AppLovin Corporation (APP) builds a software-based platform for advertisers to enhance the marketing and monetization of their content. Valued at $217.5 billion by market cap, the company provides end-to-end software and AI solutions to help businesses reach, monetize, and grow their global audiences.

Shares of this advertising giant have considerably outperformed the broader market over the past year. APP has gained 277.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 18.3%. In 2025, APP stock is up 93.6%, surpassing the SPX’s 17.2% rise on a YTD basis.

Zooming in further, APP’s outperformance looks less pronounced compared to SPDR S&P Software & Services ETF (XSW). The exchange-traded fund has gained about 20.5% over the past year. Moreover, APP’s double-digit gains on a YTD basis outshine the ETF’s 7% returns over the same time frame.

On Aug. 6, APP reported its Q2 results, and its shares closed up by 12% in the following trading session. Its adjusted EPS of $2.26 surpassed Wall Street expectations of $1.99. The company’s revenue was $1.3 billion, topping Wall Street's $1.2 billion forecast. For Q3, APP expects revenue in the range of $1.32 billion to $1.34 billion.

For the current fiscal year, ending in December, analysts expect APP’s EPS to grow 103.3% to $9.21 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

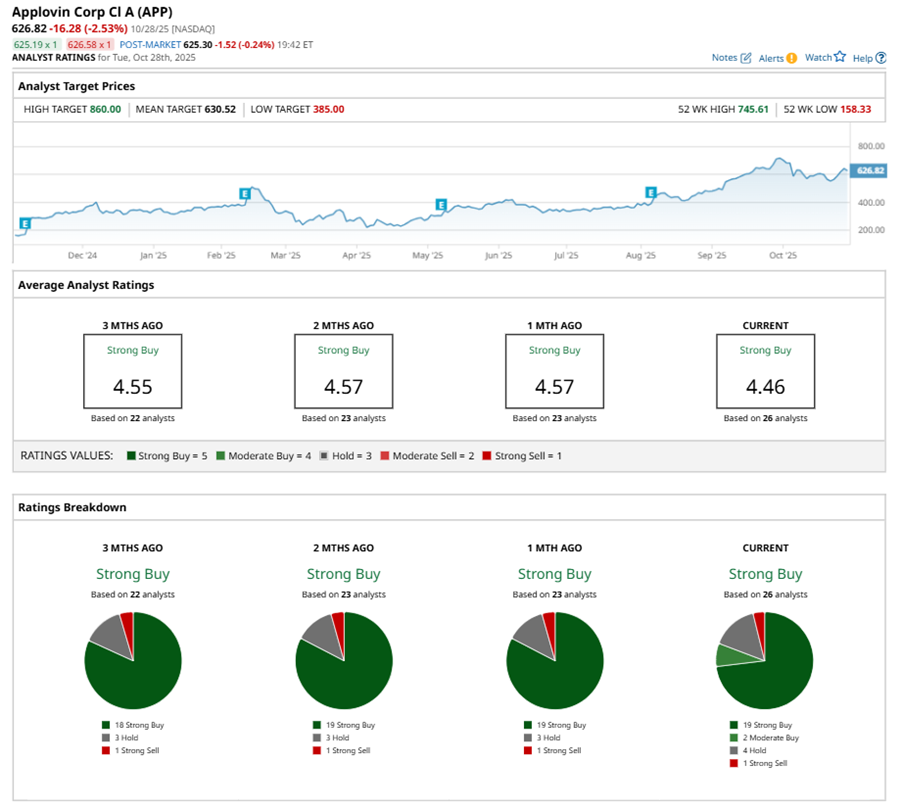

Among the 26 analysts covering APP stock, the consensus is a “Strong Buy.” That’s based on 19 “Strong Buy” ratings, two “Moderate Buys,” four “Holds,” and one “Strong Sell.”

This configuration is more bullish than three months ago, with 18 analysts suggesting a “Strong Buy.”

On Oct. 22, Deutsche Bank Aktiengesellschaft (DB) initiated a “Buy” rating on APP with a $705 price target, implying a potential upside of 12.5% from current levels.

The mean price target of $630.52 represents a marginal premium to APP’s current price levels. The Street-high price target of $860 suggests an ambitious upside potential of 37.2%.