Nike (NKE) has spent most of 2025 trying to rebuild investor trust after several disappointing quarters left the stock far below its earlier highs and trailing the broader consumer group. Shares are down more than 26% off their 52‑week high, even after a recent rebound.

Then, on Dec. 22, a regulatory filing revealed that Apple (AAPL) CEO Tim Cook, Nike's lead independent director since 2016, purchased 50,000 Class B shares at an average price of $58.97. It was a $2.95 million open-market buy that nearly doubled his stake to approximately 105,000 shares.

NKE stock reacted right away, jumping between 2% and 5% in premarket and early regular-session trading on Dec. 24. It was Cook's largest open-market purchase of Nike shares in years, and it landed at a moment when the global footwear market is expected to generate roughly $500 billion in revenue in 2025, with an annual growth rate of 5.52% through 2030. That contrast makes the point clear: the bigger issue for Nike has been execution, not a lack of demand for shoes globally.

With an insider like Cook putting nearly $3 million of his own money into a beat-up stock, the key question is straightforward: Is this a real sign Nike's turnaround under CEO Elliott Hill is starting to work, and should retail investors follow his lead? Let’s find out.

What the Financials Reveal

Nike is the world’s largest athletic footwear and apparel brand, and it runs a mixed business model. It sells through wholesale partners while also pushing more sales through its own direct‑to‑consumer channels, including its digital platforms.

Even with the brand’s global reach, the stock has struggled. Over the past 52 weeks, shares have slipped 19%, down 13% in the past three months, but in the last five trading days, they’re up 6%.

On valuation, Nike currently trades at a forward P/E of 38.16x. That is more than double the consumer discretionary sector average of 17.83x, which means the market is still pricing Nike like a higher-quality name with stronger long-term potential than the average stock in its group. Dividends have been more consistent. Nike yields 1.61% annually, the most recent dividend was $0.41 per share, and the company has raised its payout for 23 straight years. At the same time, a 93.69% forward payout ratio suggests there is not much extra room for big dividend increases right now.

In its fiscal 2026 second quarter, results were mixed. Revenue rose 1% year-over-year (YoY) to $12.4 billion, but gross margin fell 300 basis points to 40.6% due to higher tariffs in North America. Net income dropped 32% to $0.8 billion, and EPS came in at $0.53. Wholesale revenue increased 8%, but Nike Direct revenue fell 9%, highlighting the pressure points Nike is still working through as it tries to protect profits while keeping sales moving.

What’s Powering Nike’s Next Chapter

Nike’s boldest bet right now is Project Amplify, a powered footwear system built with robotics firm Dephy that aims to help people run and walk more easily. The setup includes a lightweight motor, a drive belt, and a rechargeable cuff battery, all paired with a carbon-fiber–plated running shoe to support natural ankle and lower-leg movement. More than 400 athletes have taken part so far, logging over 2.4 million steps across nine prototypes, and some described it as feeling like “a second set of calf muscles.”

At the same time, Nike is pushing into neuroscience-based footwear with its Mind Series, which includes the Mind 001 mule and Mind 002 sneaker. These shoes were developed over 10 years by Nike’s Mind Science Department, and each shoe has 22 separate foam nodes that work like small pistons to increase underfoot feedback and stimulate key sensory areas of the brain. Norwegian soccer legend and Nike-sponsored athlete Erling Haaland tested them and said the design helps him feel calmer and more balanced before playing. The Mind Series is set to launch globally in January 2026.

Analyst Calls and the Road Ahead

For the current quarter ending February 2026, analysts expect earnings per share of $0.36 versus $0.54 a year ago, which would be a 33.33% YoY drop. For the following quarter in May 2026, the estimate is $0.26 versus $0.14, which would be an 85.71% jump. Looking at the full fiscal year, the consensus calls for $1.57 in EPS for fiscal 2026, down 27.31% from $2.16 last year.

Jefferies stuck with its “Buy” rating and $115 price target on Dec. 18, pointing to “ongoing progress” in North America and EMEA, where Nike’s innovation push and distribution reset are showing up most clearly.

A day later, Bank of America analyst Lorraine Hutchinson cut her target from $84 to $73 but kept a “Buy” rating. She said progress in North America and running has been “encouraging,” but she also flagged weaker-than-expected China trends and margin guidance that “didn’t include the improvement we expected.”

