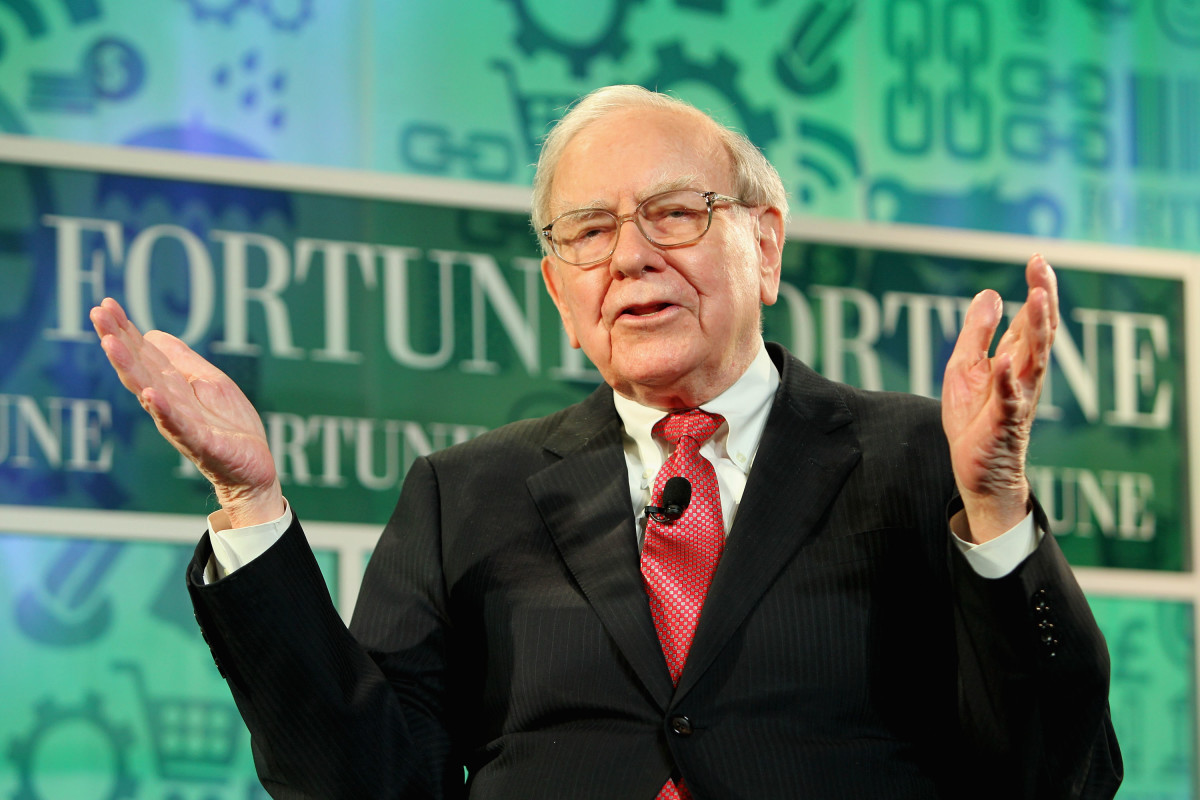

Berkshire Hathaway (BRK.B) shares nudged lower in Monday trading after Chief Executive Warren Buffett struck a cautious note in his annual letter to investors.

The letter came alongside the conglomerate's report of solid fourth-quarter earnings and a record cash pile of nearly $170 billion.

Berkshire Hathaway, which runs businesses from insurance giants to railways to consumer stalwarts like Dairy Queen, also has one of the best-performing investment portfolios on Wall Street, based on a handful of carefully selected blue-chip stocks.

Berkshire's largest stakes, accounting for around 75% of the company's $371 billion portfolio value, are compressed into five stocks: Apple (AAPL) , Chevron (CVX) , Bank of America (BAC) , American Express (AXP,) and Coca-Cola (KO) .

Buffett's mountain of cash gets bigger

Profits in some of Berkshire's (BRK.A) businesses are booming, and Buffett assured investors that the broader company's future is "built to last. However, he also hinted that the group's record $167.6 billion cash pile might not be put to work this year or even in the medium term.

Related: Berkshire Hathaway’s annual report shows Buffett’s cash hoard surges

"There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others," Buffett wrote in his annual letter to shareholders. "Some we can value; some we can’t. And, if we can, they have to be attractively priced."

"Outside the U.S., there are essentially no candidates that are meaningful options for capital deployment at Berkshire," he added. "All in all, we have no possibility of eye-popping performance."

