People usually put a lot of thought into choosing the best health or insurance policies to make life easier during difficult times. But sometimes, those very policies can lead to unexpected frustrations and headaches.

A Redditor recently asked, “Americans, what is your insurance horror story?” The responses were a collection of jaw-dropping tales, highlighting the struggles of denied claims, endless paperwork, and customer service nightmares. These stories shed light on how complicated and stressful dealing with insurance can be when things don’t go as planned. Keep reading to dive into these real-life tales of frustration and find out what you should watch out for when it comes to your own policies!

#1

I got super sick when I was 7, and had an extended hospital stay. Unfortunately, it happened during a brief lapse in my Dad’s employment history, so we were briefly between insurance.

I later found out my parents went bankrupt, and my dad had to take on higher paying jobs he hated in order to pay it off.

He eventually worked himself to death - almost literally; he worked so many hours of overtime he fell asleep at the wheel and drove off the road and crashed into a tree. Worst day of my life.

He should have been enjoying his retirement by now; instead he’s been gone for years, and my mom still struggles with depression and being a widow.

America needs universal healthcare.

Image credits: Baelish2016

#2

My dad is an oncologist and he says there has been an uptick in the number of arbitrary denials, by insurance companies, for claims that should absolutely be covered under the patient's plan.

When they're appealed they'll often eventually be approved. But the whole process moves really slow, which can be a death sentence given early treatment is critical when dealing with cancer.

**It almost seems like the insurance companies are delaying s**t on purpose, in the hopes that the patient will die before they have to pay for treatment**.

Image credits: midnightsunofab**ch

#3

My daughter was born with Cystic Fibrosis. We knew she was going to have this due to genetic testing that was done before she was born. She was denied insurance the day she was admitted into the NICU because she had a pre-existing condition since it was known in the womb that she would have CF. I had to fight with insurance literally the day she was born. This was shortly before Obamacare ended that b******t. PS I will never vote for a Republican again in my life for so much as a dogcatcher for how they demonized it because a Democrat passed it.

Insurance is supposed to be that comforting safety net we all rely on when life throws unexpected curveballs. Whether it’s a car accident, a health emergency, or damage to your home, it’s meant to help us bounce back with less stress.

But let’s be honest—dealing with insurance isn’t always smooth sailing. From endless paperwork to denied claims, the process can leave you pulling your hair out, wondering if that “safety net” even exists.

#4

Doctors kept trying to switch pain meds for my wife she was on daily doses of morphine and it was building up in her system too much. Insurance kept saying they need more reasons to switch meds. She died last year to toxic affects of morphine.

I felt joy when that ceo was taken down.

Image credits: MandoHealthfund

#5

My father was a doctor with a pre-existing condition before Obamacare, which meant the only health insurance he could get was through his state's pool of last resort. It took 30% of his income as he was self-employed and working in a very rural area. He was the only physician in his speciality for 75 miles and when things got desperate for his patients would allow them to "pay" in piano lessons, vegetables, whatever instead of cash if they needed to. He had a stroke and "died" on his bathroom floor but lived on life support for 4 more days. $350,000 later, including a 70k helicopter flight for 30 miles, a man who dedicated his life to medicine and donated all of his organs to science died less than broke because of healthcare costs.

Image credits: Misschiff0

#6

My brother was murdered by UnitedHealthcare.

They fought him and denied every single test, treatment, and prescription until it was too late and he was terminal.

One significant issue is the rise in claim denials. A 2024 report by Experian Health indicates that denials have been increasing year over year, with authorization issues and incorrect information being the primary culprits.

The impact of these denials is substantial. Patients often face delays in receiving necessary treatments, leading to deteriorating health conditions. Additionally, the administrative burden of appealing denied claims can be overwhelming, both emotionally and financially.

#7

As a Brit staring down the scope in horror at the US, I genuinely wonder how any of you survive after things like this. Not only my condolences for lost loved ones, irreplaceable property lost, etc ... but my most profound respect for enduring it all. My country is on what feels like the brink of a different form of collapse; our politicans are too busy arguing over f*****g sandwiches to realise the writing on the wall. Collectively something needs to change and its not going to come from government. I wish you all the best, honestly. .

Image credits: En-TitY_

#8

2008 went into hospital for ruptured intestine due to crohns.

Airlifted to Mayo clinic high on fentanyl for the pain.

Spent a month in hospital, came out with no colon and looking like a holocaust survivor.

