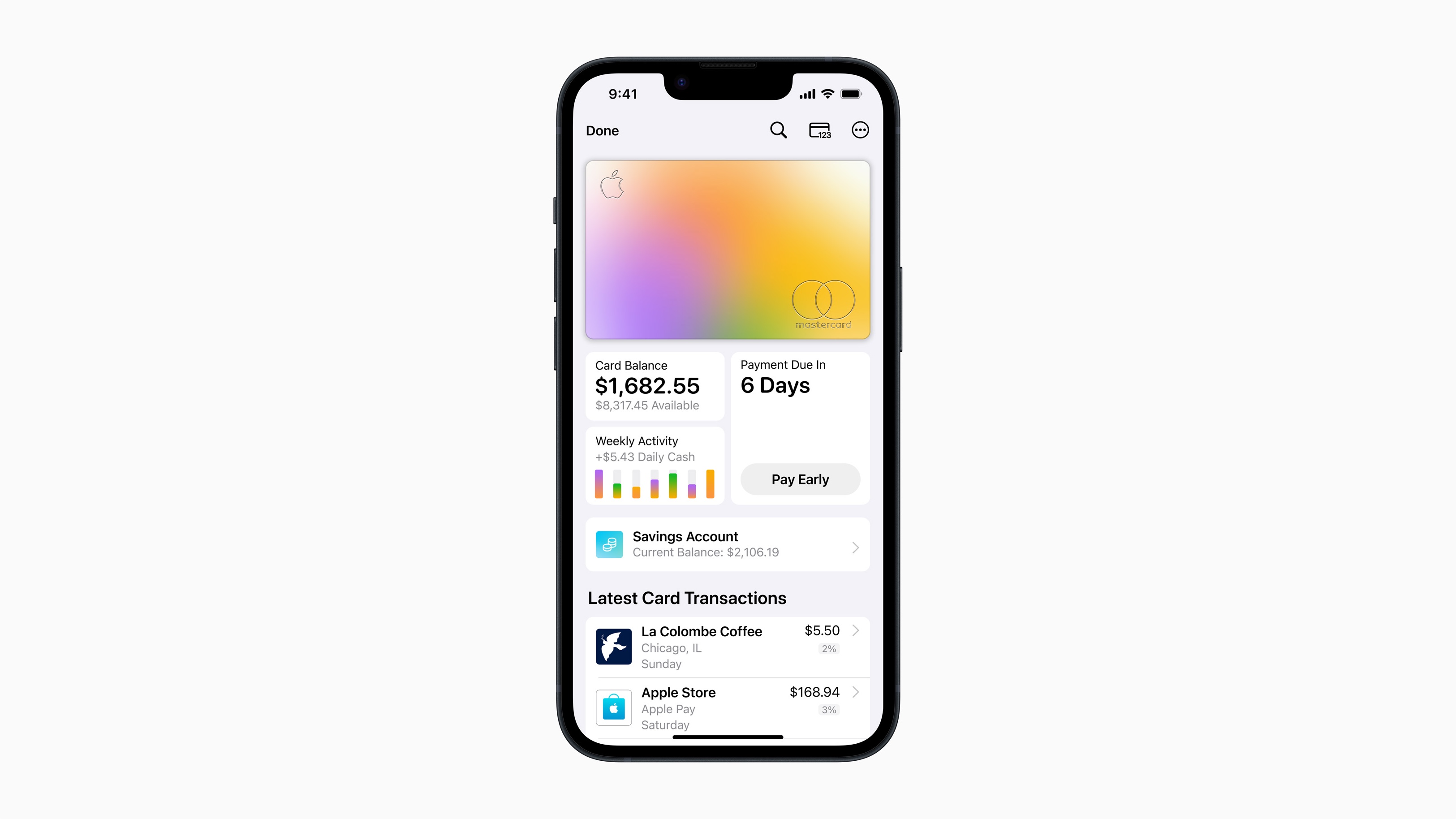

Apple’s new Savings account has been out for a couple of weeks now and, like any new Apple product, I have been using it since it became available. After a couple of weeks with the account and seeing how it interacts with the Apple Card, Daily Cash, and the Apple Cash account, I can say that Apple is on to something here.

However, if you don’t have an Apple Card, you can’t use the Savings account yet. So, unless you already have one — or plan to get one — this account isn’t going to be for you. That said, there’s a lot to consider when looking at Apple Savings such as the interest rate, deposit requirements, and fees.