"Patience pays, and one wonderful business can offset the many mediocre decisions that are inevitable," Buffett said.

Berkshire goes big in Japan

Still, Berkshire, looking to park some of its record cash, did manage to find large, diversified companies overseas, specifically in Japan, that Buffett said were "somewhat similar to the way Berkshire itself is run."

The group boosted its stakes in five so-called 'trading houses,' or sogo shosha in Japan: Mitsubishi Corp., Itochu Corp., Mitsui & Co., Sumitomo Corp., and Marubeni Corp. – to around 9% each. He plans to add modestly to them over the near term.

Buffett, who first bought into the trading houses in the summer of 2019, said the holdings were up 61% over the past year and are now valued at around $8 billion.

"An additional benefit for Berkshire is the possibility that our investment may lead to opportunities for us to partner around the world with five large, well-managed and well-respected companies," Buffett said. "Their interests are far more broad than ours."

Related: 5 questions for Warren Buffett about Berkshire Hathaway's annual report

Curiously, while Buffett often derides (jokingly) his inability to time the markets, Japan's Nikkei 225 has surged more than 83% since he first started investing in the sogo shosha. The index touched a record 39,233.71 points just today.

Nonetheless, Buffett's cautious message, delivered in the wake of stronger-than-expected fourth-quarter earnings and the death of his longtime friend and investing partner Charlie Munger, may end up defining the stock's race to $1 trillion.

"Extreme fiscal conservatism is a corporate pledge we make to those who have joined us in ownership of Berkshire," Buffett wrote.

"In most years — indeed in most decades — our caution will likely prove to be unneeded behavior, akin to an insurance policy on a fortress-like building thought to be fireproof," he said. "But Berkshire does not want to inflict permanent financial damage — quotational shrinkage for extended periods can’t be avoided — on (his sister Bertie) or any of the individuals who have trusted us with their savings."

Berkshire generated $93.4 billion in revenue over the three months ended in December, with operating profit (Buffett's preferred metric) rising 28% to $8.48 billion.

On an annual basis, operating profit was up 21% to $37.4 billion, with adjusted earnings coming in just shy of Wall Street's $17.39-a-share consensus forecast.

Caution, but a lot of respect, too

Cathy Seifert, vice president at CFRA Research, said the full-year tally "masked a turnaround in insurance profitability and a 52% rise in investment income." She affirmed a buy rating and $472 price target on the Class B stock.

"We raise our '24 operating revenue growth forecast to 12% to 18% on still-strong insurance pricing and demand, a modest recovery in Berkshire Hathaway's economically sensitive units, partly offset by an easing of investment income growth on lower rates later in 2024."

That tepid, at least by Buffett's lofty standards, backdrop likely constrains future potential excess returns vs. a previous 20% annual return," argues Macrae Sykes, portfolio manager at Gabelli Funds.

Sykes shared nine favorite picks in an interview with TheStreet on Feb. 12:

Related: Fund manager of $2 billion portfolio unveils 9 favorite stocks

"Still, the collection of companies and entrepreneurial management teams offers a very competitive, aggregated business," he added. "The belief in the American tailwind and compounding will never change and will help power future returns for shareholders."

"Berkshire remains in great shape, with a fortress balance sheet and significant cash generating ability," he added.

Keefe, Bruyette & Woods analyst Meyer Shields, however, sees share buybacks as a bigger component of near-term Berkshire performance as he lifted his price target on the group's A shares by $35,000 to $645,000 each.

Berkshire bought back around $2.2 billion in shares last quarter, taking the full-year tally to around $9.2 billion.

More Warren Buffett:

- Warren Buffett just sold shares of this popular streaming stock

- 5 questions for Warren Buffett about Berkshire Hathaway's annual report

- Berkshire Hathaway’s annual report shows Buffett’s cash hoard surges

"Though Berkshire did not purchase shares of either company in 2023, your indirect ownership of both Coke and (American Express) increased a bit last year because of share repurchases we made at Berkshire," Buffett said. "Such repurchases work to increase your participation in every asset that Berkshire owns."

"To this obvious but often overlooked truth, I add my usual caveat: All stock repurchases should be price-dependent," Buffett added. "What is sensible at a discount to business value becomes stupid if done at a premium."

Berkshire Hathaway B shares were marked 1.4% lower in recent trading and changing hands at $411.37 each, a move that trimmed the stock's six-month gain to around 15.7%.

Related: Veteran fund manager picks favorite stocks for 2024