Molson Coors Beverage (NYSE:TAP) has been analyzed by 5 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 3 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 1 | 0 |

| 2M Ago | 0 | 0 | 2 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

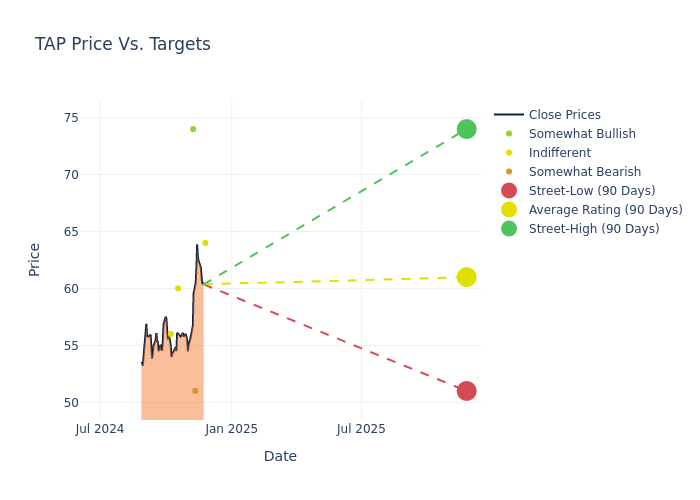

Analysts have set 12-month price targets for Molson Coors Beverage, revealing an average target of $61.0, a high estimate of $74.00, and a low estimate of $51.00. Marking an increase of 12.96%, the current average surpasses the previous average price target of $54.00.

Analyzing Analyst Ratings: A Detailed Breakdown

The analysis of recent analyst actions sheds light on the perception of Molson Coors Beverage by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Kevin Grundy | Exane BNP Paribas | Announces | Neutral | $64.00 | - |

| Lauren Lieberman | Barclays | Raises | Underweight | $51.00 | $49.00 |

| Chris Carey | Wells Fargo | Raises | Overweight | $74.00 | $52.00 |

| Andrea Teixeira | JP Morgan | Raises | Neutral | $60.00 | $57.00 |

| Vivien Azer | TD Cowen | Lowers | Hold | $56.00 | $58.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Molson Coors Beverage. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Molson Coors Beverage compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Molson Coors Beverage's stock. This examination reveals shifts in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Molson Coors Beverage's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Molson Coors Beverage analyst ratings.

Unveiling the Story Behind Molson Coors Beverage

Molson Coors owns well-known beer brands including Miller, Coors, Blue Moon, and Carling and ranks as the second-largest beer maker in both value and volume terms in the us, Canada, and the United Kingdom. Through licensing agreements, the firm also brews and distributes beer and hard seltzer under partner brands from Heineken, Anheuser-Busch InBev, Asahi, and Coca-Cola. The brewer uses independent distributors in the us, given the three-tier distribution requirements, while using a combination of distributors and an in-house sales team in Canada and Europe. North America remains its largest market, contributing over 80% of total revenue.

Unraveling the Financial Story of Molson Coors Beverage

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Decline in Revenue: Over the 3 months period, Molson Coors Beverage faced challenges, resulting in a decline of approximately -7.75% in revenue growth as of 30 September, 2024. This signifies a reduction in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Staples sector.

Net Margin: Molson Coors Beverage's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 6.57%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Molson Coors Beverage's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 1.51%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Molson Coors Beverage's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.74%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Molson Coors Beverage's debt-to-equity ratio stands notably higher than the industry average, reaching 0.47. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

How Are Analyst Ratings Determined?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.