Through it all, Dave Girouard kept the faith.

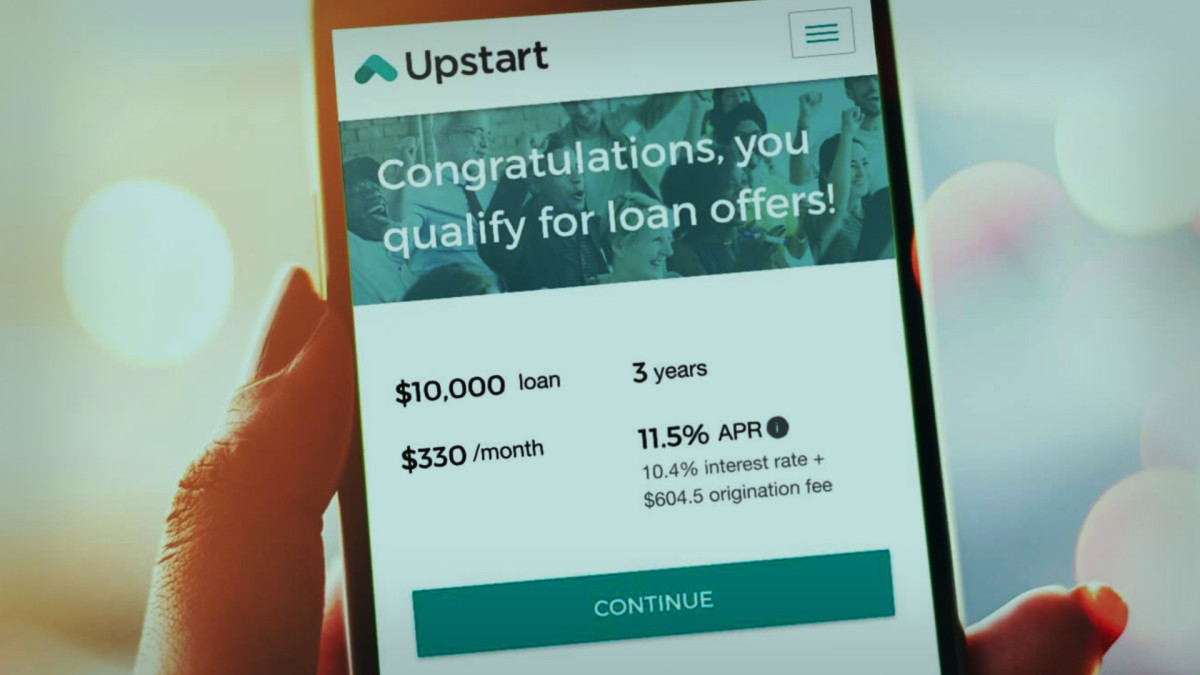

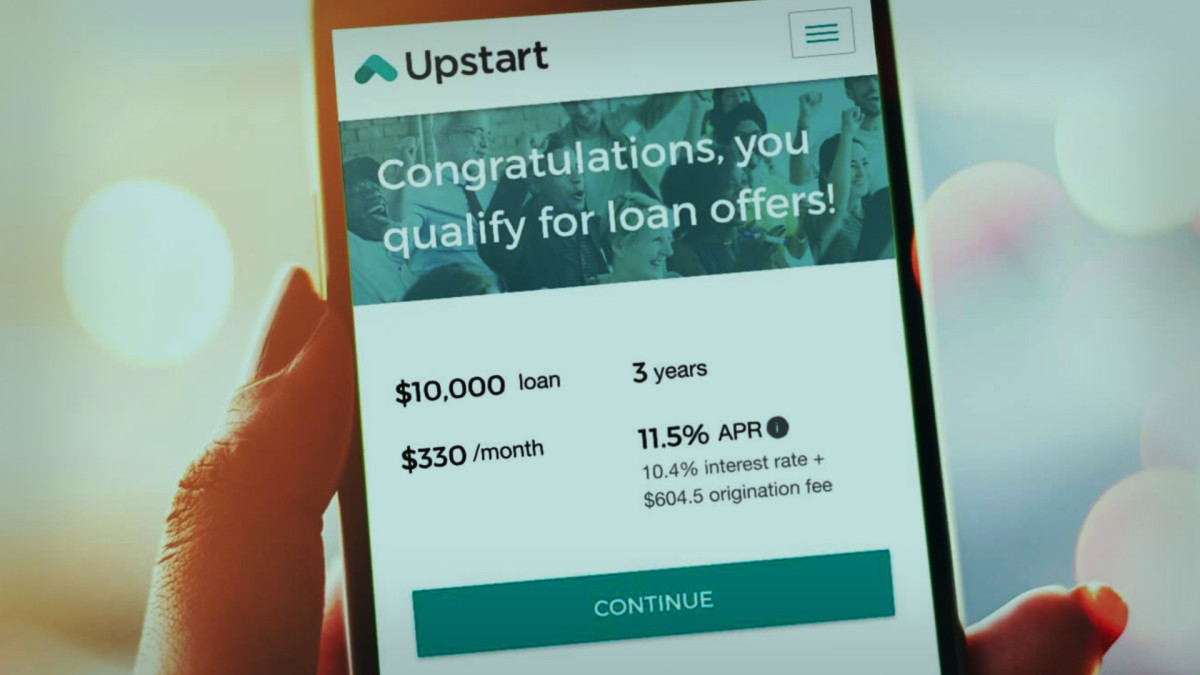

The co-founder and chief executive of Upstart Holdings (UPST) saw some dark times in the past year or so for the company, which connects consumers with lenders on its online platform using artificial intelligence.

