Nvidia (NVDA) -) has been the stock market’s brightest shining star this year.

But even Chief Executive Jensen Huang’s biggest fans weren’t likely expecting Nvidia’s shares to nearly triple this year or to rally 57% since March.

Real Money analyst Bruce Kamich is among the few who got Nvidia’s rally right. On March 17 he wrote that investors should “look for further gains” before the graphics-chip specialist surprised everyone with blockbuster AI-fueled guidance in May, sending the shares soaring.

Kamich recently updated his analysis, including a new Nvidia stock-price target that will likely frustrate many investors.

SAM YEH/AFP via Getty Images

Nvidia benefits from surging AI demand

Following the successful launch of ChatGPT last December, companies have rushed to launch their own artificial-intelligence initiatives.

While generative-AI applications that are available broadly today focus mainly on searching, digesting and creating content, AI’s benefits could reshape many industries.

Related: Analyst who nailed the 'summer swoon' says buy this now

Health-care companies are designing applications that can help speed drug development, manufacturers hope to use AI to improve production and quality, and financial companies plan to use AI to improve wealth-management and risk controls.

The flurry of investment in AI has created a surge in demand for faster and more energy-efficient chips that can process data better and more cheaply.

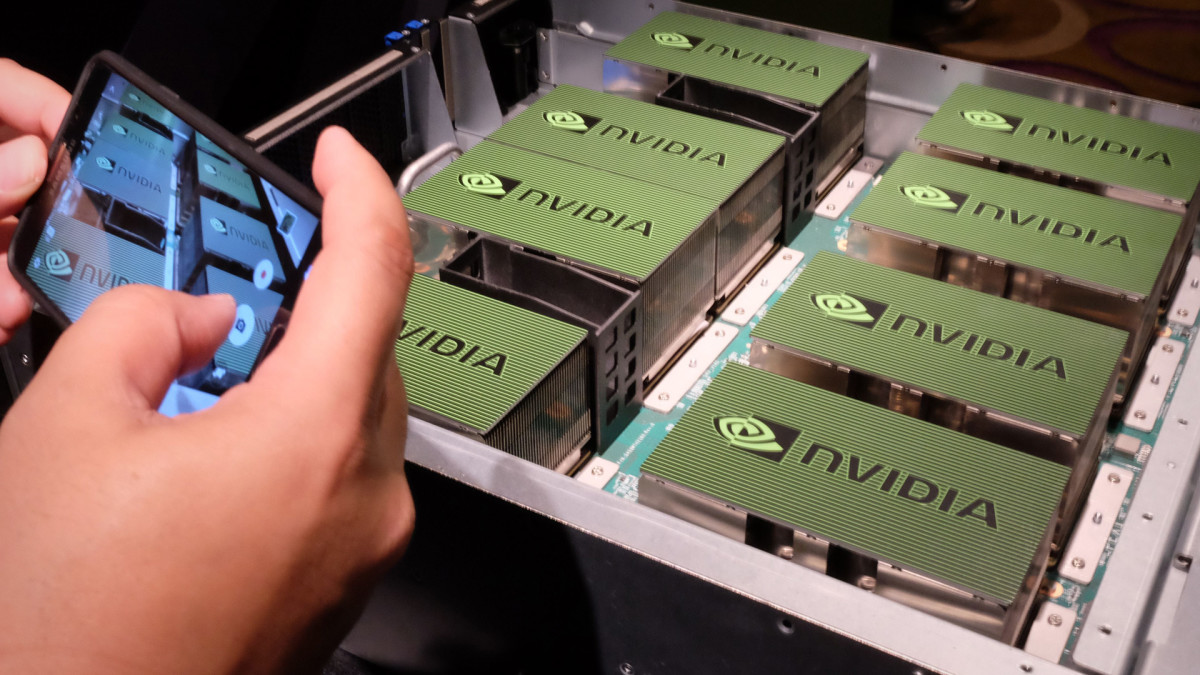

Existing network infrastructure relies primarily on central-processing-unit computing power that’s ill-equipped to train and operate AI applications. So sales of Nvidia’s fastest graphics-processing unit, the H100, are soaring.

And each H100 chip costs as much as $40,000, Nvidia’s sales and profit have taken off. Raymond James estimates Nvidia spends only $3,320 to manufacture each of these chips.

Rising demand and robust margins were behind CEO Huang's surprise disclosure when he increased the company’s second-quarter sales forecast to $11 billion, far north of the $7 billion Wall Street estimates.

Nvidia exceeded its gaudy forecast, reporting sales of $13 billion, and it also upped third-quarter guidance. It expects Q3 revenue of $16 billion, topping analysts' $12.4 billion outlook.

More From Wall Street Analysts

- An analyst that correctly called the bull market in stocks offers a warning many investors won't like

- Analyst who owns Nvidia stock updates his price target after blockbuster results

- 'Market Wizard' stock analyst says we've seen the peak in technology stocks this year

Given Nvidia's financials, saying it's making the most of its AI opportunity is an understatement.

Nvidia’s price charts suggest a new target

Technical analyst Kamich has analyzed price charts for professional investors for more than 50 years. His recommendation of Nvidia in March was based on his analysis of Nvidia’s price and volume action and critical technical indicators.

Following Nvidia’s blockbuster earnings last month, Kamich on Sept. 15 reviewed Nvidia’s daily and weekly charts for new insight. He also used point-and-figure charts to update his price targets.

Unfortunately for the Nvidia bulls, Kamich was unimpressed.

"Nvidia looks like it's not living up to all the hype and expectations," wrote Kamich. "Downside risk has increased."

Kamich noted that on-balance-volume -- essentially a measure of up minus down day volume -- has been stalled for four months, suggesting more active selling than buying. He also pointed out that the moving-average convergence divergence oscillator, a momentum indicator, has weakened since mid-June.

That's not what Kamich wants to see to add conviction for further upside. His price targets don't offer much comfort, either.

Using a daily point-and-figure chart, he calculated a downside target of $401. A weekly P&F chart suggests shares could retreat to $397. At last check Nvidia shares were trading above $434.

Although point-and-figure charts don't indicate when a stock will reach a specific price target, the downbeat analysis suggests that traders take action to protect their gains.

"It reminds me of the CEO being interviewed about the quarter, and he/she says, 'It couldn't be better.' If the quarter couldn't be better, then the next quarter will be weaker. Traders who are long NVDA from lower levels should consider taking profits and/or raising sell-stop protection to lock in gains," concluded Kamich.

Sign up for Real Money Pro to see what other stocks Kamich thinks could be winners.