Apple (AAPL) shares are under pressure to start the week, down about 2.5% at last check.

The loss is outpacing the declines in the S&P 500 and the Nasdaq, as investors sell the largest company in the U.S.

The selling pressure can be pegged to several things, but it’s mainly on reports about disrupted iPhone production.

Specifically, the company “could see a 6 million shortfall in iPhone production from disruptions at its key China manufacturing plant.”

Widespread protests in China are also sparking concerns about the country’s economy.

Trading Apple Stock

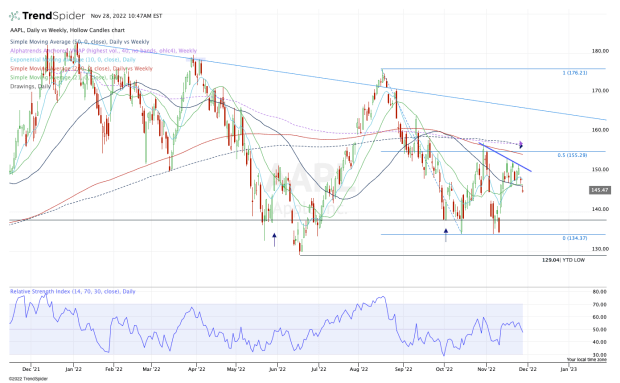

Chart courtesy of TrendSpider.com

Apple is a leader among megacap tech. Within FAANG — and including Tesla (TSLA) and Microsoft (MSFT) — Apple stock has held up the best amid this year's decline.

Today is just one day of action, but there’s two things I don’t like about Apple’s daily chart at the moment.

First, the stock is now below all its major daily moving averages, including the 10-day, 21-day, 50-day and 200-day. That’s discouraging.

Second, the stock actually made a nice rally attempt early in the session, only to be rejected by the 21-day and 50-day moving averages.

Again, this is just one day of action. But it comes when the S&P 500 remains above its 50-day, 21-day and 10-day moving averages and is holding active support. Apple is not.

If it cannot regain the $146 to $148 area and its short-term moving averages, then lower prices may be in store for Apple.

In that case, the bulls should see how the stock handles the $135 to $138 area. If it holds as support, it may be a dip to buy. If support fails, it puts the 2022 low in play near $129.

If the stock goes back above $148, downtrend resistance comes into play (blue line). If Apple stock can clear that hurdle, it opens the door to the $155 to $157 zone, where it finds the October high, the 200-day and 50-week moving averages and the weekly VWAP measure.

Apple continues to face headwinds out of China, as well as the broader macro pressures that the rest of the world is facing. That said, it’s been a leader within megacap tech.

If it were to lose that status, it could pressure the Nasdaq. But let’s go one step at a time.