Wife felt like something was wrong, went into obgyn to check on baby. No heart beat at 8 months. they induced labor.

Buried son.

Received a bill for $110k for Mayo Clinic which the insurance company denied.

Received a bill for $20k for abortion which the insurance company denied.

Spent 4 months of daily calls with hospital and insurance company fighting charges all the way down to $12k.

Image credits: Pickle_ninja

#9

My migraine meds were denied. They allowed me 9 pills per month. On an average day I need two pills. AFter over 6 months of fighting them they finally approved my meds. But only 18 pills per month. I had no choice. I go to fill the prescription. My responsibility was $5. The insurance companies responsibility $0. Fighting me over nothing. The pre-authorizations are out of control. Why do you need to pre-auth. a $5 d**g? That use to be used on expensive and experimental stuff. Not the everyday needs. My buddy had neck surgery 3 months ago. Left surgery with all of his scrips, gets to the pharmacy and his pain meds were denied. He needed a prior-auth. Bullsh*t. The man went 6 days with no pain meds after a fairly complicated rebuild of several of his vertebra. I hated to see the CEO get shot. But also wondered what took so long. I don't like feeling like this. This isn't who we are, or were. But I think we are headed for new territory. Stay safe.

Automation in claims processing, while streamlining operations for insurers, has introduced new challenges. A 2020 study estimated that automated processing saves U.S. insurers over $11 billion annually. However, for patients, challenging a denial can consume significant time and resources.

#10

My father got hospitalized for a week from heart failure. Literally guaranteed death without getting medical help, lungs were filled with fluid and he was effectively drowning.

Insurance decided that the entire stay was completely unwarranted because, according to them, it didn't seem like he was sick enough. They didn't want to cover _anything_ relating to it.

While we were eventually successful, it took years to fight. Bill was in the six figures.

Image credits: aleques-itj

#11

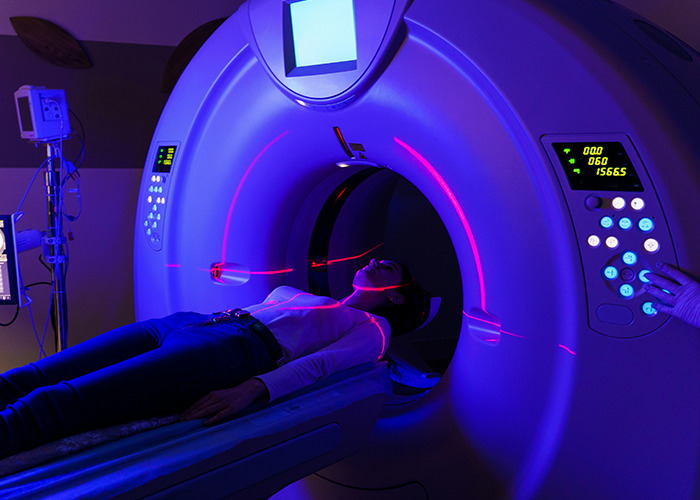

My wife just got her third denial for authorization (from UHC) for an MRI on her hip that her doctor has been trying to get her for over a year.

The first reason: she didn’t submit X-rays. Submitted X-rays, reapplied.

The second reason: she hadn’t done PT before the request. Submitted evidence that she has done PT on and off for seven years, to no improvement, reapplied.

The third reason: she needs to have X-rays done first.

This AI auto rejection cruelty is par for the course.

Image credits: therevspecial

#12

I thank my stars for living somewhere with universal healthcare. My socialist brain cannot simply comprehend the daily trauma you all must go through.

Even the healthiest of people must live in fear. One day you can have it all, the next, through no fault of your own, a stray strand of DNA corrupts and bang, you have cancer and not only do you have to face the fact you could die, but also become bankrupt and end up on the streets losing everything. Just because some faceless corporation says no, our shareholders prefer the money.

On a side note. If you did get cancer and your life saving treatment was denied. And you then decide to take out your frustration on a CEO of a particular faceless corporation, could you theoretically use self-defence as a legal defence? They’re the ‘head’ of the entity that decides you should die, and taking out that frustration is you trying to defend your life.

Common reasons for claim denials include missing or inaccurate data, lack of prior authorization, and discrepancies in documentation. Policyholders are advised to meticulously review their claims and ensure all information is accurate to mitigate these issues.

#13

My mom killed herself because she was afraid her condition was going to get our family kicked off our insurance.

