Tesla shares moved lower again Friday, extending their year-to-date slump past 30%, as analysts continue to reset EV delivery forecasts and profit margin estimates ahead of the group's first quarter earnings later this month.

Tesla (TSLA) shares have been under significant pressure since late last year, with declines extended following a weaker-than-expected first quarter profit update that included narrowing margins and a warning that full-year delivery totals would be "notably lower" than they were in 2023

The electric vehicle group handed over 387,000 new cars to customers over the three months ended in March, a 20% decline from the record 484,000 it notched over the final months of last year and the biggest miss to estimates since Wall Street began compiling data in the mid 2010s.

Weaker-than-expected sales figures from China, where last month's volumes fell to the lowest levels in more than a year, are also adding to pressure on the market's aggressive full-year delivery targets for Tesla.

That's compelled Wells Fargo analyst Colin Langan to lower his full-year delivery target by around 12%, compared with his prior forecast of a level that would have been flat with 2023 levels.

Tesla's inventory bloat adds to pricing risk

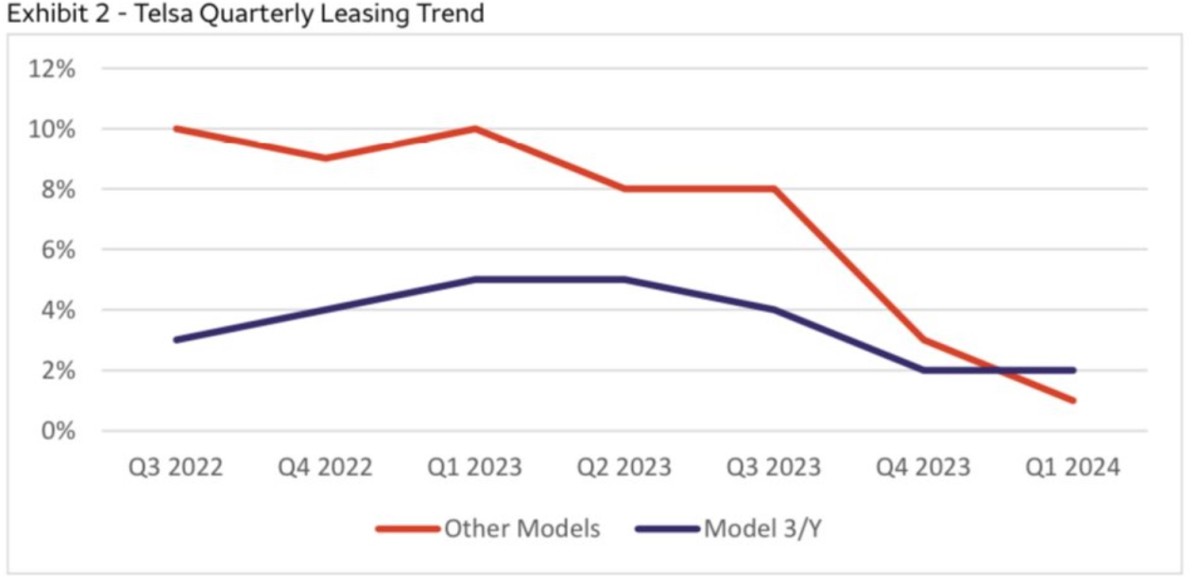

He also noted that Tesla's bloated inventory, which he estimates at around 160,000 units, as well as lower lease rates will add to pricing and margin risks.

Langan, who carries a neutral rating on Tesla stock, lowered his price target by $5 to $120 a share in a note published Friday.

Related: Top analyst reveals new Tesla price target ahead of Q1 earnings

Citigroup analyst Itay Michaeli, who also carries a neutral rating on Tesla, lowered his price target by $16 to $180 a share, noting that “given near-term Tesla demand headwinds (in our view tied to product age, saturation), we still see more downside than upside to our near-term estimates.”

Tesla's profit margins, probably the most closely tracked metric by analysts on Wall Street, narrowed to 17.6% over the three months ended in December, down from a 23.8% margin over the year-earlier period.

Tesla profit margins in focus, robotaxi tease

Analysts expect Tesla to post a bottom line of around 53 cents a share for the three months ended in March, down a third from 85 cents a share over the year-earlier period, on revenue of around $22.6 billion.

Gross-profit margins, based on Refinitiv forecasts, are likely to narrow to around 17.2%, with estimates ranging between 14.7% and 20%.

Tesla is slated to report first-quarter earnings after the close of trading on April 23.

Wedbush analyst Dan Ives, a longtime Tesla bull who carries a $300 price target and an outperform rating on the stock, called the first-quarter deliveries a "nightmare." He said Chief Executive Elon Musk's seeming focus on robotaxis over a cheaper-priced Model 2 sedan could further test investors' patience.

Related: Analyst revises Tesla stock price target after robotaxi news

Ives says that full robotaxi autonomy is likely several years away, while markets are expecting a Model 2 sedan, expected to price in the region of $30,000, sometime in the next 18 months.

Without a low cost model to sell. There isn’t one financial model that any analyst has that works for tesla. They must develop a low cost tesla. $tsla

— Ross Gerber (@GerberKawasaki) April 12, 2024

"With the ongoing debacle around margins and demand, Musk will need to quickly take the reins back in to regain confidence in the eyes of the Street," Ives said. "It all starts with this upcoming conference call and laying out the growth strategy for Tesla in China (and globally) to reverse this negative demand trend."

Tesla shares were marked 1.8% lower in early Friday trading and changing hands at $171.79, a move that extends its second-quarter decline to around 1.8%.

Short interest in the stock remains highly elevated, with data from S3 Partners suggesting it hit a 2024 high of 3.9% of the float outstanding last week.

Betting against the group has been highly profitable, as well, with short sellers up more than $5.77 billion so far this year, according to S3 data.

Related: Veteran fund manager picks favorite stocks for 2024