Apple Card has been around for a few years now and, with it, Daily Cash. Up until now, you've only had one place to house all of that cash back: the Apple Cash Card.

Now, there's the Apple Savings account, a brand new way to save in a high-yield account without fees, using both Daily Cash rewards from your Apple Card and deposits.

“Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future. Savings delivers even more value to users’ favorite Apple Card benefit — Daily Cash — while offering another easy-to-use tool designed to help users lead healthier financial lives,” reads a statement from Apple on the new launch.

But what exactly will it offer, and is it worth moving your savings into an Apple-branded vault? Here's everything we know about the Apple Savings account.

What is the Apple Savings account?

The Apple Savings account is a new savings account that users with an Apple Card can choose to open. Apple is marketing it as a "high-yield" savings account that users can deposit their Daily Cash into in order to get more out of the rewards they earn with their Apple credit card.

In addition to automatically depositing earned Daily Cash into the account, users can deposit additional funds into the account directly from a linked bank account.

How much interest will the Apple Savings account earn?

Apple Savings offer 4.15 percent APY.

What kinds of fees will the Apple Savings account charge?

Just like Apple Card, the company is trying to go the no-fee route with its new Apple Savings account.

There are many savings account products in the financial market that have monthly maintenance fees, a minimum monthly balance in order to avoid those fees, and a minimum initial deposit to earn a certain percentage rate. Apple, in comparison, says that its new Apple Savings account has "no fees, no minimum deposits, and no minimum balance requirements."

So, if you have found that your current savings account has been nickel and diming your money, Apple's Savings account might be a good option for you.

Who can open an Apple Savings account?

Apple says that its new Apple Savings account will only be available for Apple Card customers. This means that, if you do not have the company's credit card, you will not be able to sign up for the new savings account.

More specifically, Apple's Savings account is only available for Apple Card owners and co-owners of the credit card. This language seems to indicate that if you have co-owners of an Apple Card, each person will open their own separate Savings account rather than one joint Savings account.

Limiting the Savings account to Apple Card owners and co-owners also means that members of your Apple Card Family, like a child that may be an authorized user, will not be able to open an Apple Savings account.

You must be 18 years old to open an Apple Savings account, and your Apple Card must be in "good standing."

How will I create and manage my Apple Savings account?