#14

My surgery to remove ovarian cancer surgically was deemed, ELECTIVE. The type I had wouldn't respond to chemo or radiation therapies, but since it wasn't going to immediately kill me it was just cause I wanted it apparently. Had to pay 6k out of pocket.

Image credits: Bubbly_Ad_8072

#15

So, I am a diabetic. My doctor wanted Lantus insulin, but insurance wanted another, cheaper insulin that's not as effective (Basaglar**)**. So my doctor doubled the dosage. So my insurance decided to make the dosage two times 14 days worth (2 weeks a month) instead of 30 days worth so I had to pay the copay twice a month. That meant 28 days a month, and most months except February have more than 28 days. I ended up having to ration my insulin, and the copay went from $25 for 14 days to $65 for 14 days in less than 2 years. That meant I had to go to the pharmacy, stand in line, and get refills, every 14 days. And the pharmacy ran out a lot, so I had to come back. I can't drive, so I had to walk a mile to CVS down the road for this (and other medicines). I just started "buffering" a week at a time just so I could deal with this inconsistency.

"How come your blood sugar never goes down?" the doctor asked. I told him, and he shook his head, saying this was so common. He tried swapping insulin types, or increasing the dosages, but insurance said no. My A1C was like 10.

Then I ended up on Tricare, because I married someone in the military. I got Lantus, Trulicity, and BOOM, my A1C dropped to 6 in less than a year. I know the military has efficiency issues, but I pay nothing out of pocket in Tricare: no copay, no prescriptions, and no fees. It's like $58/month from my wife's pension for the both of us. I mean, socialized medicine WILL work in this country, The companies just don't want it to.

When my first wife died (the military officer was my second marriage), her insurance dropped her because she was dead. Then they sent her a $230,000 hospital bill for her last week of life because she was on a ventilator in critical care. No, I don't live in a communal property state, but they sent her to collections, and heavily implied (illegally) that I had to pay. I didn't.

Let me repeat this: they sent my dead wife to collections. Then lied that I had to pay because she was dead. Bill collectors called me, called me at work, called our son, and even MY sister. Not her sister, MY sister. I had legal notices and bills for her, in her name, coming as late as 8 years after her death. In fact, twice, she had a summons to go to court. Then a summons for arrest for failure to appear in court, however THAT sheriff had common sense and took her death certificate. He even said he was sorry for bothering me.

F*****g crazy.

Image credits: punkwalrus

The human toll of claim denials is profound. Patients report increased stress, delayed medical interventions, and financial strain. In some cases, individuals have been forced to forgo necessary treatments due to insurance hurdles.

#16

My wife had an emergency surgery for a spontaneous retinal detachment. Literally minutes away from going blind. Insurance tried not to pay because she had not gotten pre-authorization, and then after that, claimed a SPONTANEOUS event was a pre-existing condition.

Image credits: therevspecial

#17

Not me, but someone I know was diagnosed with cancer in her early thirties. Her oncologist found cancer cells in her lymph nodes, indicating that it had metastasized, so he ordered a full body MRI to assess where it had spread to. Her insurance denied it because they said she was too young to be considered at risk, despite her actively having cancer. They did eventually approve it, but not without a lot of pressure from her doctor.

Image credits: MyFullNameIs

#18

My girlfriend had kidney failure as a child and had been in dialysis for over 15 years. She graduated college and was working as a teacher. She had to stop due to complications with her condition and go on disability. This was prior to Obamacare so we tried to get coverage from all the insurance companies since it’s impossible for anyone to afford dialysis without insurance. Every single company decline to cover her due to her pre-existing condition. They essentially told her that she was too expensive to live.

Image credits: Myst031

Healthcare providers are also feeling the strain. A survey commissioned by AKASA revealed that nearly 50% of providers have seen an overall increase in their denials rate compared to the previous year, adding pressure to an already burdened system.

To navigate these challenges, it’s crucial for policyholders to be proactive. Understanding the specifics of one’s insurance policy, maintaining thorough records, and promptly addressing any issues can make a significant difference in the claims process.

