It's easy to forget about the importance of dividends when the market is notching new all-time highs. And while no old saw is a substitute for a comprehensive wealth management plan, there really is something to the cliche about high-quality dividend stocks never going out of style.

Dividends really do matter. Although such regular payouts to shareholders have become much less popular over the decades, dividends still account for a critical share of the market's total return (price change plus dividends).

Since 1960, 69% of the total return of the S&P 500 can be attributed to reinvested dividends and compounding, according to a study by Hartford Funds. And while companies may not pay dividends like they used to, dividends have still fueled nearly a quarter of the S&P 500's annualized total returns so far this decade.

Interestingly, the case for dividends actually gets more compelling when the market is making new highs and valuations are getting stretched.

"Dividends have historically played a significant role in total return," the Hartford Funds report notes, "particularly when average annual equity returns were lower than 10% during a decade."

Sadly, average annual equity returns are indeed looking to be pretty poor over the next 10 years, at least by one highly regarded measure. The S&P 500 Shiller cyclically adjusted price/earnings ratio (CAPE) has a solid track record of forecasting long-term annualized returns. At its current level, Shiller CAPE gives the broader market an implied annualized total return of 3.9% over the next 10 years.

That's pretty crummy considering the S&P 500 delivered an annualized total return of more than 12% over the past decade. It also suggests that dividend stocks as an asset class could be very helpful to buy and hold these days.

Wall Street's top S&P 500 dividend stocks

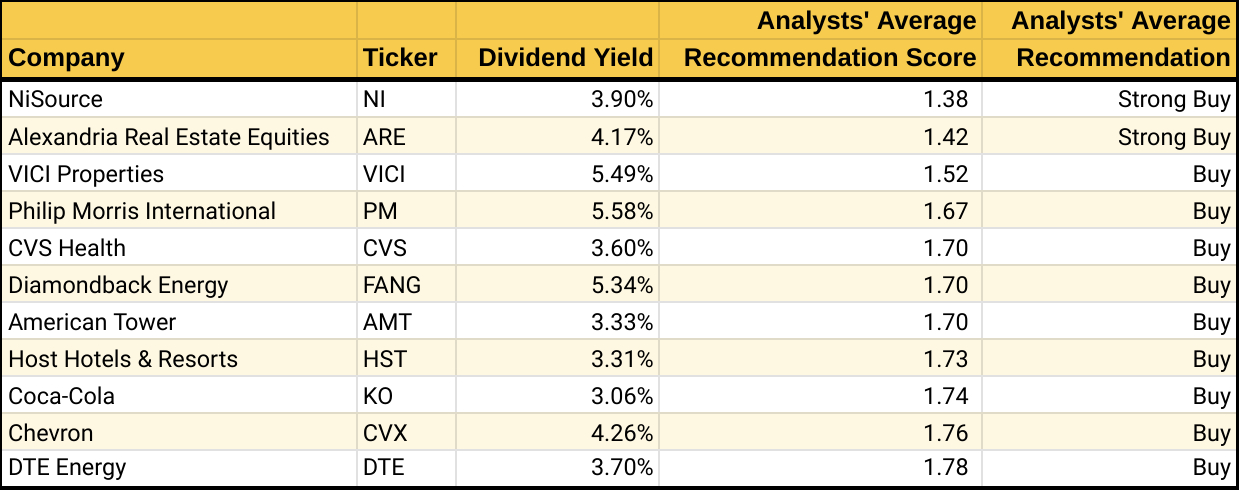

In order to find Wall Street's top dividend stocks to buy now, we used S&P Global Market Intelligence to screen the S&P 500 index for analysts' highest rated names yielding at least 3% as of January 19.

A note on the ratings system: S&P Global Market Intelligence surveys analysts' stock recommendations and scores them on a five-point scale, where 1.0 equals Strong Buy and 5.0 means Strong Sell. Any score of 2.5 or lower means that analysts, on average, rate the stock a Buy. The closer the score gets to 1.0, the stronger the Buy call. In other words, lower scores are better than higher scores.

We used a 3% yield as our lower bound because that's essentially twice the S&P 500's yield of 1.49%.

If you're looking to add Buy-rated dividend stocks to your portfolio, the names listed below are the best the S&P 500 has to offer, according to industry analysts.