When Apple launched its own credit card, eyebrows around the world were raised; now, the future of Apple Card looks bleak. Eyebrows almost fell off when Apple announced that it was launching a new savings account, but its latest financial offering is doing a lot better.

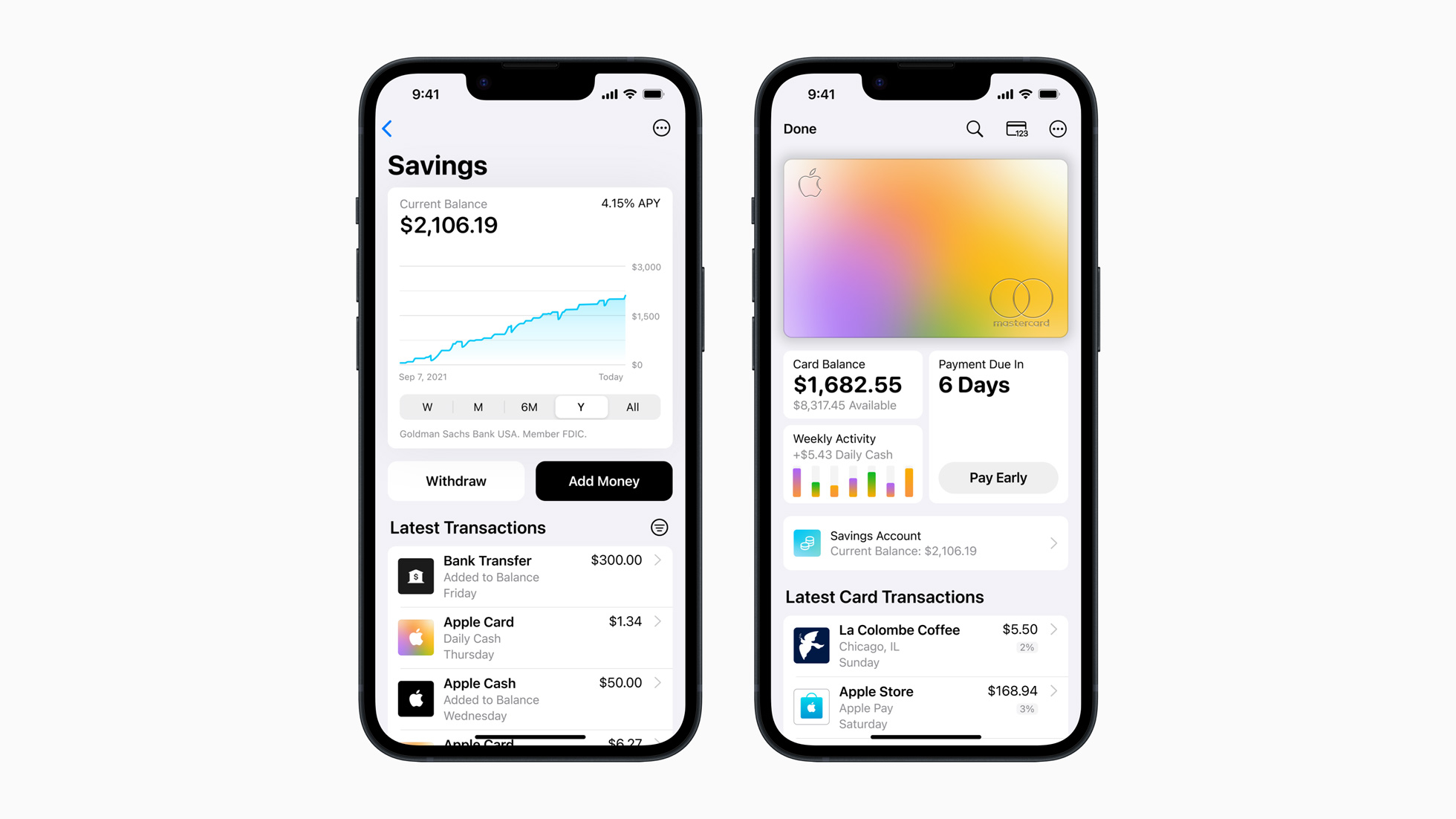

Apple Card Savings accounts have now been around since mid-April 2023, but they're already off to a flying start it seems. Apple now says that the high-yield savings account has garnered more than $10 billion in deposits since that April launch, with savers earning an APY of 4.15%.

How much of that $10 billion is being saved in light of iPhone 15 Pro price hike rumors, I wonder?

Billion with a 'B'

Apple announced the news via a press release, saying that "since the launch of Savings, 97 percent of Savings customers have chosen to have their Daily Cash automatically deposited into their account, enabling users to easily establish and continue cultivating healthy savings habits."

“With each of the financial products we’ve introduced, we’ve sought to reinvent the category with our users’ financial health in mind. That was our goal with the launch of Apple Card four years ago, and it remained our guiding principle with the launch of Savings,” Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, said via that statement. “With no fees, no minimum deposits, and no minimum balance requirements, Savings provides an easy way for users to save money every day, and we’re thrilled to see the excellent reception from customers both new and existing.”

The Apple Card Savings account is backed by Goldman Sachs, just like the Apple Card proper. And while the bank is thought to be losing huge sums of money on Apple Card, it seems things are very different when it comes to savings.

“We are very pleased with the success of the Savings account as we continue to deliver seamless, valuable products to Apple Card customers, with a shared focus on creating a best-in-class customer experience that helps consumers lead healthier financial lives,” said Liz Martin, Goldman Sachs’s head of Enterprise Partnerships.

At this point, Apple Card and Apple Card Savings are only available to people in the United States, although we have to imagine that it wants to change that as soon as possible.