#19

I underwent treatment for endometriosis and the insurance company would deny my medication and request a prior authorization for every refill. The d**g is approved for this use, so it’s on label. Problem is, I bleed internally because of the endometrial tissue having spread to my digestive tract and adhering to other internal organs. So when they made me do paperwork for each refill, I would be bleeding internally into other organs and into my abdominal cavity while I waited for the medication that blocked the hormone production that caused the bleeding. This condition has caused a 30% paralysis of my digestive tract. So I spent that time in excruciating pain with vomiting. Fun part is it appears to have not worked and I’m trying to get a hysterectomy with the ovaries removed to stop the hormone production and I just know this is going to be a joy to argue with insurance. As if it’s not hard enough to get a doctor to agree to the procedure because “you might want kids one day”. But my ovaries are polycystic and constantly hemorrhagic and I’m technically menopausal. I’m married and in my 30s and we don’t want kids but apparently we aren’t the ones who get to decide that.

#20

Had to call every few days to beg and cry for them to approve a specific pill for chemo-induced nausea. I was supposed to take it the morning of treatment and they would only allow one pill dispensed from the pharmacy at a time, so every few days I’d deal with the anxiety of calling them and begging for approval so I’d be able to tolerate the poison being pumped into me (which…they approved of) I would be on the phone for hours just crying and hoping they’d push it through. My doctors and local pharmacist would call too.

They wanted me to f****n raw dog chemo.

#21

When I was a young teen (early 80s) I was injured in an accident.

Face injury, muscle damage, possible orbital bone break, possible eye injury, etc.

When I got to the hospital, I sat in the ER for over two hours because there had just been a bad multi car accident.

THEN, they didn't want to treat me because they weren't sure the insurance would cover it.

My mom worked FOR THE HOSPITAL (Admin, not medical), it was THEIR OWN insurance .

They wanted her to pay cash to cover a certain percentage, can't remember what exactly, but it was over $2000.

They didn't want a check, they wanted cash. She went across the street to the bank and got the cash.

I got treated, spent a couple days in the hospital, got out and recovered, no orbital break, no eye injury, just a bunch of stitches.

Once the insurance was filed and paid, my mom asked for her money back. They said, "you'll get a check in the mail."

NOPE. She went and literally sat on the administrator's desk until they brought her cash.

They made her pay cash before they would treat me, when I was covered by THEIR OWN INSURANCE, then they would by god pay her back in cash.

Needless to say, she quit that day.

Seeking professional assistance can also be beneficial. There are organizations that offer support to policyholders facing claim-related challenges, providing guidance to ensure rightful claims are honored.

#22

My daughter was born early and spent seven weeks in the NICU. When she got out we got a bill for something like $400,000 and it took months to get the hospital and insurance company to sort it out. We have stacks of paperwork showing that everything has been settled but every so often we get a letter or a call from one of them because they randomly decided that we still owe them $100,000.

Image credits: e36

#23

Took an ambulance ride a while back because I thought my appendix burst. I had never been in that much pain before and I couldn’t walk. I felt silly taking the ambulance though because the hospital is one block away and it would have only taken me 2 minutes to walk there. But walking wasn’t an option and driving definitely wasn’t. I kept getting really dizzy and passing out and couldn’t stay conscious. Anyways…that 30 second 1/4 mile ambulance ride costed me $13,500….

Image credits: PlasticGlitterPickle

#24

A family member was dying of cancer and there was some kind of medication keeping her alive that was $40,000 per monthly dose.

Then her insurance dropped her.

Her family did a GoFundMe, they had in-person fundraisers in town, and so many people came together to contribute. It was heartwarming to see.

They raised enough money for two more doses, two more months, before she died. I don’t know how much longer she would have lived with that medication, I guess we will never know, but at least some CEO got an extra $40K per month for a few months.

While insurance is intended to provide security, the increasing prevalence of claim denials highlights the importance of vigilance, thoroughness, and advocacy in ensuring that policyholders receive the benefits they are entitled to.

#25

I work for a DME company. We exist solely for the shareholders in hopes of packaging and selling the company to a larger company like Medtronic. Our income is largely, perhaps mostly, based on over billing Medicare. We waive patient costs all the time on the basis that we will still make record profits year over year of medicare pays their part less than half the time they're asked to.

This is happening at scale across the entire healthcare industry, the system is utterly vampiric. Healthcare could be so much cheaper if there wasn't an entire for-profit industry dedicated to exploiting our poorly constructed state health system.

Image credits: PositiveChi

#26

My little sister was hired to work in a call center that processed denials. She worked from home during COVID. She doesn’t work for an insurance company they contract this out. People call in, they give their info (usually already on the screen from caller ID) she reads the script. She has no knowledge, no power, no ability to forward their claims to someone who does.

