicago, Illinois, Archer-Daniels-Midland Company (ADM) is a major food processing and agricultural commodities trading corporation. The company operates a global network of processing plants and crop procurement facilities, where it transforms cereal grains and oilseeds into a wide range of products for the food, beverage, nutraceutical, industrial, and animal feed markets. ADM also provides agricultural storage and transportation services and is a significant player in global agribusiness with a market cap of $28.4 billion.

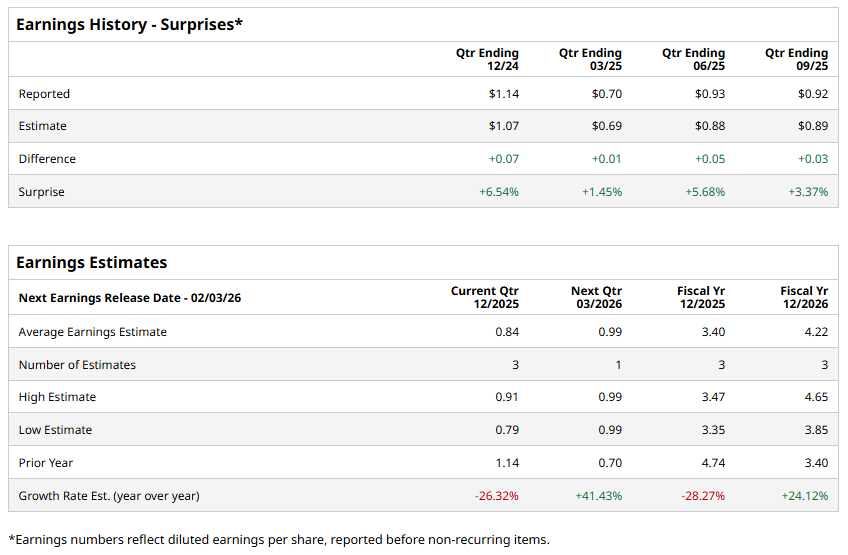

The farm products giant is expected to release its Q4 earnings soon. Ahead of the event, analysts expect ADM to report a profit of $0.84 per share, down 26.3% from $1.14 per share reported in the year-ago quarter. The company has surpassed the Street earnings projections in all of the past four quarters, which is impressive.

For the fiscal year 2025, analysts expect the company to deliver an EPS of $3.40, down 28.3% from $4.74 reported in the previous year. However, in fiscal 2026, its earnings are expected to rebound 24.1% annually to $4.22 per share.

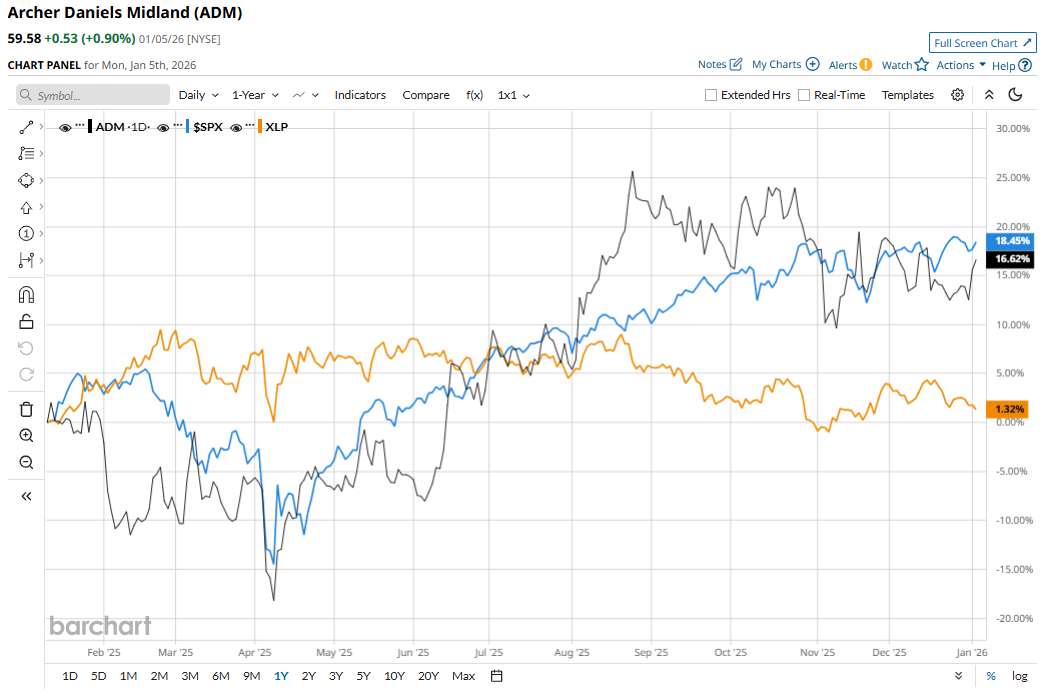

ADM has soared 19% over the past 52 weeks, outperforming the S&P 500 Index’s ($SPX) 16.2% gains and the Consumer Staples Select Sector SPDR Fund’s (XLP) marginal dip during the same time frame.

In 2025, Archer-Daniels-Midland’s stock saw periods of upward movement largely due to earnings results that beat analyst expectations and positive sentiment around operational improvements and strategic initiatives, even amid a challenging agricultural market. The stock has been trading with a generally positive tone in early 2026. The share price climbed about 2.7% on Jan. 2, rising alongside broader market strength after a brief pullback at the end of 2025.

Analysts remain cautious about the stock’s prospects. ADM has a consensus “Hold” rating overall. Of the 11 analysts covering the stock, one suggests a “Strong Buy,” five recommend “Hold,” two advise “Moderate Sell,” and three give “Strong Sell” ratings. The stock currently hovers above its mean price target of $56.11.