Another Casualty In The Economic War

One theme of our posts since Russia invaded Ukraine is that America's economic war against Russia is hurting America. As we noted over the weekend ("Sanctions On Russia Backfire On The West"), the mainstream media has belatedly started to realize this as well.

The mainstream media now acknowledges what we predicted here months ago. $UGA $OXY $USO $BNO (Corrected typo) https://t.co/yaHpp8tb6J

— Portfolio Armor (@PortfolioArmor) June 5, 2022

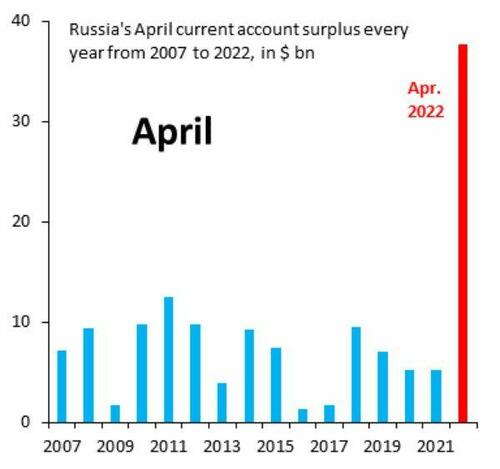

Instead of weakening Russia, our sanctions have raised the prices of the raw materials Russia sells, swelling its current account surplus.

U.S. Treasury Bonds Feel The Heat

American policymakers seem to have underestimated the impact our sanctions would have on gas prices at home. And they may have underestimated the impact on U.S. Treasury bonds as well. But it's something we wrote about here back in March ("Betting Against Bonds"):

Betting Against The Long Bond

The ProShares UltraShort 20+ Year Treasury ETF (NYSE:TBT) is a 2x levered bet against long duration U.S. Treasuries, the bonds most sensitive to interest rate movements. Our system doesn't consider the macro picture when selecting its top names. Instead, it gauges stock and options market sentiment to estimate which securities are likely to perform the best over the next six months. Nevertheless, that bottoms-up approach often reflects the macro picture, and the inclusion of TBT certainly does.

As we pointed out over the weekend ("Sanctioning Ourselves"), U.S. sanctions on Russia--particularly, the freezing of its dollar reserves--will likely lead to a weaker dollar, as non-Western countries diversify away from the dollar to avoid having their reserves frozen by us in a future conflict.

In short: 👉 China � sells U.S. � Treasuries to buy Russian � commodities. 👉 Higher inflation in the U.S. 👉 The Yuan becomes a commodity-backed currency, and a threat to dollar supremacy. https://t.co/PbQitqgCc9

— David Pinsen (@dpinsen) March 12, 2022A likely result of that will be higher interest rates in the U.S., as it may take higher rates to entice risk-averse, non-European countries to hold U.S. Treasury bonds.

TBT Climbs Accordingly

Flash forward to this week, and here's how TBT (and our other top names from mid-March) have done so far since then.

Four of our top ten names from mid-March are up double digits so far, and they're all plays on blowback from our economic sanctions on Russia: our bet against Treasuries, TBT, plus three bets on oil & gas: Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares (NYSE:GUSH), United States Gasoline Fund, LP (NYSE:UGA), and United States Oil, LP (NYSE:USO). Overall, our top ten names from March 14th are up 15.72% so far, on average, versus -0.95% for the SPDR S&P 500 Trust (NYSE:SPY).