Related: Analysts overhaul Super Micro stock price targets after Q4 earnings

Back in February, when Upstart missed Wall Street's quarterly expectations, Girouard talked about the "difficult lending environment"; how in the past two years "we experienced an economy unlike any in recent history"; and how "you would be hard-pressed to find an economic cycle similar in form to what we've experienced since the beginning of the pandemic."

He described a world with interest rates at their highest in decades, "elevated consumer risk throughout multiple bank failures leading to extreme caution and conservatism among lenders, and a significant dislocation in capital markets." The environment, he said, "presented one hurdle after another."

Founded in 2012, Upstart went public in December 2020 and saw its shares touch a record close of $390 on Oct. 15. 2021. But things started to go bad, as in real bad, and the stock went to about $11 in March 2023.

Upstart's shares fell 19% in February, and Girouard declared that "without question, 2023 was a challenging year for both Upstart and the lending industry, and we're glad to be done with it."

Upstart Holdings

Upstart CEO: 'We're turning a corner'

Now things are the upswing. Upstart posted second-quarter results on Aug. 6 and investors obviously liked what they heard. The stock skyrocketed nearly 40%, and Girouard was in a much better frame of mind.

"I've said many times over the last couple of years that I've never lost an ounce of faith or optimism in the future of Upstart, and today you can begin to see why," he told analysts during the company's earnings call. "The numbers and guidance we released today demonstrate that we're turning a corner."

Related: Analysts review Apple stock price hit from Google antitrust ruling

Girouard said Upstart had made "real progress" toward returning to sequential growth and Ebitda profitability, and "toward resuming our role once again as the fintech known for high growth and healthy margins."

Model accuracy, fraud detection, automation, funding resiliency, acquisition costs and revenue optimization "are leaps and bounds better than they were in 2022," he said.

"Most importantly, I'm thrilled to share that we very recently launched one of the largest and most impactful improvements to our core credit pricing model in our history," Girouard said. "In fact, with this launch, 18% of all accuracy gains in this model since our inception have been delivered by our [machine learning] team in the last 12 months."

Upstart posted an adjusted net loss of 17 cents a share, compared with adjusted earnings of 6 cents a year earlier and stronger than forecasts of a 39-cent loss.

Revenue totaled $128 million, down from $136 million a year earlier but still ahead of the consensus estimate of $124 million.

The company said that 143,900 loans were originated in the quarter for a total of $1.1 billion, down 6% from a year earlier.

Looking ahead, the company expects total revenue of about $150 million in the third quarter and positive adjusted Ebitda in the fourth quarter.

"Tackling the world's most entrenched problems with AI is difficult and it doesn't happen overnight," Girouard said. "But to those who ultimately solve these problems, there comes a tremendous reward. Today, we're tackling problems that we weren't even aware of a couple years ago."

"My perspective is that top to bottom we've gone through a significant reinvention of the company, both from a technology and business-model perspective," he added.

Analyst says loan buyers are returning to Upstart

Analysts weighed in on Upstart's quarterly results and several adjusted their price targets and ratings.

Citi upgraded Upstart to neutral from sell with a price target of $33, more than double the previous $15, according to The Fly.

More AI Stocks:

- Nvidia stock tumbles in tech slump amid questions over key chip

- Microsoft exec warns of an ongoing problem

- Apple earnings top forecasts, iPhone sales slip ahead of AI launch

The second quarter results were mixed but "green shoots" are emerging, the analyst told investors in a research note.

The firm sees several elements that indicate "upside revision risk has returned," including improving conversion ratio, steadily declining Upstart Macro Index and an improved second-half 2024 fee-revenue outlook.

The expected Federal Reserve pivot to cutting interest rates and Upstart's artificial-intelligence progress must also be considered, Citi maintained.

“The downside narrative appears tougher to justify,” the firm said.

JP Morgan raised its price target on Upstart to $27 from $24 but affirmed an underweight rating on the shares.

The company's Q2 headline earnings came in a touch ahead of Wall Street’s estimates and the third-quarter guidance was well ahead, the investment firm said.

JP Morgan said management was seeing loan buyers return to the Upstart platform.

Piper Sandler raised its price target on Upstart to $31 from $28 while maintaining a neutral rating on the shares.

The firm noted Upstart's second-quarter revenue came in ahead of muted expectations. Similarly, the Q2 Ebitda beat versus analyst estimates was due largely to grounded expectations.

Related: Veteran fund manager sees world of pain coming for stocks