When Apple released its first-ever VR headset this year bringing a $3,499 price tag in tow, the expectation was that it would be a niche product. Still, despite an early surge in sales in the early days of Apple Vision Pro, the headset's launch managed to underwhelm. This week, Apple analyst Ming-Chi Kuo reported that the company cut Vision Pro shipments by about 300,000 units and a 2025 refresh could be in jeopardy.

It's the latest hit to Vision Pro, and would be one of the first tangible indications that the headset is in trouble. Previously, there seemed to be a general lack of public interest related to Vision Pro, with YouTube videos about the device flopping and some stores reportedly selling only a few units a week. But what do declining sales figures and scarce enthusiasm mean for the future of Apple Vision Pro?

As an early adopter, I learned firsthand just how weird Vision Pro was as a first-gen product. Strolling into an Apple Store about eight hours after the location opened on launch day in the U.S., there were no problems buying a headset. Apple employees told me that while Light Seal and Cushion configurations might not be in stock, there were plenty of Vision Pro units to go around. I've had more trouble picking up an iPad mini on launch day than when purchasing Apple's first new product in nearly a decade.

I purchased Vision Pro knowing that there was one big uncertainty related to the headset: software and app support. That's still my concern, not declining sales. However, Apple won't cruise to a victory in the VR/AR market. Meta is a force, combining affordable hardware with a software strategy that parallels that of Windows. Vision Pro isn't a failure yet, but Apple can't stop making it better and empowering developers to create great visionOS apps if it wants to beat Meta.

We never expected Vision Pro to sell a ton of units

First, it's important to put our expectations in context. With the headset costing more than a used car, no one thought that Apple Vision Pro would start off putting up iPhone, iPad, or Apple Watch numbers. In fact, it was likely that Vision Pro wouldn't sell more than the Meta Quest 3, either — you could buy seven Quest 3 headsets for the same price as one Vision Pro.

Apple's strategy here was clearly to start off with a premium, high-end device and eventually bring that down to consumer-level products over time. It may be semantics, but Apple Vision Pro would suggest that a standard Apple Vision will come someday.

Still, it's impossible to ignore just how low sales numbers are for Apple Vision Pro have been so far. Kuo's report says that Apple “cut its 2024 Vision Pro shipments to 400-450k units (vs. market consensus of 700-800k units or more)." For perspective, the first-ever iPhone sold roughly 270,000 during launch weekend. While the iPhone wasn't as expensive as Vision Pro, it did cost about $750 after accounting for inflation, which was a lot to ask for a phone in 2007. It still went on to sell over six million units.

The elephant in the room is Meta, which is unmistakably thriving. An earnings report released in February 2024 revealed that the Quest 3 likely sold between 900,000 and 1.5 million units in its first quarter. Apple isn't one to worry about competitors, but it should absolutely keep an eye on Meta.

As an early adopter, I'm worried about the App Store — not declining sales

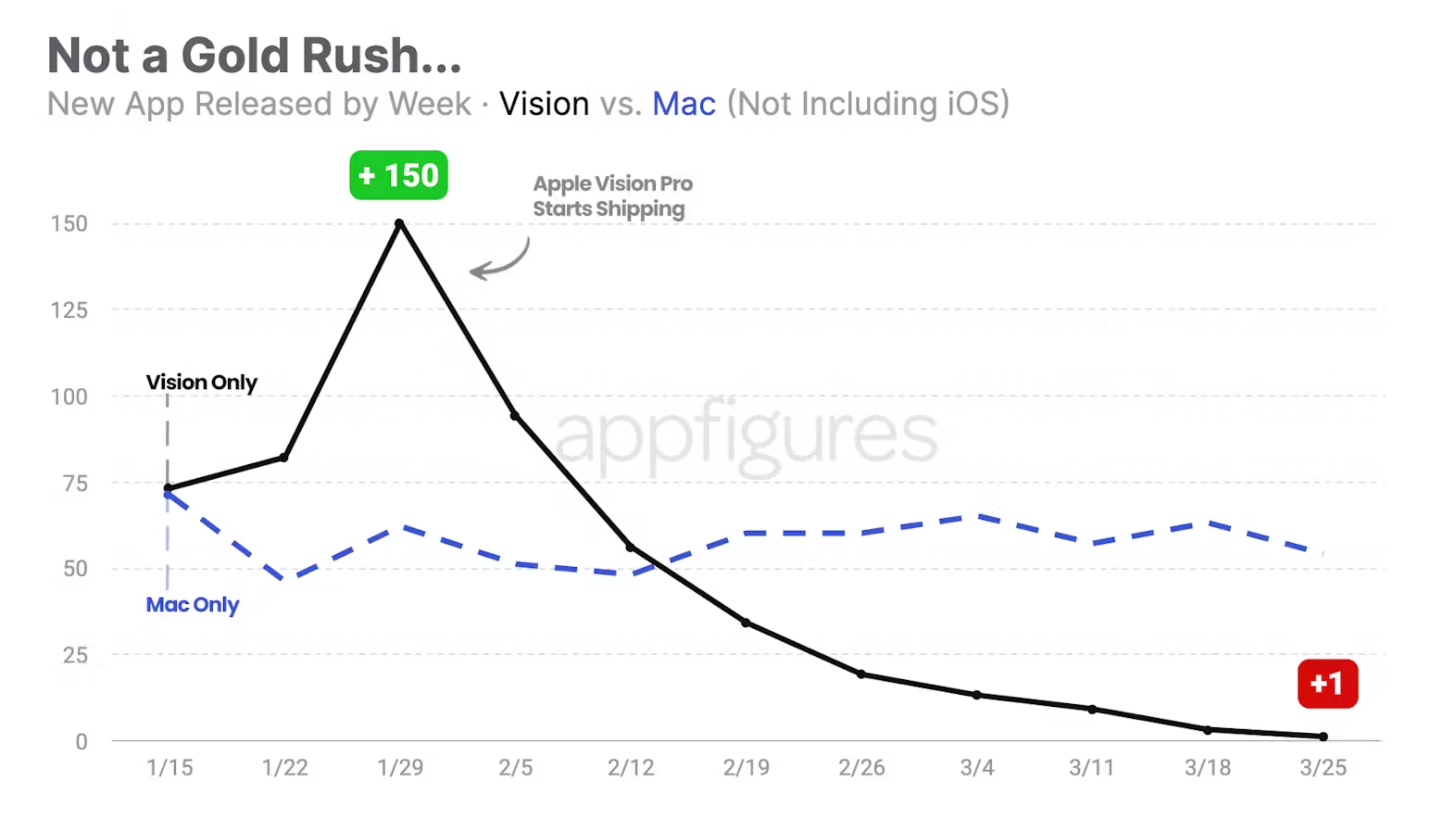

Meta is succeeding where Apple is failing, and that's in software. Vision Pro launched with about 600 native visionOS apps, with support for thousands more iPadOS apps as well. However, app development has slowed to a crawl in recent weeks. Just take a look at this chart from Appfigures showing the number of visionOS vs. macOS apps added to the App Store over time:

This is what concerns me as an early Vision Pro adopter. I knew there would be limited apps at launch, but I can't say I expected the situation to be exactly the same months later. I also didn't expect Apple to forget about Vision Pro. More than two months after launch, there are still two visionOS Environments that aren't available and no new immersive experiences have arrived. There are still a handful of first-party Apple apps that don't run as native visionOS apps. If Apple doesn't care about developing for visionOS, why should third-party developers?

Meta isn't far ahead of visionOS in the raw number of supported apps; the Meta Quest Store and the Quest App Lab have over a thousand apps each. That's more than the visionOS App Store, but isn't all that impressive considering the head start Meta and Quest have had.

However, with Meta's recent announcement that it plans to license Horizon OS — the operating system that powers Quest headsets — to third parties, the company's strategy becomes clear. Meta wants to put Quest headsets on as many faces as possible. And if it can't, Meta will do the next best thing, which is getting Horizon software on third-party headsets. It's the polar opposite of Apple's strategy, but will it work?

It's impossible to count out Apple this early in the company's mixed-reality push. Remember, Android is an open platform just like Horizon OS will be, and Apple still found dominance with closed ecosystems in iOS and the iPhone. There's no reason Apple can't do it again with visionOS and Vision Pro.

Apple is in 'Vision' for the long haul

It's easy to get caught up in the negative hype around Vision Pro, but it's far too early to deem the headset a failure. Before buying the $3,500 headset, I used the first-generation iPad and Apple Watch, and both of those products suffered from many of the same issues as Vision Pro does today. Both of those products also grew to become commanding forces in their respective categories.

Apple isn't afraid to cancel projects that it isn't absolutely committed to, no matter the loss. It canned the Apple Car project after a decade and about $10 billion in research and development costs. And yet, Apple Vision Pro made it to launch. That alone should tell you that Apple is all-in on mixed-reality hardware, regardless of how the first generation of Vision Pro goes.