Consumer electronics giant Apple is looking to stand apart from other tech firms working on artificial intelligence by focusing on user privacy. That stance earned Apple stock a buy rating on Wednesday.

Apple's privacy position on AI should resonate with consumers, Rosenblatt Securities analyst Barton Crockett said in a client note.

"Strong privacy is by far the top feature consumers want in AI, based on our recent U.S. survey, arguing for market share lift potential for Apple in AI, based on the unique privacy focus of Apple Intelligence, to date unmatched by Android," Crockett said.

Crockett upgraded Apple stock to buy from neutral. He also raised his price target to 260 from 196.

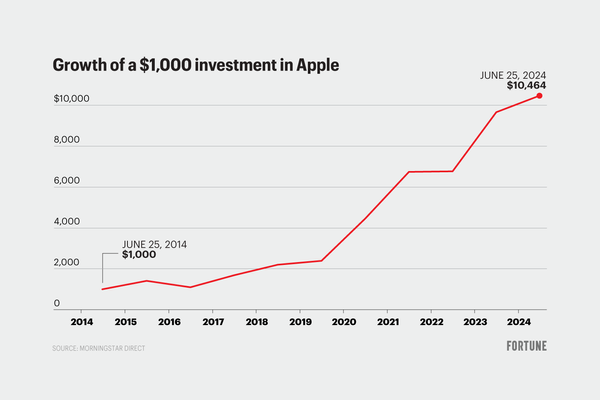

On the stock market today, Apple stock rose 2% to close at 213.25. Apple stock notched a record high 220.20 on June 12 before a recent pullback.

Apple Stock Could Get AI Services Lift

Apple's privacy-focused approach to AI contrasts with missteps from rivals, such as Microsoft's much-criticized Recall feature for AI PCs. Recall takes screenshots of nearly everything people do on their PCs. The Recall feature is now on hold.

Also, Apple rejected a deal to use Meta Platforms' Llama AI chatbot because the social media company's privacy practices weren't stringent enough, Bloomberg reported.

Elsewhere on Wall Street, BofA Securities analyst Wamsi Mohan reiterated his buy rating on Apple stock with a price target of 230.

In a client note, Mohan said AI could be "an incremental lever for growth" for Apple's services business.

"Apple's recent announcement to integrate AI into its operating systems and give third-party developers deep access to features, including Siri, should drive significant innovation from developers," Mohan said.

He added, "We view conversational AI with context and privacy as key to monetization of the installed base of Apple devices over time with increased productivity, higher-priced apps, increased subscription and payments from partners."

Follow Patrick Seitz on X, formerly Twitter, at @IBD_PSeitz for more stories on consumer technology, software and semiconductor stocks.