Applied Digital Corp (NASDAQ:APLD) reported better-than-expected financial results for the first quarter of fiscal 2026 after the market close on Thursday.

Applied Digital reported first-quarter revenue of $64.22 million, beating analyst estimates of $49.99 million, according to Benzinga Pro. The digital infrastructure provider reported a first-quarter adjusted loss of three cents per share, beating analyst estimates for a loss of 13 cents per share.

"We feel this third lease validates our platform and execution, positioning Applied Digital as a trusted strategic partner to the world's largest technology companies," said Wes Cummins, chairman and CEO of Applied Digital. "With hyperscalers expected to invest approximately $350 billion into AI deployment this year, we believe we are in a prime position to serve as the modern-day picks and shovels of the intelligence era."

Applied Digital shares gained 19.3% to $34.93 on Friday.

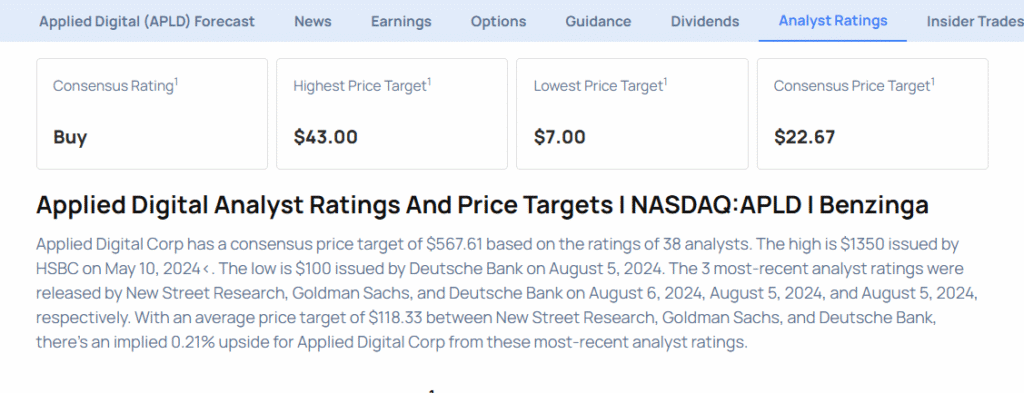

These analysts made changes to their price targets on Applied Digital following earnings announcement.

- Needham analyst John Todaro maintained Applied Digital with a Buy and raised the price target from $21 to $41.

- Craig-Hallum analyst George Sutton maintained the stock with a Buy and raised the price target from $23 to $37.

- HC Wainwright & Co. analyst Kevin Dede maintained Applied Digital with a Buy and raised the price target from $20 to $40.

Considering buying APLD stock? Here’s what analysts think: