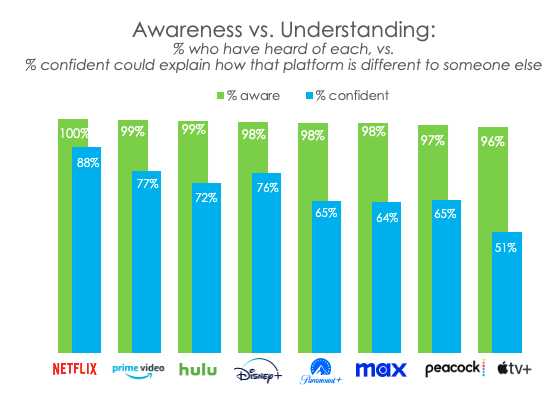

While 96% of U.S. consumers recently polled are familiar with Apple TV Plus, only 51% can explain the difference between the subscription streaming service and other major SVODs.

Netflix, meanwhile, boasts 100% "brand awareness" and an industry-leading 88% brand "understanding," according to Hub Entertainment Research, which surveyed 1,600 consumers or its 2025 Evolution of Video Branding report.

In most cases, Hub notes, brand understanding lags significantly behind awareness for most big U.S. SVOD services.

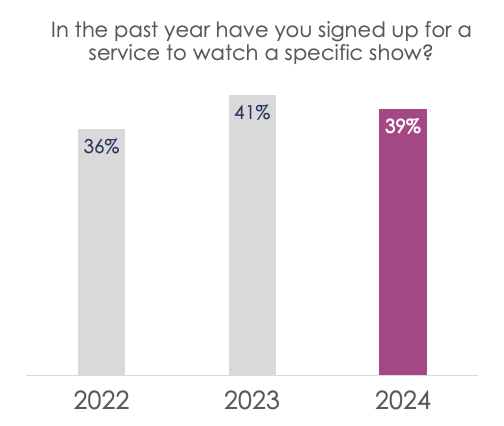

And without brand understanding, the research company says, users tend to sign up for SVOD services based on their desire to see a specific movie or TV show.

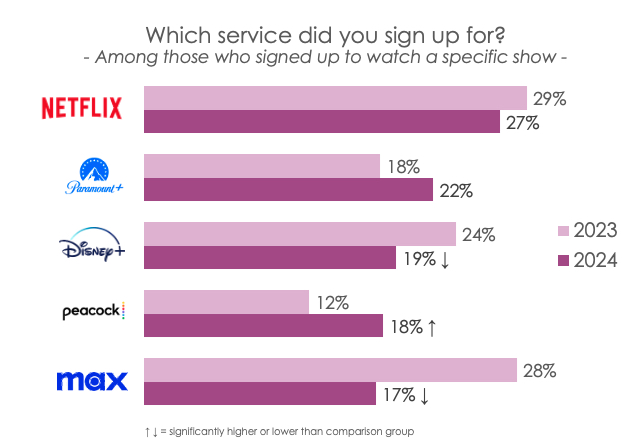

Notably, in 2024, fewer users signed up for Max and Disney Plus to see a specific program, a dynamic, Hub claims, that could be tied to both services significantly scaling back on content.

Conversely, Peacock -- which has seen increased investment, including NBCUniversal's decision to pay the NFL $100 million to put a playoff game exclusively on its streaming service -- has seen an uptick in sign-ups driven by specific content.

“As big streamers aim to be all things for all people, viewers are struggling to identify what distinguishes them from each other,” said Hub consultant Jason Platt Zolov, in a statement. “Until streamers develop more brand-defining features, viewer loyalty is at risk and consumers will continue to churn as they chase shows across services.”