Apple Inc. (NASDAQ:AAPL) is reportedly changing its approach to software updates. The tech giant appears to be opting for staggered rollouts of new features instead of bundling everything into annual iOS releases.

What Happened: In his latest weekly "Power On" newsletter, Bloomberg columnist Mark Gurman said that Cupertino plans a significant update with iOS 18.4 this spring.

However, several features that were initially set for the latter half of 2025 are now delayed.

Previously, the analyst reported that the much-anticipated Siri overhaul, which aims to incorporate in-house LLMs for a more conversational assistant, was also pushed back.

Beyond LLMS, a larger-than-usual number of features for iOS 19 are also postponed till spring 2026. That's around when iOS 19.4 will be released, said Gurman in the newsletter.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Why It Matters: Earlier this month, Cupertino alerted investors about the potential uncertainty in the profitability of its future products, including AI and virtual reality.

In its updated annual report, Apple included a new “risk factors” section, highlighting that some of its upcoming products may not achieve the same revenue and profit margins as its flagship product, the iPhone.

Apple reported fiscal fourth-quarter revenue of $94.9 billion, surpassing analyst expectations of $94.56 billion. The company also posted adjusted earnings of $1.64 per share, beating the anticipated $1.60 per share.

This marked the seventh straight quarter that Apple has outperformed analyst forecasts for both revenue and earnings, according to Benzinga Pro.

During the earnings call at the time, Apple CEO Tim Cook shared that the adoption rate of iOS 18.1 is double that of iOS 17.1.

During the same call, Apple CFO Luca Maestri was asked about the company's capital expenditure outlook, particularly concerning investments in private cloud computing and AI.

What Analysts Are Saying: Goldman Sachs analyst Michael Ng inquired whether these investments could affect Apple’s typical annual capex range of around $10 billion.

In response, Maestri explained that Apple uses a hybrid model for its data centers, combining both proprietary and third-party resources. This makes its capex numbers distinct from other companies.

He confirmed that Apple is already investing in infrastructure to support its AI-related features, with additional spending planned for fiscal year 2025.

In its 10-K filing filed in November, Apple reported research and development expenses of $31.37 billion, rising 5% over 2023.

Price Action: Apple’s stock rose 1.31% on Monday, closing at $232.87, but dipped 0.18% in after-hours trading. Year-to-date, the company’s shares have increased by 25.44%, slightly trailing the Nasdaq 100 index, which has gained 25.8%, according to Benzinga Pro data.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next:

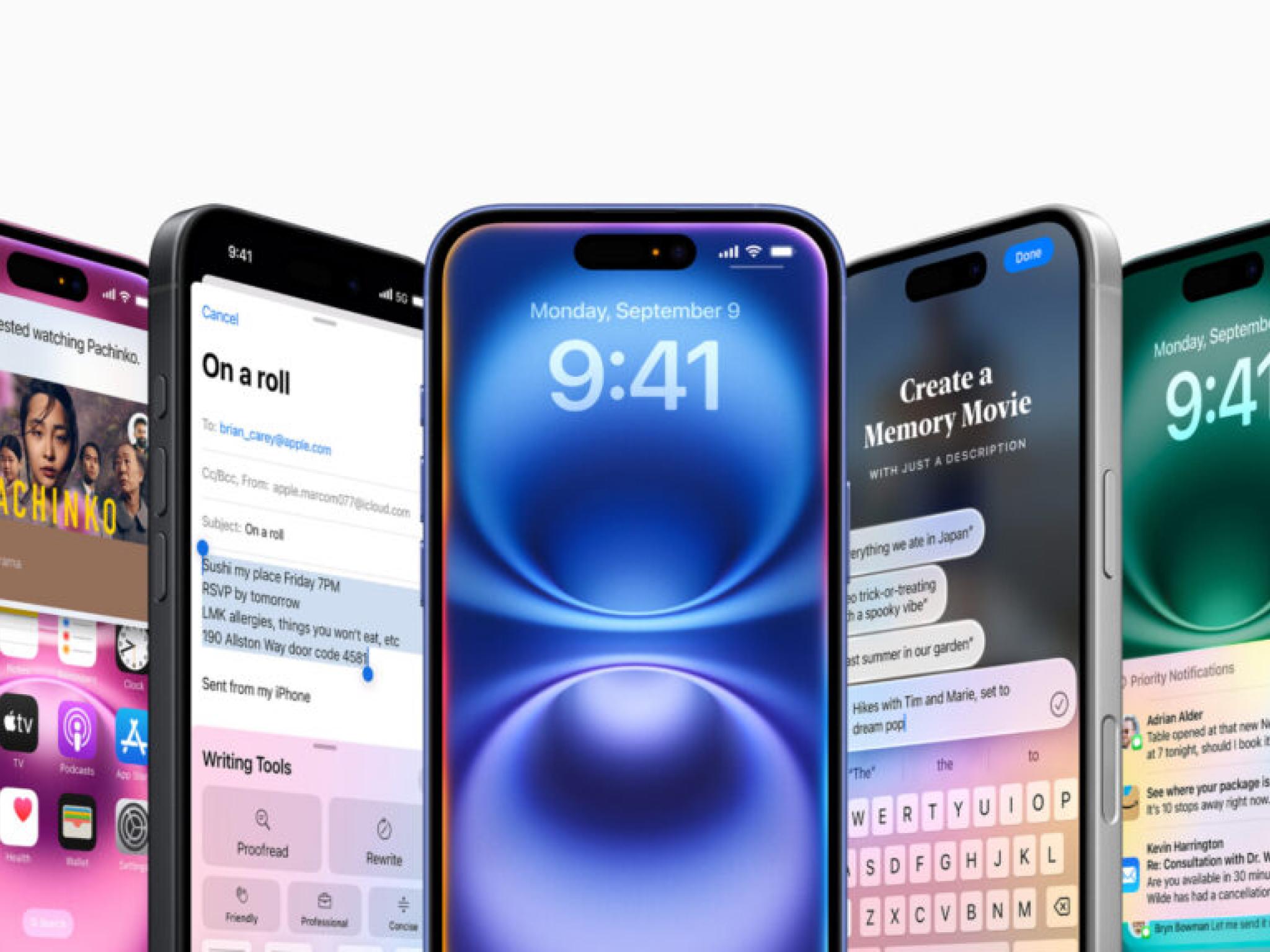

Photo courtesy: Apple