Apple has today announced that it will start rolling out Apple Pay Later randomly to users in the U.S. starting March 28.

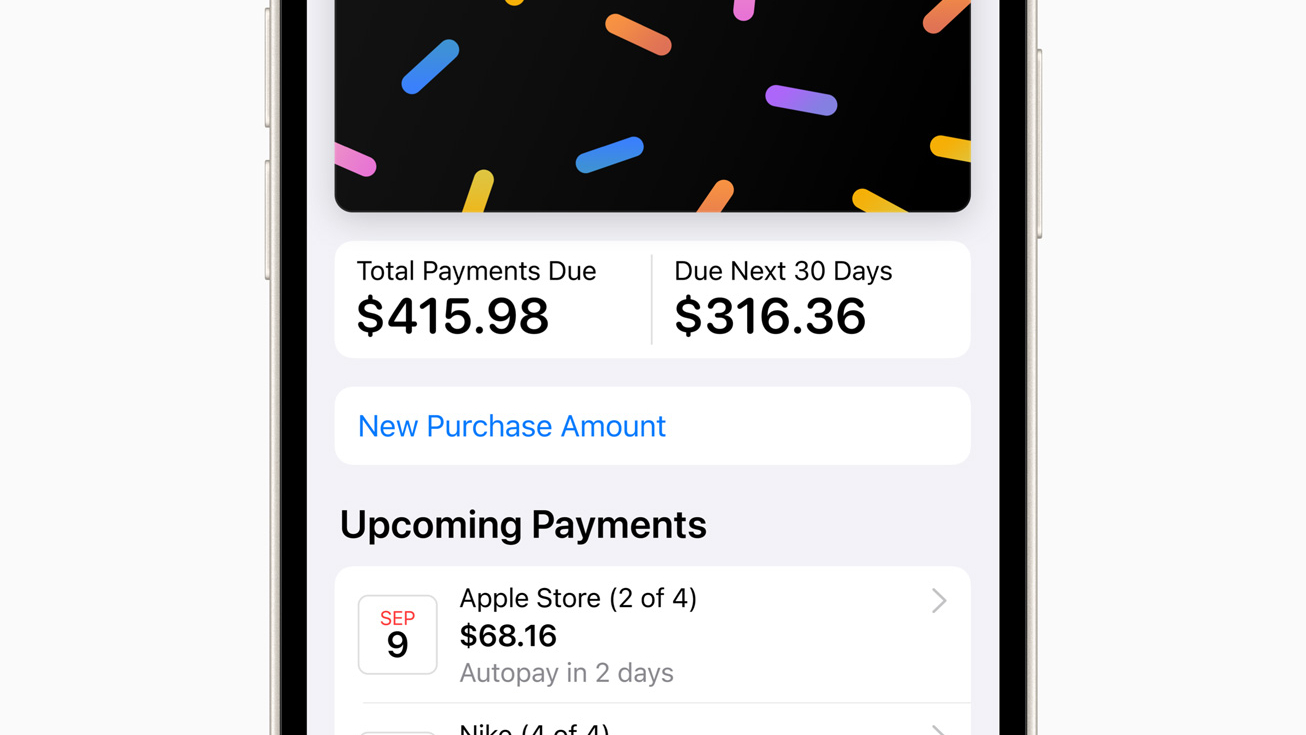

Apple Pay Later lets users split Apple Pay payments into four installments spread over six weeks with no interest or fees, with a loan value of between $50 and $1,000. You can apply online and in the Apple Store app for loans against purchases of iPhones and iPad with merchants that accept Apple Pay.

Right now, Apple is "inviting select users to access a prerelease version of Apple Pay Later, with plans to offer it to all eligible users in the coming months." Strangely, those users will be selected "randomly" for early access to a prerelease version of Apple Pay Later.

Apple Pay Later... later

There's no reason given for this strange rollout. However, the most obvious answer is that the feature isn't ready yet.

As for Apple Pay Later's features, applying won't impact your credit score, and the feature is built right into the Wallet app so you can view and manage all of your loans in one place. Payments are authenticated with Touch ID and Face ID just like regular Apple Pay.

Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet said “Apple Pay Later was designed with our users’ financial health in mind, so it has no fees and no interest, and can be used and managed within Wallet, making it easier for consumers to make informed and responsible borrowing decisions.”

Apple Pay Later is enabled by the Mastercard Installments Program, so anywhere that accepts Apple Pay is eligible for customers who want to use the loans and merchants don't need to do anything to implement it for their customers.