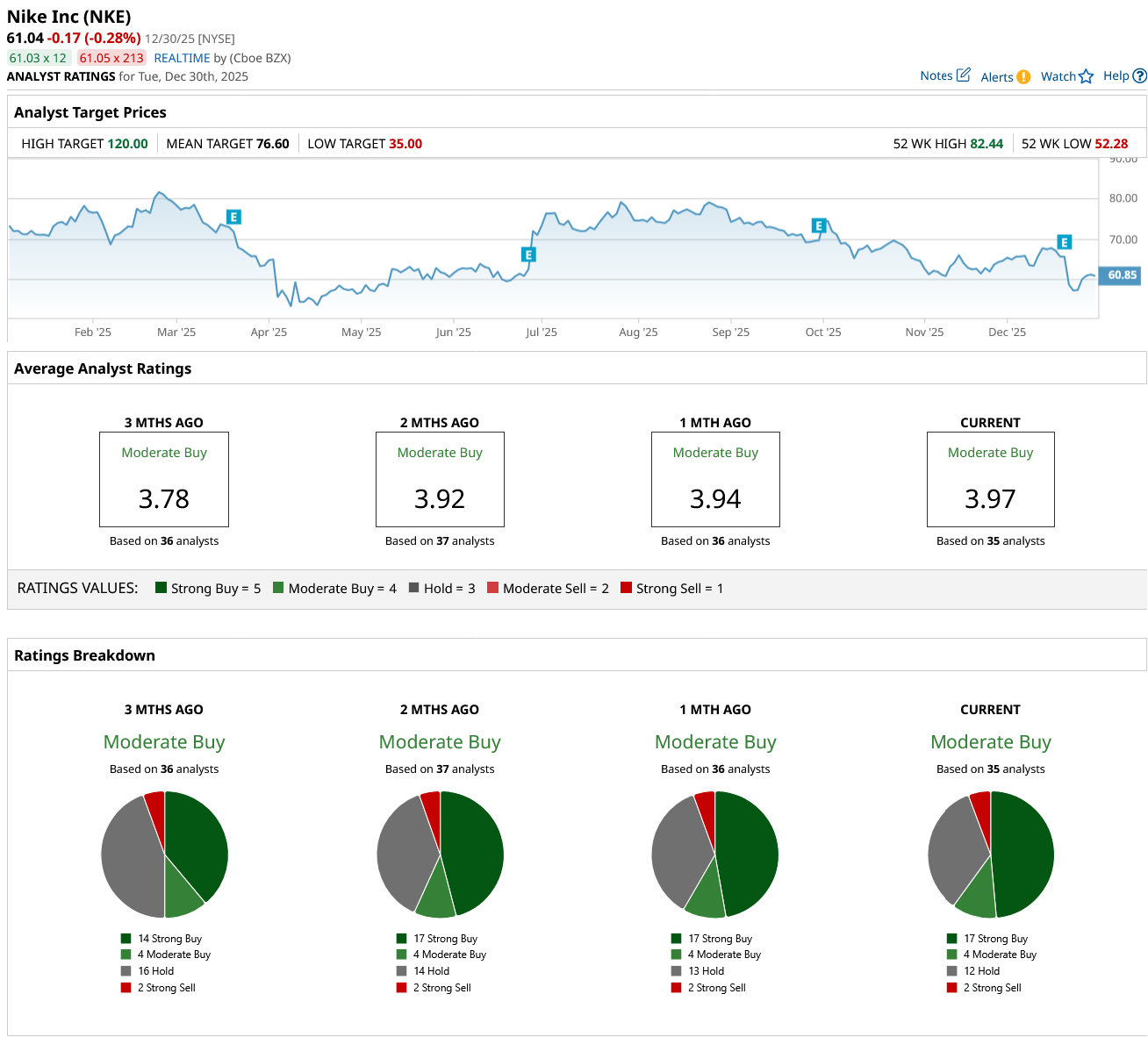

Zooming out, the overall Wall Street view lines up with Cook’s nearly $3 million vote of confidence. The 35 analysts surveyed rate the stock a consensus “Moderate Buy,” and the average price target of $76.60 suggests about 25.7% upside from the current share price.

Conclusion

Cook’s $3 million buy is a strong confidence signal, but it is not a green light for everyone to blindly load up on NKE. Especially with earnings still projected to be under pressure and the stock trading at a rich multiple versus its sector. For investors who can tolerate volatility and give the turnaround time, adding gradually makes more sense than chasing a quick pop because the upside case depends on execution across Direct, margins, and the China reset. Most likely, shares chop around near term as the market waits for cleaner fundamentals, but the direction skews higher over the next 12 months if Nike delivers even modest margin stabilization and the innovation pipeline translates into demand.