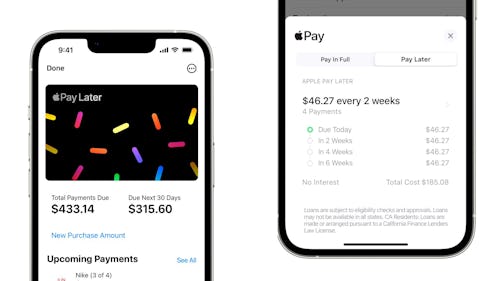

At Apple’s WWDC 2022, the company announced it would introduce a buy now, pay later service (BNPL) that lets Apple Pay users split purchases into separate payments over six weeks without interest or late fees. The service, which comes with iOS 16, won’t require a separate app or any sort of extensive registration — instead, it’ll be built into Apple Pay and Wallet. You’ll pay the first payment up front and the other three every two weeks. Payments are managed in the Wallet app, and you can pay them in advance if you want.

Apple also announced Apple Pay Order Tracking, a tool for merchants to give receipt and shipping information through Apple Wallet.

“This sounds dangerous; I can’t wait”

— This marks Apple’s foray into the exploding buy now, pay later industry, where companies like Affirm, Klarna, Sezzle, and more have boomed. As we wrote last month, Stockholm-based Klarna is valued at a whopping $45.6 billion; Afterpay was acquired by the mobile payment company Block, formerly known as Square, for $29 billion in January; PayPal bought the company Paidy for $2.7 billion.

Not so fast —

The BNPL space has exploded for offering small loans on a purchase-by-purchase basis — suggesting the bleak idea that many people can’t afford everyday purchases like groceries without splitting the bill into installments. For all the convenience of a frictionless splurge, there’s a dark side. Last month, SF Gate published an absolutely harrowing article about how BNPL services lack the consumer protections of genuine credit lenders and can tank the credit scores of vulnerable users. The article cited a survey by the polling site Piplsay which suggests that 43 percent of Gen Z BNPL users have missed at least one payment.

Afterpay has faced federal class-action lawsuits in both California and Maine alleging that the company did not properly convey the fees behind its service. BNPL is a loan, and should be regulated as such. In July 2021, the Consumer Financial Protection Bureau warned consumers to be careful with BNPL services, citing a Credit Karma survey which found that 42 percent of Americans had used BNPL services at least once, 38 percent had missed a payment, and a whopping 73 percent of payment-missers had seen their credit score drop. The existing cottage industry of BNPL providers could take a huge hit from Apple’s competition, and they’re already struggling amid the economic slowdown. Klarna recently laid off 10 percent of its workforce, and Affirm stock is down 80 percent over the past six months, with a drop of more than 5 percent today alone.