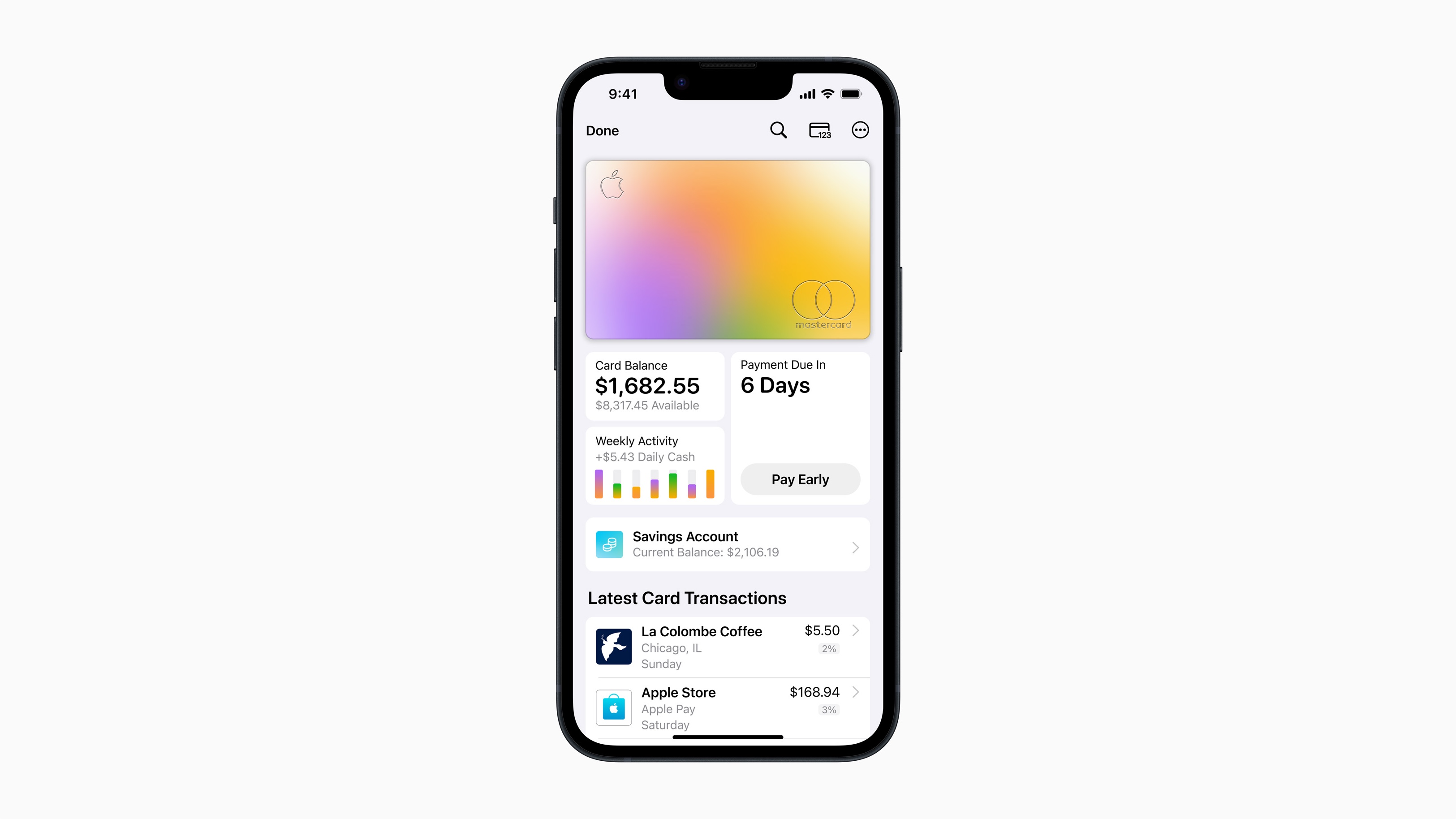

Apple's new Savings account won't be found directly in the Wallet app. Instead, it is contained within the Apple Card experience in the Wallet app.

"Apple Card users will be able to easily set up and manage Savings directly in their Apple Card in Wallet," states Apple.