Thankfully, just like Apple Card, these are all areas where Apple’s new Savings account shines in comparison to a lot of traditional banks.

Apple Savings has one of the best interest rates on the market

Let’s face it. The most important thing about a savings account is the interest rate. There’s not much else that matters. The money is meant to sit and grow over an extended period of time. If the interest rate sucks, it’s not a good savings account. Thankfully, Apple Savings has one of the best interest rates on the market right now.

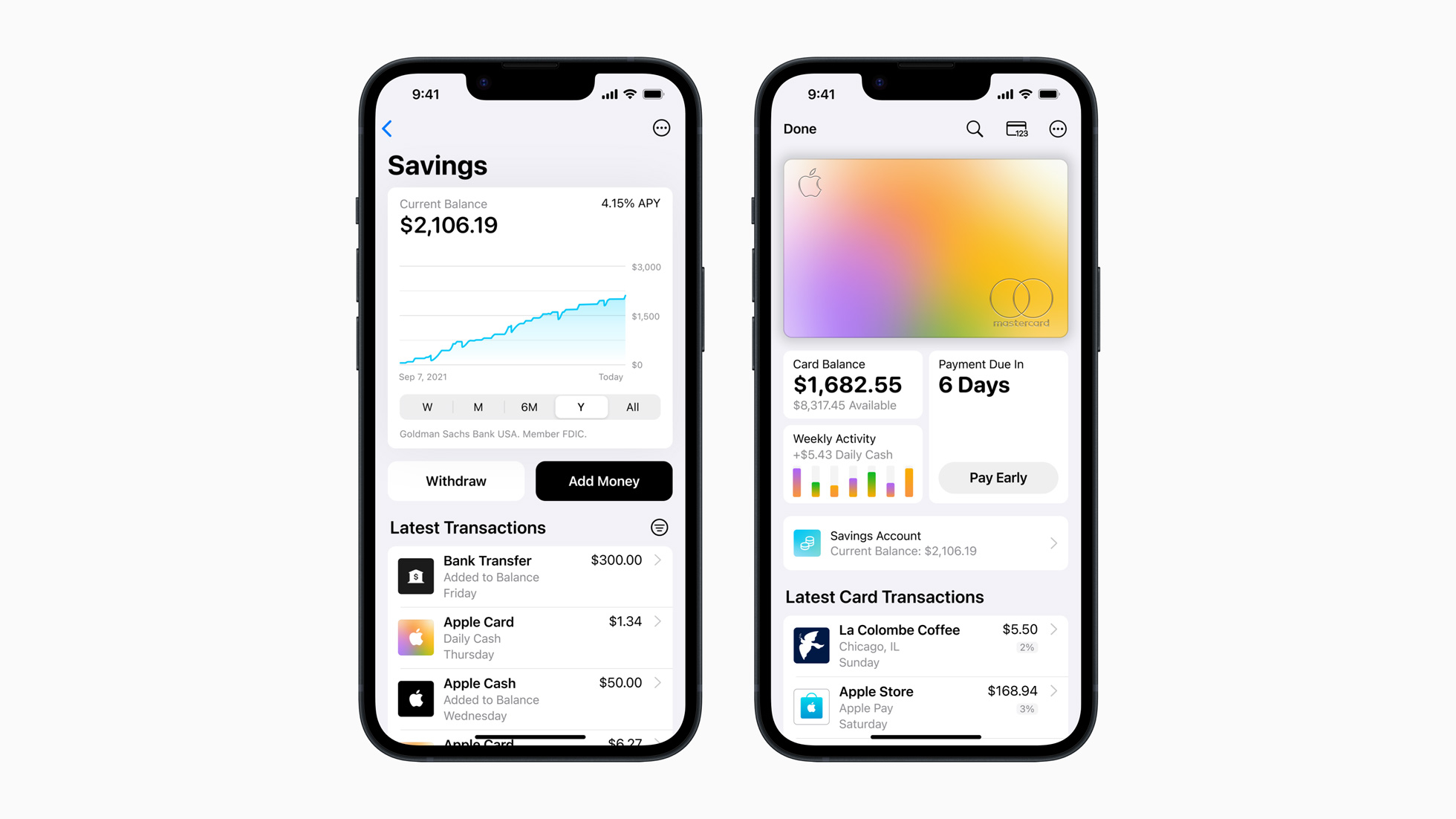

At launch, Apple Savings offers a 4.15% APY. That blows away most of the traditional banks which continue to offer interest rates as low as less than one percent. Even some of the online offerings from Citi, Discover, and Capital One, which I was expecting to see higher rates for, didn’t reach the level of interest rate offered by Apple Savings.

