Analysts' ratings for UiPath (NYSE:PATH) over the last quarter vary from bullish to bearish, as provided by 2 analysts.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 1 | 0 | 0 |

| Last 30D | 0 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

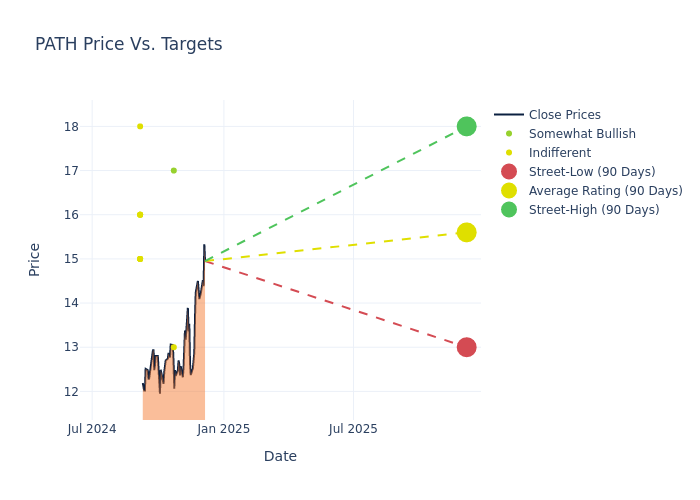

Analysts have recently evaluated UiPath and provided 12-month price targets. The average target is $15.0, accompanied by a high estimate of $17.00 and a low estimate of $13.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 11.76%.

Decoding Analyst Ratings: A Detailed Look

The standing of UiPath among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Mark Murphy | JP Morgan | Lowers | Overweight | $17.00 | $19.00 |

| Michael Turrin | Wells Fargo | Lowers | Equal-Weight | $13.00 | $15.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to UiPath. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of UiPath compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of UiPath's stock. This analysis reveals shifts in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into UiPath's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on UiPath analyst ratings.

About UiPath

UiPath offers an end-to-end cross-application enterprise automation platform. The platform leverages a range of automation technologies including robotic process automation, application programming interface, and artificial intelligence. UiPath's solution can automate a broad range of repetitive tasks across industries including claims processing, employee onboarding, invoice to cash, loan applications, and customer service.

Unraveling the Financial Story of UiPath

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: UiPath's remarkable performance in 3 months is evident. As of 31 July, 2024, the company achieved an impressive revenue growth rate of 10.07%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: UiPath's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of -27.22%, the company may face hurdles in effective cost management.

Return on Equity (ROE): UiPath's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -4.46%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): UiPath's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -3.1%, the company may face hurdles in achieving optimal financial returns.

Debt Management: UiPath's debt-to-equity ratio is below the industry average at 0.05, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: Simplified

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.