The big keep getting bigger.

Apple (AAPL) is nearing a $3 trillion market cap and is hitting all-time highs in Monday’s trading session.

The move comes ahead of the firm’s annual WWDC event, which in 2023 runs from June 5 to June 9.

Don't Miss: Does Broadcom Stock Still Have Upside After Wild Price Action?

The rally in Apple has been critical. The Cupertino, Calif., tech giant's shares are up 42% this year, helping lead the megacap tech stocks higher.

With several firms valued in excess of $1 trillion — Nvidia (NVDA) recently joined that club — the megacap tech stocks have been pushing the indexes higher.

In other words, Apple’s rally is doing more than making Warren Buffett’s Berkshire Hathaway (BRK.B) (BRK.A) happy. It’s making all long investors happy.

With a key event on deck for later this afternoon, let’s look at the chart as Apple stock hits new highs.

Trading Apple Stock Ahead of WWDC

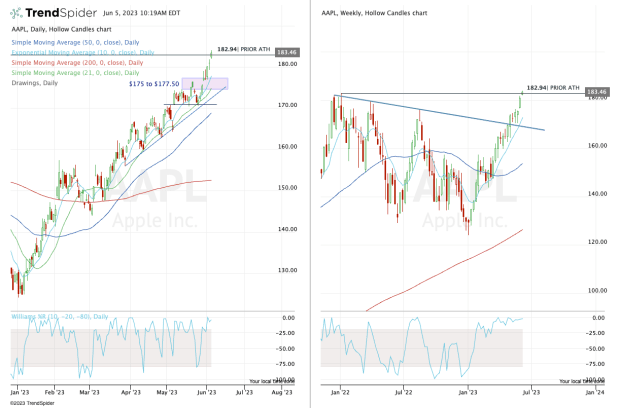

Chart courtesy of TrendSpider.com

Shares of Apple consolidated just below the $175 level and struggled with the $175 to $177.50 zone for most of May.

A late-month push higher sent Apple stock over this zone, and though it appeared ready to falter, it has continued to rally higher.

Now, if we get a quick dip down to this area — for instance, on any sort of sell-the-news reaction to the WWDC event — investors should pay attention.

Not only was the $175 to $177.50 zone a key area of interest over the past month, it also includes the rising 10-day and 21-day moving averages and a gap-fill level at $175.77.

Active bulls may want to consider buying the dip down to this zone. An overshoot of the zone could land Apple stock in the low-$170s, which was support throughout May and comes into play near the 10-week and 50-day moving averages.

Don't Miss: Did Target Stock Just Bottom?

As for upside, a runaway rally would have the bulls looking for a move to $200.

With estimates calling for slight declines in earnings and revenue this year, the rally in Apple may be a bit baffling to investors. That's especially so with the shares trading at more than 30 times earnings.

It’s clear that Apple is acting as a flight-to-safety trade. The risk with that, of course, is a sell-the-news reaction is possible, particularly with the runup we’re seeing ahead of the event.

So keep the above zones in mind when navigating this week’s event.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.