/Arch%20Capital%20Group%20Ltd%20logo%20and%20data-%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Arch Capital Group Ltd. (ACGL), headquartered in Pembroke, Bermuda, is a global insurer specializing in insurance, reinsurance, and mortgage insurance worldwide. It leverages specialized underwriting across key lines and maintains a robust footprint, prioritizing strong capital and client service. The company has a market capitalization of $35.48 billion.

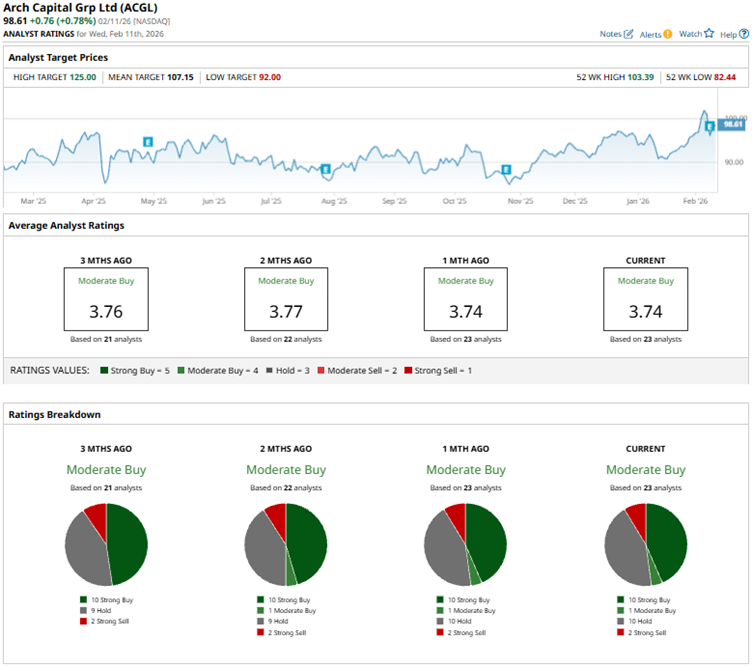

While Arch Capital’s stock has benefited from its diversified operations, the gains have also been tempered. Over the past 52 weeks, the stock has gained 10.1%, and it is up 2.8% YTD. The stock reached a 52-week high of $103.39 on Feb. 6 but is down 4.6% from that level.

On the other hand, the broader S&P 500 Index ($SPX) has gained 14.4% and 1.4% over the same periods, respectively, indicating that the stock has underperformed the broader market over the past year. Next, we compare the stock with its own sector. The State Street Financial Select Sector SPDR ETF (XLF) is up 2.3% over the past 52 weeks but down 3.7% YTD. Therefore, the stock has outperformed its sector over these periods.

On Feb. 9, despite Arch Capital reporting better-than-expected fourth-quarter results, the stock dropped 4.8% intraday. The company’s underwriting income increased by 32.3% year-over-year (YOY) to $827 million. Arch Capital’s after-tax operating income available to its common shareholders grew 31.9% from the prior-year period to $2.98 per diluted share.

For the current quarter, Wall Street analysts expect Arch Capital’s EPS to grow 62.3% YOY to $2.50 on a diluted basis. However, EPS is expected to decrease 4% annually to $9.45 in fiscal 2026, followed by an 8.2% improvement to $10.22 in fiscal 2027. The company has a solid history of surpassing consensus estimates, topping them in all four trailing quarters.

Among the 23 Wall Street analysts covering Arch Capital’s stock, the consensus is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings, one “Moderate Buy,” 10 “Holds,” and two “Strong Sells.” The ratings configuration has remained the same over the past month.

Post the Q4 results, analyst Elyse Greenspan from Wells Fargo reaffirmed an “Overweight” rating on Arch Capital’s stock, while increasing the price target from $106 to $109. RBC Capital, represented by analyst Rowland Mayor, raised the price target from $108 to $115, while keeping its “Outperform” rating.

Arch Capital’s mean price target of $107.15 indicates an 8.7% upside over current market prices. The Street-high price target of $125 implies a 26.8% upside.