There are some banks that are currently beating Apple’s rate, however. I personally use Betterment for almost everything now and, as of the writing of this article, their interest rate for their savings account is 4.35%. It’s not a huge difference in comparison to Apple’s offering, but those kinds of offers are out there if you look hard enough.

Apple Savings offers a solid interest rate without the deposit requirements

Despite some other banks offering a higher interest rate than Apple Savings, you have to watch out — a lot of the time, that higher rate is only available if you deposit and maintain a certain balance.

Banks love interest-gating their savings accounts. For example, when I was researching this piece, I found an online bank that was offering a 4.75% APY. However, when I took a closer look, I realized that you had to deposit and maintain a $5000 balance in order to get that “special” rate.

Some of the best interest rates for savings accounts will commonly come with these deposit requirements in order to be eligible for the rate. It’s a crappy practice that, thankfully, Apple Savings does not participate in.

This is another nice thing about Apple Savings. There is absolutely no deposit requirement to open up an account. There is no deposit amount that you need to maintain in order to keep the account in “good standing.” And there is no deposit amount that you need in order to qualify for the 4.15% interest rate.

That said, there is a deposit limit. Apple Savings will not let you keep a balance of more than $250,000 in the account. For most, that’s not going to be a big deal. Keeping more than $250,000 in savings and not in investments sounds like something that would set financial experts’ hair on fire.

Apple Savings, like Apple Card, has no fees

When Apple announced Apple Card, one of the things that the company really honed in on was that, in addition to offering decent rewards and a great experience in the Wallet app, it would have zero fees. That meant no foreign transaction fees, no late fees, etc. The company took the same approach with Apple Savings.

Unfortunately, traditional banks earn a lot of their money from fees. While most use checking accounts to prey on customers by charging overdraft fees, some banks will even find ways to charge fees on savings accounts.

Some do this by implementing deposit requirements. If you don’t maintain the required balance, the bank will charge you a fee which, ironically, makes it even harder to maintain your balance. This can trap customers in an endless loop of a balance below the requirement resulting in fees which results in a balance below the requirement and so on and so forth.

Some banks will also allow customers to connect their savings accounts to their checking accounts. However, if a customer overdrafts in their checking account and the savings account does not have enough to cover it, that can also result in fees. It’s a really crappy practice that is predatory on customers with lower balances.

Thankfully, Apple Savings has no fees. There is no deposit requirement to open the account nor a balance requirement, so there are no fees that Apple will charge The company does note that an external bank could charge you and that the charge could reflect in your account, but that Apple nor Goldman Sachs, who oversees the account, will charge customers any kind of fee.

That’s a great win for customers who are starting savings or just don’t want to deal with remembering deposit requirements.

Transfers are instant — if they are to Apple Cash

One of the frustrating things about our current financial system is how slow it still is to transfer money between accounts. While delayed availability is expected when you are transferring funds between institutions, I still even see delays when transferring money between accounts within the same institution.

