Apple (AAPL) helped lend some stability to the Nasdaq last night when it reported earnings after the close. Now it’s doing so on Friday.

Big tech has not reacted well to earnings this week and Amazon (AMZN) didn’t help matters, falling about 20% at in the immediate aftermath of its report.

When Apple reported around 4:30 pm ET on Oct. 27, it too slipped lower. However, the stock quickly recovered its losses and ended the after-hours session slightly higher -- and boosted the Nasdaq futures as a result.

As for Friday, shares opened higher by about 2% and quickly ripped higher, now up about 7.5% after the company delivered a top- and bottom-line beat.

How Apple trades from here will be important.

Of the mega-cap tech stocks, this one has held up the best. Not only in regards to its earnings reaction this quarter, but also in regards to how much it’s pulled back from the high.

If Apple can stand strong, the Nasdaq may be able to hold up. If not, then we could be looking at more selling pressure.

Trading Apple Stock on Earnings

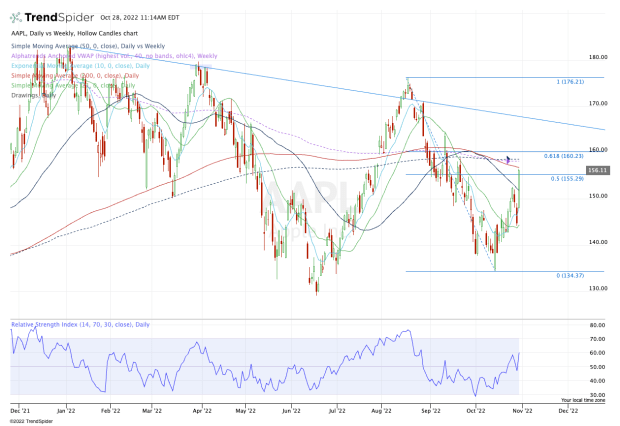

Chart courtesy of TrendSpider.com

Apple stock pulled back about 5% in the two days leading into Friday. That’s what we call “pre-earnings jitters” and given how the rest of big tech has performed, that type of price action is completely justified.

That said, given the muted reaction in yesterday’s after-hours session and even in this morning’s pre-market session, Friday’s 7%-plus rally is equal parts surprising and impressive.

Once again, Apple seems to be saving the market.

With today’s rally, shares are erupting through the 50-day moving average and — at least for the moment — the 50% retracement.

However, the $157.50 to $160 area is a big hurdle for the stock. In that zone, Apple stock faces its 200-day and 50-week moving averages, the weekly VWAP measure and the 61.8% retracement.

If Apple can clear these measures, then downtrend resistance (blue line) is back in play, followed by the mid-$170s.

If the $157.50 to $160 area rejects Apple stock, bulls will want to see it hold the 50-day moving average and the $150 level. Below that will put its short-term moving averages back in play.

Below $143 and the October low near $135 could be back on the table.

For now, traders have to assume the bulls are back in control. However, how the stock handles $157.50 to $160 will tell us just how in control they are.