Nvidia shares edged higher in early Monday trading, following a month of relatively meager gains, as a top Wall Street analyst issued a bullish price target for the world's third biggest tech giant.

Nvidia (NVDA) shares have added nearly $2 trillion in market value this year, but its gains have largely stalled since the semiconductor stalwart's early-June 10-for-1 stock split. The split followed its stronger-than-expected fiscal-first-quarter earnings report.

The stock's broader prospects have remained largely intact, however, and some analysts have argued that Apple's (AAPL) June 10 unveiling of its AI ambitions and the ongoing surge in Tesla (TSLA) shares over the past month have redirected investor interest.

Related: Analyst adjusts Nvidia stock rating on valuation

Nvidia, with a market value of $3.1 trillion, sits below Microsoft (MSFT) and Apple (at $3.48 trillion and $3.47 trillion respectively) as the world's third-largest company.

UBS analyst Timothy Arcuri, however, notes that while investor sentiment on Nvidia stock "has faded somewhat in recent weeks, creating more of a 'wall of worry,'" he sees the pause as "ultimately healthy" for the stock if the new profit outlook from he and his team materializes.

Acuri, who lifted his Nvidia price target by $30 to $150 a share, sees next year's earnings in the region of $5 a share, with revenue rising past $200 billion. That's thanks to solid sales for its new line of AI-powering Blackwell systems and the ramp up in spending from hyperscalers such as Microsoft, Google (GOOGL) , Meta Platforms (META) and Amazon (AMZN) .

Big AI spenders benefit Nvidia

Hyperscalers in fact are poised to spend around $92 billion this year alone building out their massive computing infrastructure. The investment reflects their clients' move to leverage their massive datasets to enhance sales of everything from drive-through dining to the most complicated pharmaceutical testing.

Related: Fed's Powell testimony, CPI report to roil markets this week

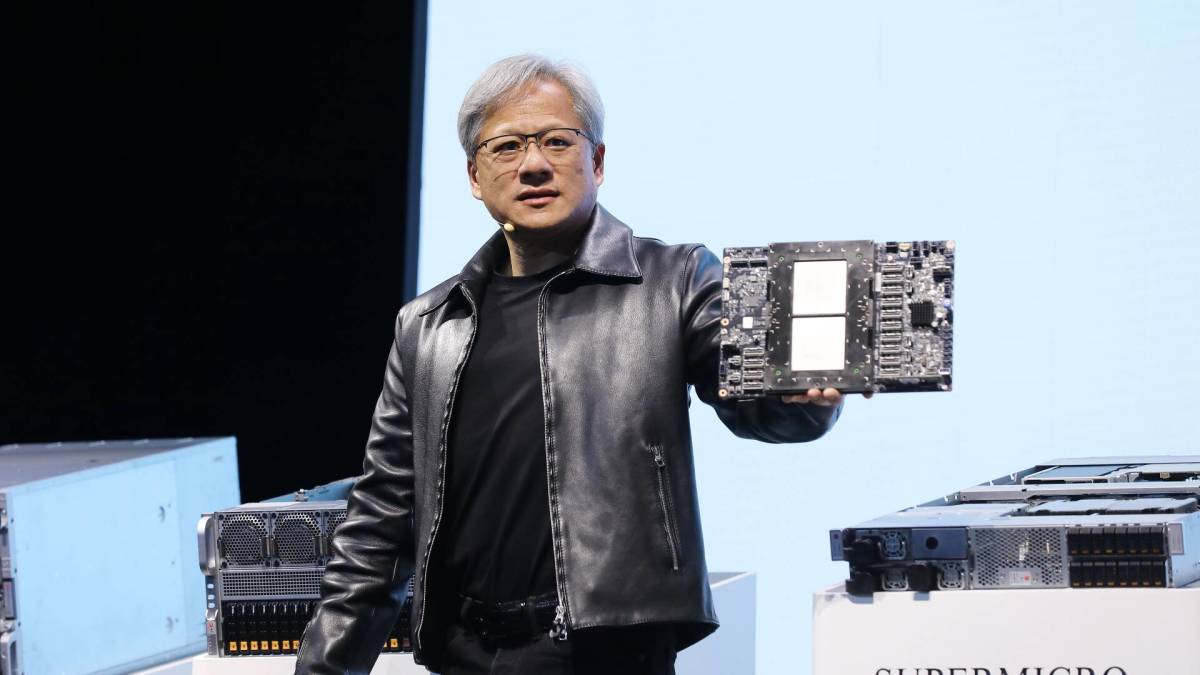

That's helping Nvidia, which earlier this spring launched the Blackwell line of computing processors, which are likely to replace the company's benchmark H100 chips and drive consistent revenue gains.

The new Blackwell GPU architecture, named after the African American mathematician David Harold Blackwell, performs AI tasks at more than twice the speed of Nvidia's current Hopper chips, while using less energy and providing more bespoke flexibility, the tech group has said.

"Our recent supply-chain checks confirm our prior suspicions that demand momentum for Blackwell rack-scale systems remains exceedingly robust," Arcuri wrote. "Even though our estimates have consistently been well ahead of [Wall Street,] we are even now still baking in a gap to what is being suggested by the supply chain."

Arcuri also boosted his 2025 revenue forecast by around 12%, to $204 billion, with earnings coming in just shy of the $5 mark. He maintained a buy rating on Nvidia shares.

"We now believe EPS of ~$5 could be doable for 2025 as the order pipeline for NVL72/36 systems is materially larger than just two months ago as hyperscaler budgets for 2025 firm up," he added.

Related: Analyst resets Nvidia stock price target after trillion-dollar Q2

Nvidia offers a solid near-term outlook

Current-year prospects are also solid, with Nvidia telling investors in May that current-quarter revenue would rise to around $28 billion, with a 2% margin for error. It offered the estimate even as it said the Blackwell system of processors and software wouldn't start shipping until the second half of 2024.

Analysts had worried that a gap between the current H100 chips and the new Blackwell offering would create a kind of air pocket in revenue as customers canceled orders for the older chips and waited for the newer system.

More AI Stocks:

- Nvidia has $4 trillion value in sight as AI seen powering chip sales

- Adobe faces troubling FTC lawsuit for ‘trapping' customers

- Apple plans major change to future iPhones

Nvidia is also moving forward with Rubin, another advanced line of AI-powering chips, which CEO Jensen Huang unveiled during a speech at National Taiwan University in Taipei last month.

Named after the American astronomer Vera Rubin, who is credited with discovering so-called dark matter, the new Rubin systems will be rolled out in 2026, Huang said.

Nvidia shares were marked 1.7% higher in early Monday trading to change hands at $127.98 each.

Related: Veteran fund manager sees world of pain coming for stocks