Amazon (AMZN) is developing its own AI chips but said it does not want to compete with Nvidia (NVDA) .

On Dec. 3 at AWS's annual re:Invent conference, the e-retail and tech giant's cloud unit said it planned an Ultracluster: a massive AI supercomputer built with hundreds of thousands of its home-built Trainium chips.

💰💸 Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter 💰💸

Amazon wants to position its Trainium chips as a cost-effective alternative to Nvidia's costly GPUs, which most AI training uses today. International Data Corp.'s data pulled by The Wall Street Journal shows that Nvidia currently dominates 95% of the AI chip market.

“Today, there’s really only one choice on the [graphics-processing-unit] side, and it’s just Nvidia,” AWS Chief Executive Matt Garman said. “We think that customers would appreciate having multiple choices.”

Apple is an AWS’s Trainium chip customer. It released its first major generative AI product, Apple Intelligence.

Trainium 2, which costs around 40% less than Nvidia GPUs, is already available, while the new Trainium 3 chip will become available next year.

Related: Legendary billionaire tech investor makes an amazing claim about Nvidia's stock

Despite developing its own chips, AWS continues to collaborate with Nvidia. AWS is partnering with Nvidia on Project Ceiba, another AI supercomputer program.

"It's not about unseating Nvidia," Gadi Hutt recently told Business Insider in an interview. Hutt is a senior director of customer and product engineering at Amazon's chip-designing subsidiary, Annapurna Labs.

“Nvidia is a very important partner for us. It's really about giving customers choices,” Hutt said. “It's not a competition. There's no machine-learning award ceremony every year.”

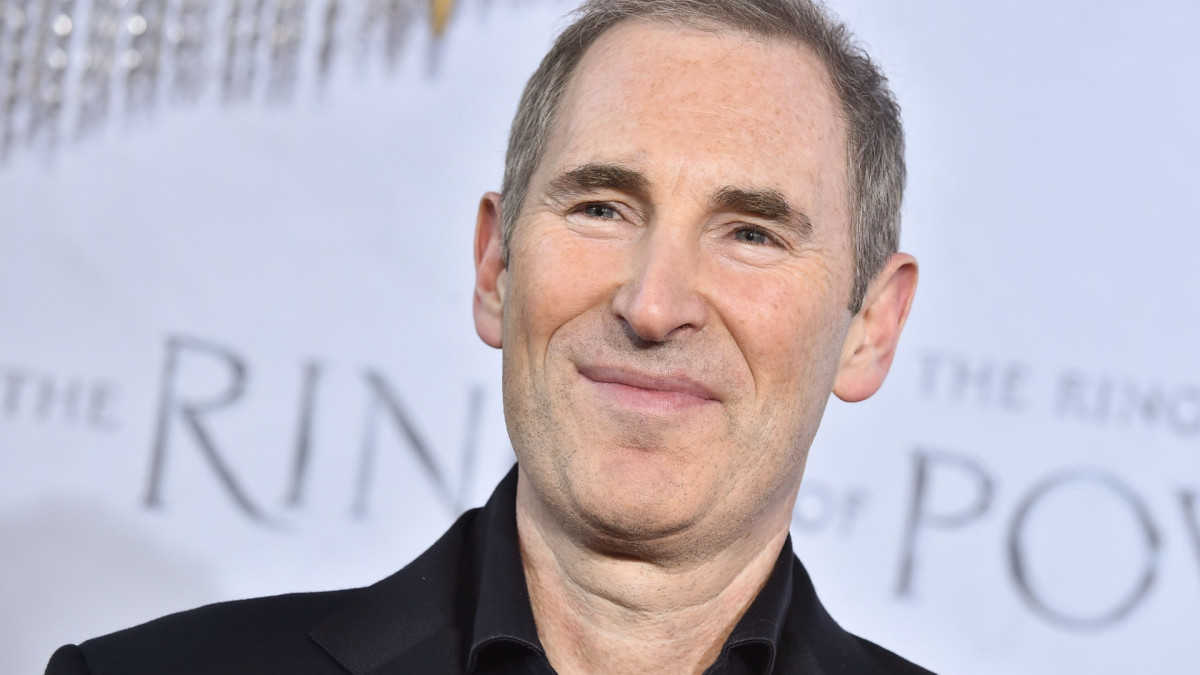

Noah Berger/Getty Images for Amazon Web Services

AWS drives Amazon’s Q3 performance

In the third quarter of 2024, Amazon.com reported net income rose to $15.3 billion, or $1.43 a share, from $9.9 billion, or 94 cents, in the year-earlier period. Net sales of $158.9 billion rose 11% from $143.1 billion a year earlier.

AWS contributed significantly to the results, with sales increasing 19% year-over-year to $27.5 billion, accounting for approximately 17% of Amazon's total net sales.

Related: Holiday shopping season may catapult this formerly battered Amazon rival

The segment’s operating income for Q3 was $10.4 billion, up from $7.0 billion in Q3 2023. This represents about 60% of Amazon's total operating income of $17.4 billion for the quarter.

AWS is Amazon’s cloud-computing service, built to help customers — startups, enterprises and government agencies — lower IT costs and operate more efficiently.

AWS is now the world’s No.1 provider of cloud services, with a market share of 31% in Q3 2024, according to estimates from Synergy Research Group.

Microsoft Azure captured 20% of the market in Q3 2024, while Google Cloud's share climbed to 13% from 12% in the previous quarter.

Analyst raises Amazon stock price target

Investment bank Roth MKM raised its stock price target on Amazon.com to $250 from $220 and maintained a buy rating.

The firm also named Amazon stock its Top Mega Cap pick for 2025, according to thefly.com.

The firm has growing confidence in Cloud demand as Gen AI capabilities move beyond proof-of-concept, with ROI becoming clearer. It credited AWS’s potential for accelerating AI Cloud growth, driven by its leadership in Internet Cloud infrastructure.

Roth highlighted that Amazon's full-stack AI Cloud, including Bedrock, Foundational Models, and in-house silicon, has come together faster than expected.

More Tech Stocks:

- Super Micro's stock price surges after key ruling

- Veteran trader takes a fresh look at Sofi Technologies

- Druckenmiller predicted Nvidia's rally, now has new AI target

The firm also cited Amazon CEO Andy Jassy, who emphasized that AWS's Gen AI investments drive greater retail efficiency, potentially leading to margin improvements.

On Dec. 3, investment firm BMO Capital said AWS would benefit from near-term growth in cloud/AI workloads. The firm has an outperform rating and a $236 price target on Amazon shares.

Amazon stock closed at $226.09 on Dec. 9 and is up 49% year-to-date.

Related: Veteran fund manager delivers alarming S&P 500 forecast