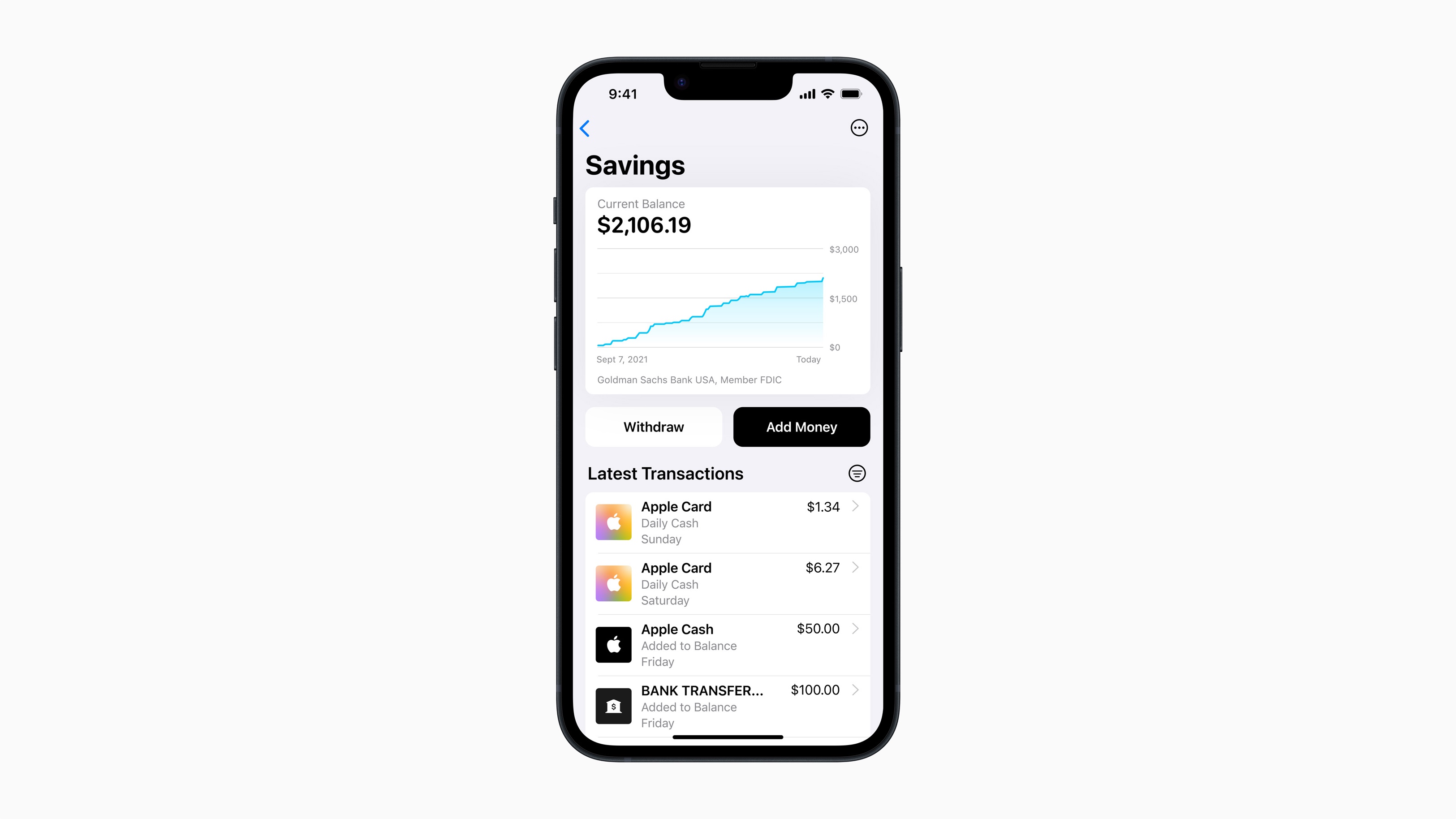

The Savings account features its own dashboard, showing users their balance and the amount of interest they have earned.

"Once set up, Apple Card users can watch their rewards grow in Wallet through an easy-to-use Savings dashboard, which shows their account balance and interest accrued over time," is how it's described.

How will I make deposits and withdrawals from my Apple Savings account?

Does Apple Savings account have a maximum balance?

Yes, the maximum Apple Savings account balance is $250,000.

