Apple, Inc.’s (NASDAQ:AAPL) supply chain in China was severely constrained in the June quarter, and the degree of impact could be quantified when Cupertino reports third-quarter results Thursday after the market closes.

An earnings call is scheduled for 5 p.m. ET.

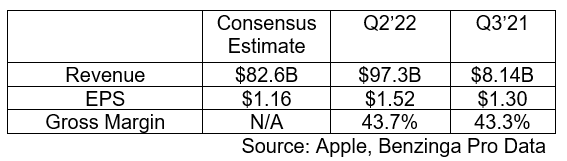

Key Q3 Expectations: Apple is widely expected to report a year-over-year decline in earnings per share and record anemic sales growth. On the June quarter earnings call, Apple CFO Lucas Maestri said the fiscal third quarter will likely take a $4-billion to $8-billion hit from COVID-19 supply disruptions in China and chip shortages.

Related Link: Apple's AR Headset Will Be An Industry Game-Changer, Says Analyst

Rosenblatt Securities analyst Barton Crockett said in a recent note that Apple will outperform peers and therefore consensus estimates are beatable. The analyst sees the company’s sports deal with Major League Soccer and its likelihood of clinching the Sunday National Football League Ticket deal as key developments during the quarter.

The Rosenblatt analyst models iPhone revenue of $39.2 billion and Mac sales of $8.6 billion for the quarter.

A slowdown in China sales has left investors worried, given the lockdowns in place in several parts of the country for most of April. China accounted for roughly 18.9% of Apple’s revenue in the March quarter.

Apple's Forward Outlook: For the September quarter, analysts, on average, expect EPS of $1.31 on revenue of $90 billion.

The quarter is the second-busiest one for the company, given it encompasses the back-to-school season.

For the fiscal year ending September 2022, EPS and revenue are expected at $6.13 and $393.47 billion, respectively.

Apple’s Stock Performance: Cupertino’s stock has shed about 11.5% year-to-date. This compares to the 15.6% drop by the S&P 500 Index and the 23% plunged by the tech-heavy Nasdaq Composite Index.

After plunging to a low of $129.04 on June 16, the stock has reversed course and advanced to a high of $157.33 — a trough-peak gain of about 22%. The recent gain has pushed the stock into overbought territory. It would require a solid report to push the stock higher.

On the upside, the stock has near-term resistance around the $166 level, and it could see support around the $150 level in the eventuality of a pullback after earnings.

Historically, Apple’s shares perform better in the second half of the year than the first half, primarily due to back-end loaded hardware sales during the holiday and back-to-school seasons.

Given the impending launch of a slew of products, including the new iPhone 14, and expectations concerning an improvement in the economy, the gains this time around could be stronger.

This is contingent on Apple executing on its launch plans, which in turn depends on alleviation of supply chain challenges. Since Apple is sensitive to consumer spending, the economic trajectory also has a part to play in how well the company can redeem itself after a soft quarter.

AAPL Price Action: Apple shares were slipping 0.6% to $155.84 Thursday, according to Benzinga Pro data.