Apple (AAPL) lately has held up well, after a not-so-perfect quarter and also with the marketwide selloff.

On Monday, the S&P 500 hit its lowest level since May 2021, while the Nasdaq is currently 22.5% off its high. Not a pretty run.

Over the weekend, Berkshire Hathaway (BRK.B) (BRK.A) held its annual meeting, where investors tuned in to hear what Warren Buffett and Charlie Munger thought of the market.

Among the tidbits, Berkshire bought roughly $600 million of Apple stock in the first quarter. That’s besides the investment group holding more than $150 billion of the stock.

Apple makes up roughly 40% of Berkshire's portfolio of public shares and the holding is more than double the size of its next largest holding, Bank of America (BAC).

Perhaps more interesting is Buffett’s comment on Apple: “Unfortunately, the stock went back up, so I stopped. Otherwise, who knows how much we would have bought?”

So the question now becomes: Should investors be buying the dip in Apple stock as well? If so, here are the levels to know.

Trading Apple Stock

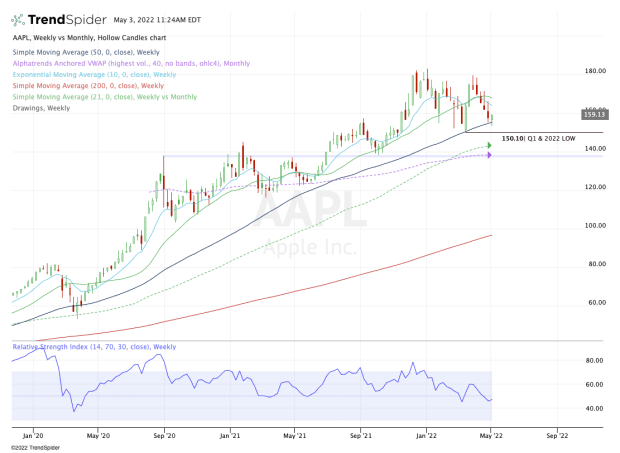

Chart courtesy of TrendSpider.com

The weekly chart above clearly lays out the longer-term trend in this one. It also highlights the controlled pullback we’ve seen so far.

Apple stock is down 13% from the all-time highs, which is reasonable considering the carnage we’ve seen in the first four months of the year.

The stock continues to hold the 50-week moving average as support.

If we can see Apple find its footing -- as it did in mid-March, just ahead of a Federal Reserve meeting -- the bulls would love to see this stock clear $170.

That would put Apple stock back above the 10-day, 21-day and 50-day moving averages, as well as its 10-week and 21-week moving averages and the 50% and 61.8% retracement.

That’s a mouthful of technical jargon to some investors. But clearing all these levels would open the door for a return to all-time highs.

On the downside, a close below the 50-week moving average could put the 2022 low in play down near $150. On the plus side, this might well draw in some more Buffett buying.

A break of this level could thrust Apple stock down to the $138 to low-$140s zone.

There we find a current support and resistance zone, a prior breakout area, the monthly VWAP measure and the 21-month moving average. The last of those was most recently tested in March 2020 and held as support.

For long-term buyers, that $138-to-low-$140s range up to $150 is the zone within which they may want to consider scooping up the stock.