Microsoft (MSFT) has got its head in the clouds, and that's just how the software giant likes it.

The expression is usually intended to describe someone daydreaming and out of touch with reality, but Microsoft is coming on strong in the new reality of cloud computing and artificial intelligence.

Related: Analysts eye Google spending ahead of earnings as Meta spooks AI bets

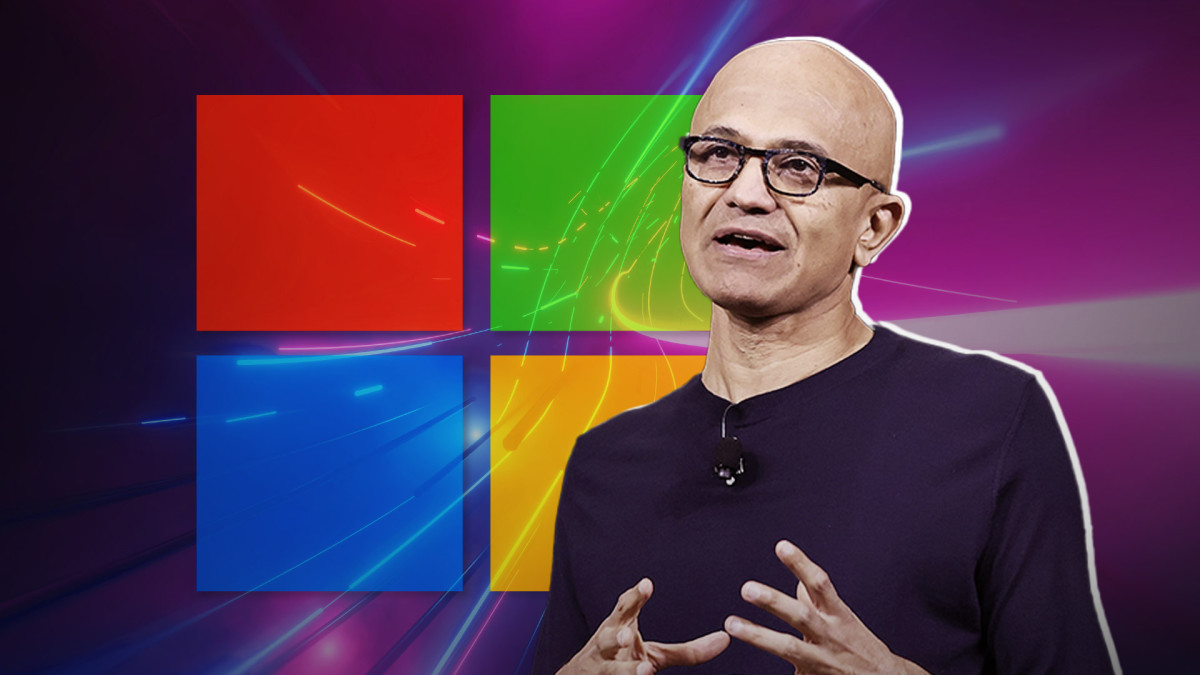

On April 25, the company beat Wall Street's fiscal third-quarter-earnings expectations. Chief Executive Satya Nadella told analysts that the strong numbers were powered by the continued strength of Microsoft Cloud, which surpassed $35 billion of revenue, up 23% from a year earlier.

"Microsoft Copilot and Copilot stack spanning everyday productivity, business process and developer services to models, data and infrastructure are orchestrating a new era of AI transformation, driving better business outcomes across every role and industry," Nadella said during the company's earnings call.

Microsoft earned $2.94 a share, up from $2.45 per share a year earlier and surpassing the FactSet analyst consensus estimate of $2.82 per share.

Revenue totaled $61.86 billion, up from $52.9 billion and ahead of FactSet's call for $60.85 billion.

Nadella said that Azure, Microsoft's cloud computing platform, "again took share as customers use our platforms and tools to build their own AI solutions."

Gaming sets records, Microsoft CEO says

The chief executive said that Microsoft offers "the most diverse selection of AI accelerators," including the latest from Nvidia (NVDA) , Advanced Micro Devices (AMD) , and its own first-party silicon.

"Over half of our Azure AI customers also use our data and analytics tools," he said. "Customers are building intelligent applications running on Azure, PostgreSQL, and Cosmos DB with deep integrations with Azure AI."

Related: Analysts reset Facebook-parent Meta stock price targets amid post-earnings plunge

Microsoft concluded its $68.7 million acquisition of computer game maker Activision Blizzard in October. Nadella said the company is “committed to meeting players where they are by bringing great games to more people on more devices."

“We set third-quarter records for game-streaming hours, console usage, and monthly active devices," he said.

Several analysts responded to the earnings report by adjusting their price targets for Microsoft shares.

"With AI adoption accelerating cloud adoption and prospects for Integrated Cloud margins to remain at elevated levels, profit generation at Microsoft should continue to grow," said TheStreet Pro's Chris Versace. "That is leading us to lift our MSFT price target to $480 from $450."

Bank of America Securities analysts reiterated their buy rating and $480 price target for Microsoft, telling investors that "cloud and [artificial intelligence] continued to fuel upside for Microsoft."

"Microsoft's native AI offerings (such as Azure AI or OpenAI services) continued to drive incremental growth in Q3," B of A said.

"Coupled with OpenAI consumption strength, Azure is the only software business that is benefiting from AI at this point in the cycle. This validates our view that Microsoft remains ahead of the curve in this massive new cycle."

Analyst cites 'well-balanced beat' at MSFT

The investment firm said it continued to view "Microsoft as a key beneficiary of AI, consolidation and cloud."

"We believe Azure strength is enough to drive total revenue growth higher for now (we raise our FY25E total revenue estimate by $1.4 billion)," B of A said.

More Tech Stocks:

- Cathie Wood buys $22 million of battered tech stock

- Analyst revamps Nvidia price target as Mag 7 earnings loom

- Analyst unveils new Amazon price target as stock tests $2 trillion

Macquarie analyst Frederick Havemeyer raised the firm's price target to $460 from $455 a share while affirming an outperform rating on the stock, following what he described as "a well-balanced beat."

While fiscal Q3 was only the second full quarter of results to include Activision Blizzard, the analyst said, the gaming segment continues to show signs of early benefit from the deal, with gaming revenue increasing 51% year-over-year, "led by strong Activision results."

Havemeyer, who called Microsoft the firm's top generative AI pick. estimated Azure AI Services crossed $4 billion in run-rate revenue.

He also said that he liked signs that testing and adoption of Copilot are progressing, and he told investors that key growth drivers, especially Azure and Gaming, continue to perform well.

Piper Sandler raised the firm's price target on Microsoft to $465 from $455, reiterating an overweight rating on the shares.

The investment firm attributed the target increase to strong AI and cloud secular tailwinds that accelerated Azure revenue growth of 31%.

Accelerating growth coupled with the leadership commitment to sustaining a 43%+ operating margin next year — during a peak capital-expenditure investment cycle — affirmed Piper's bullish stance on Microsoft, the analyst told investors in a research note.

Wells Fargo raised its price target on Microsoft to $500 from $480 and stood by an overweight rating on the shares.

Microsoft delivered "impressive" results, the investment firm said, with Azure, bookings, margin upside, and strong Al demand signals enabling management to provide an early fiscal 2025 outlook for double-digit revenue and operating profit growth.

Related: Veteran fund manager picks favorite stocks for 2024