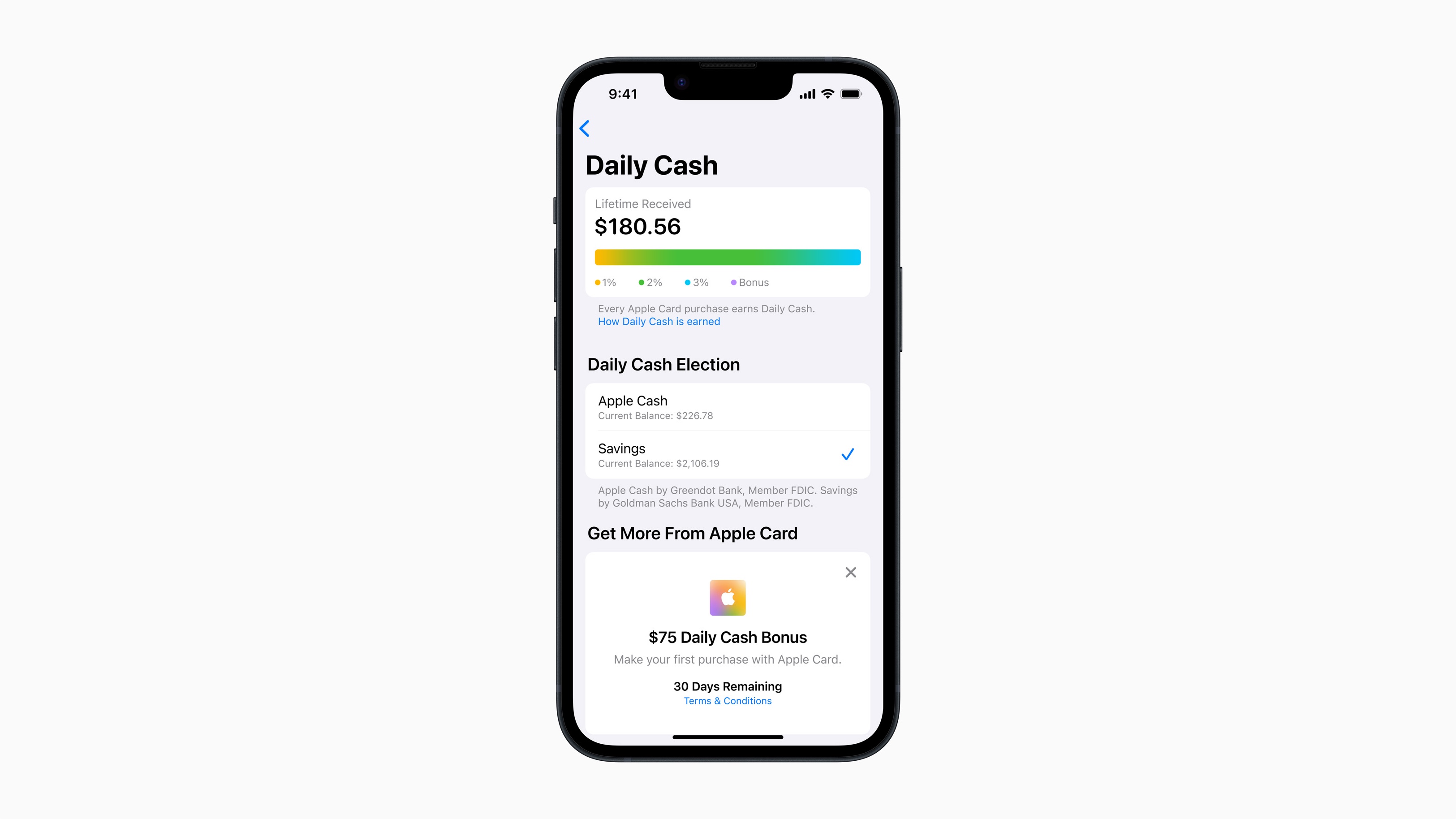

There are two ways to make deposits into your Apple Savings account. The first allows account holders to have Daily Cash earned with their Apple Card automatically deposited into their new Savings account rather than their Apple Cash card:

"All future Daily Cash received will be automatically deposited into it, or they can choose to continue to have it added to an Apple Cash card in Wallet. Users can change their Daily Cash destination at any time."

Account holders can make additional deposits into their Savings account from a linked bank account. The company also notes that you can make withdrawals to your Apple Cash card or linked bank account:

"To expand Savings even further, users can also deposit additional funds into their Savings account through a linked bank account, or from their Apple Cash balance. Users can also withdraw funds at any time by transferring them to a linked bank account or to their Apple Cash card, with no fees."

When will the Apple Savings account launch?

Apple Savings account was launched on April 17, 2023, and requires iOS 16.4 to apply for the account and manage it.