/Apple%20Products%20on%20Desk.jpg)

Apple (AAPL) stock Is trading at 4-month lows at $171.21 on Friday, Sept. 29, close to its lows in May. But its earnings are still expected to grow and its free cash flow outlook is bright. This makes it very attractive to value buyers.

For example, analysts forecast that earnings per share (EPS) for the year ending Sept. 2024 will rise to $6.57, up from $6.07 expected for the year ending Sept. 2023. That implies EPS growth of 8.23% over the next year.

FCF Growth

Moreover, free cash flow (FCF) could exceed $121 billion next year. That is significantly higher than the $105 billion in FCF forecast for the year ending Sept. 30, 2023.

The fundamental reason is that its FCF margin is extremely high at almost 30%. For example, last quarter (fiscal Q3 ending June 30) its FCF was $24.287 billion generated from sales of $81.8 billion. That works out to an FCF margin of 29.7%.

So, if we apply this 30% margin to next year's sales forecast of $405.9 billion, Apple's FCF could reach $121.77 billion.

I discussed this FCF margin in my Aug. 6 Barchart article, “Apple Stock Tumbles After Earnings, But Its Free Cash Flow Growth Makes It a Buy.” I argued that the company's FCF could rise to over 35% by the end of 2024.

That implies its FCF could rise to over $142 billion in the next year or two. In fact, I wrote in my Sept. 4 Barchart article, that it's possible that Apple could produce $169 billion in FCF. This is possible based on the huge 68% margins it makes from its services division, which is growing as a proportion of total sales.

That has tremendous implications for its valuation going forward.

AAPL Target Price

For example, using a 5% FCF yield metric, which is the same as a 20x FCF multiple, we can see that AAPL stock could have a $2.84 trillion market valuation. That is the result of multiplying $142 billion in FCF by 20.

This is 6% higher than its present market cap of $2.68 trillion. That implies that AAPL stock could rise 6% to $181.48 per share.Moreover, if the company makes $169 billion in FCF in the next several years, the stock could have a $3.38 trillion market cap. That is 26% over today's price.

In effect, AAPL stock could rise between 6% and 26% over the next year or so as the market realizes how much FCF the company makes, including its incredibly high FCF margins.

Sell Short OTM APPL Puts for Income

One way to make money or extra income if you are long AAPL stock, is to sell short out-of-the-money (OTM) AAPL put options in near-term expiration periods.

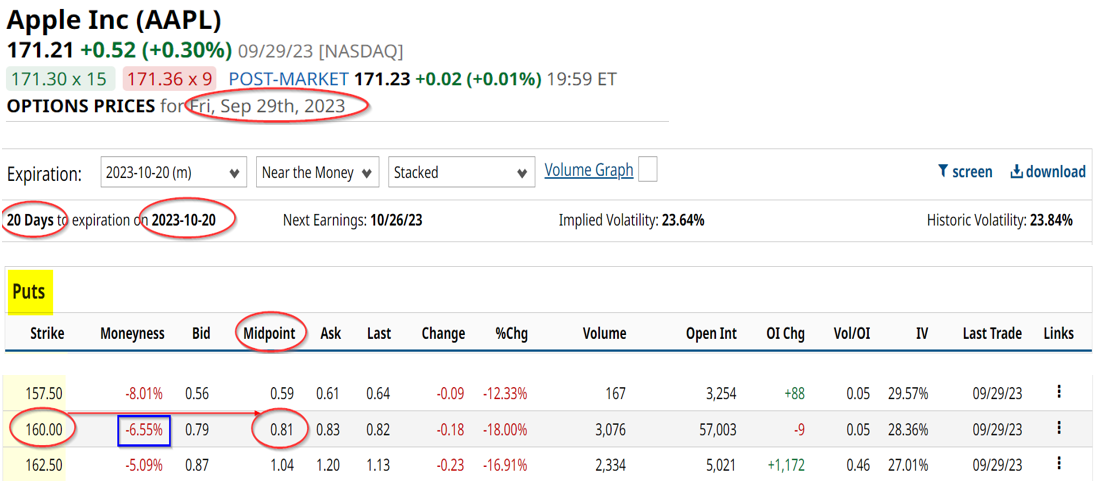

For example, for the Oct. 20 expiration period, which is 20 days from now, the $160 strike price puts sell for 81 cents. That means that any investor who sells short those puts can collect an immediate yield of 0.506% or a three-week investment (i.e., $081/$160.00).

Moreover, that strike price is deep out-of-the-money (OTM). The $160 strike price is 6.55% below the closing price on Sept. 29 of $171.21 per share.

So, if that trade could be repeated over a year, the expected return would be 8.60%. This is because there are 17 periods of 3 weeks in a year (i.e., 0.506% x 17 = 8.60%). Obviously, this is a theoretical return, as there is no guarantee that an investor can make a 0.5% yield every 3 weeks shorting OTM AAPL puts.

For example, here is what this means on a practical basis. If an investor secures $16,000 in cash and/or margin with their brokerage firm, they can enter an order to “Sell to Open” 1 put contract at the $160 strike price for expiration on Oct. 20. The account will then immediately receive $81.00

Then, as long as the stock does not fall to $160 on or before Oct. 20, the investor will not be required to purchase 100 shares of AAPL at $160.00.

In the meantime, they get to keep the $81 in their account. That effectively lowers their breakeven point to $159.29 per share. That means that the breakeven point is 6.96% below the closing price of $171.21 on Sept. 21.

If the investor can repeat this yield every 3 weeks for $81.00, the total expected return is $1,377 for a year. That works out to 8.60% of the total $16,000 invested during that time. This shows that investors can make extra income by shorting OTM puts in AAPL stock.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.