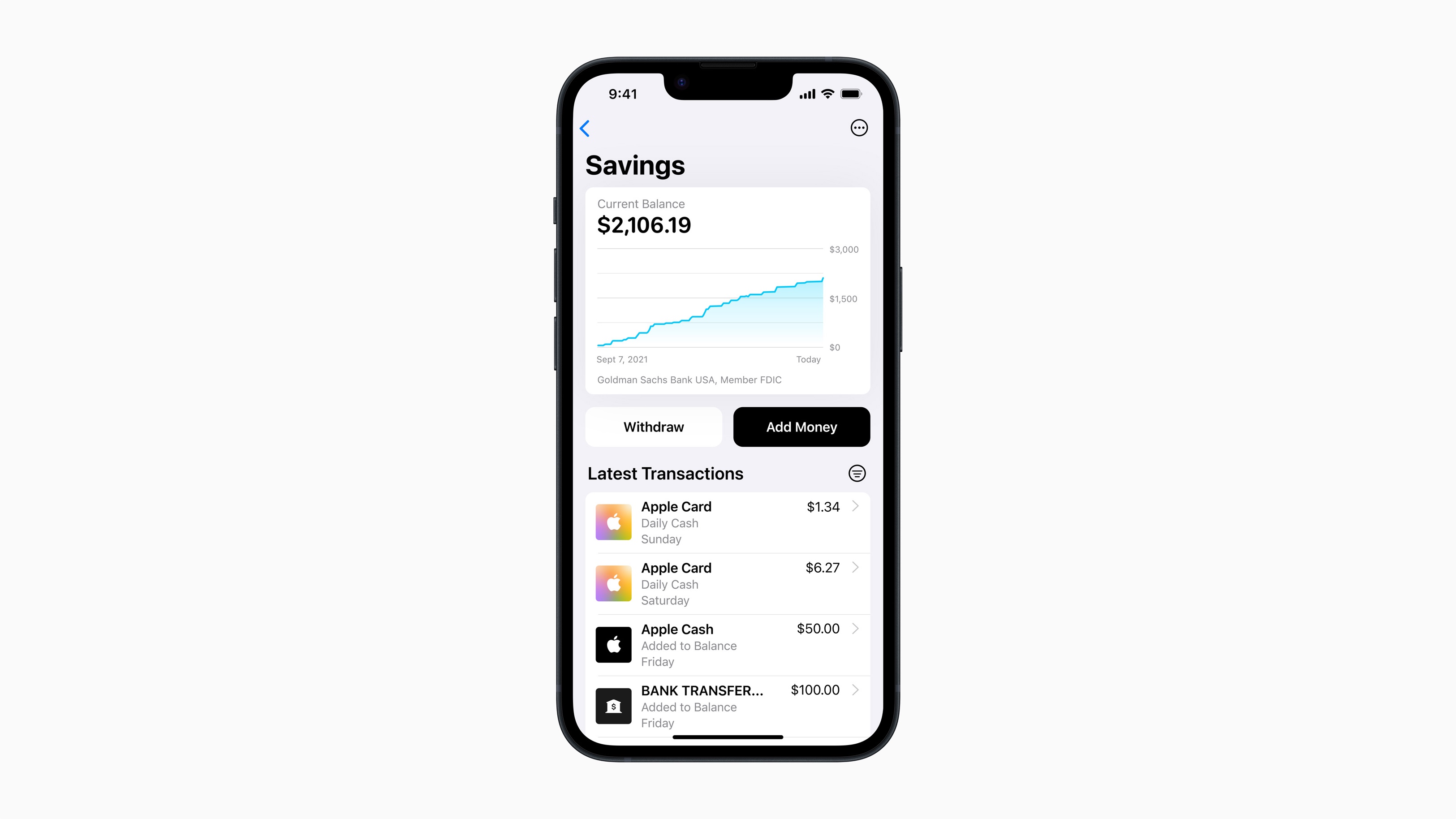

Apple Savings definitely has a leg up here. The company says that transfers between your Apple Cash and Apple Savings account will generally be instantaneous, meaning that transferred funds between accounts should usually be available immediately.

That sounds boring, but this is the kind of infrastructure that more experimental currency like crypto is going after. It’s great to see a non-crypto account offer the same benefit — as long as you are transferring within Apple’s accounts, of course.

Speaking of instant transfers, having earned Daily Cash from your Apple Card transfer right into your Apple Savings account is a great feature. I’ve historically treated Daily Cash like monopoly money so having it skip into savings will definitely help me be more responsible with it.

One thing to note is that Apple, like many other financial institutions, does implement transfer limits. The company says that users can not transfer more than $10,000 at a time and more than $20,000 in a five-day period between Apple Savings and Apple Cash. While some may find that annoying, that’s a pretty common requirement and one you are unlikely to be able to sidestep anywhere else.

What else do you need?

With a great interest rate, no deposit requirements, and wicked-fast transfers to and from Apple Cash, what else do you need in a savings account?

Well, one of the things I’d love to eventually see is the ability to put your savings into buckets. For example, have some savings in an emergency fund bucket, more in a vacation bucket, and so on. I’d also love to see Savings offered without the need to have an Apple Card.

However, I have a growing feeling we’ll see Apple make such moves if, or more likely when, the company rolls out its rumored checking account.