With all the controversy surrounding Anheuser-Busch InBev (BUD), the parent of Bud Light, you wouldn’t know it by looking at the stock price.

Through April 7 Anheuser-Busch shares had fallen in four straight sessions -- but by a grand total of 0.63%.

The stock ticked down on Monday as well, lower by 3% at last glance. But the slip came after a 10-day win streak, which vaulted Anheuser-Busch stock to 52-week highs.

Don't Miss: AMD Stock Presents a Buy-the-Dip Opportunity for the Bulls

The brewer on March 2 reported solid earnings, rallied initially, then struggled for upside traction. But more impressive has been the recent rally, which came amid controversy about the company’s latest LGBTQ initiatives.

All this said, Anheuser-Busch stock continues to outperform the shares of its peers, like Molson Coors (TAP) and Boston Beer (SAM).

Trading Anheuser-Busch Stock

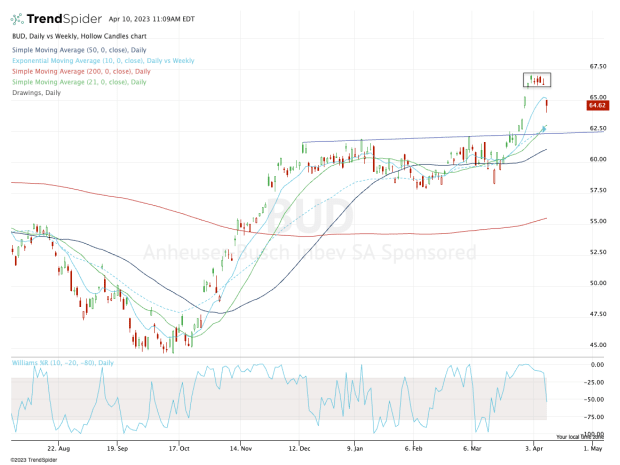

Chart courtesy of TrendSpider.com

Last week, Anheuser-Busch stock was consolidating after a big rally. The shares climbed about 15% from the March 15 low to the March 31 high.

With today’s move lower, the bulls are wondering where support may come into play.

On the upside, the bulls would like to see the stock regain the $65 level and thus the 10-day moving average.

If it can do that, the recent consolidation zone is back in play and it will have the bulls sniffing for new 52-week highs.

Don't Miss: Here's Where to Buy Costco Stock on a Deeper Dip

Conversely, more weakness could send the stock back into a key area on the chart.

That zone is around $62 to $62.50. In that range we find prior resistance, as well as the rising 21-day and 10-week moving averages. If the stock has a quick knee-jerk dip into this area, traders should pay close attention to see whether buyers step in.

If they don't, the door might open down to the $58 area, which was a support level several times over the past few months.

Given BUD's recent headlines, as well as the price actions of its peers, the bulls have to be impressed with the way Anheuser-Busch stock has been trading. Let’s see whether it can continue its uptrend from here.