Literally her job is to be a warm body to read the script that says “no”.

People would be begging her, and she would be reciting the script and scrolling Instagram. She had no power, no way to escalate, no knowledge. And this is the person you call when your claim is denied.

#27

I moved to Georgia and had to apply for Medicaid because my job didn't offer insurance. I got an official letter stating, "You qualify for Medicaid. However, we are not going to give it to you." Since Georgia had refused to participate in the Federal Medicaid expansion, I went without insurance for the next 2 years and almost died.

Image credits: NicolePeter

#28

My wife's doctor wanted her to get a 2nd type of breast screen since the mammogram didn't get good visualization, and they didn't like something they saw. The insurance company denied the screen, but had an appeal address. The appeal was right back to the insurance company, which, of course, denied it again. We were forced to shell out $1,000 out of pocket or just hope my wife didn't have breast cancer. Of course, we paid, and nothing was wrong, but insurance companies do not care about doctor recommendations.

$1,000 is a lot of money, but I know there are literally thousands of cases that are worse than ours, and I know that someday, I might need this company that I've paid thousands and thousands of dollars throughout my life to be there to help, and they may just give me the middle finger and watch me die, and crow about their quarterly earnings to their investors the next day.

If any of these stories resonated with you, we’d love to hear your thoughts! Have you ever had a frustrating experience with an insurance claim, or maybe one that went surprisingly well? Share your story in the comments below!

#29

I couldn’t afford insurance as a small business owner. My near death experience has me half a million in medical debt.

Image credits: Pure_Preference_5773

#30

I got hurt at work suffered an amputation on site with no pain meds. They slowly pulled my toes off with my crushed boot.

My family lost our health insurance at the end of the month because I wasn't working. But it's okay cobra was only $2500.

Image credits: Designer_Situation85

#31

Got a bill from an anesthesiologist a week shy of 18 months (and two weeks into the calendar year) after my kid was born for $2000. Insurance tried to tell me the bill would count as the current calendar year instead of when services happened. Took a couple months of "just try and take my money" phone calls but I eventually won. $0

btw.....this was United Healthcare.

#32

Not me, the mother of my wife's work friend. Her house outside of Gulfport AL was flattened by Katrina, and she spent the rest of her life living in hotels and rentals while her home insurance and the government managed flood insurance argued over whether a storm surge is wind or flood damage.

Image credits: Casual-Notice

#33

Husband was getting a stem cell transplant to treat his stage 4 lymphoma. The morning of the procedure, the hospital realized we didn’t have insurance because he had recently lost/quit his job/ran out of FMLA and the previous employer had not submitted the paperwork to COBRA. We had to contact them to fax a form and I had to write a check for $1600 to cover the previous two months of COBRA so his transplant could proceed. If my sister hadn’t have gone to hs with that transplant coordinator and I didn’t have $2k in my bank he wouldn’t be here today.

Image credits: amyloudspeakers

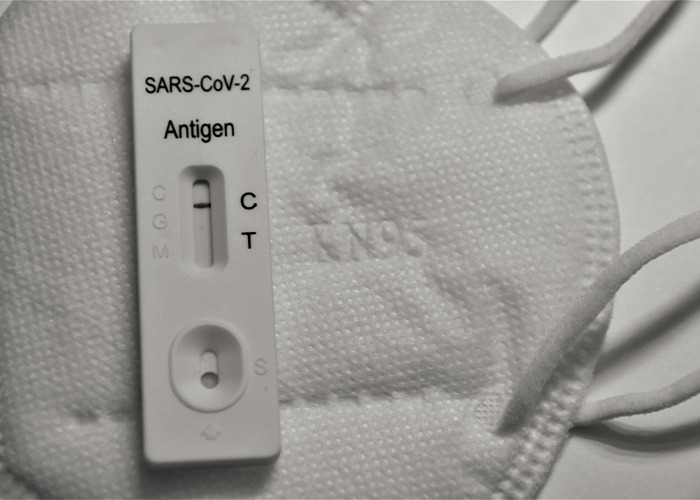

#34

Far less severe than what I'm sure will populate this thread, but a terrific example of the nonsense that is American Health Insurance.

During COVID, I was working for a Hawaii-based organization, but on the East Coast. Someone in my office popped positive for COVID, so everyone in the office went to a testing site to get tested.

My claim for the COVID test was denied, because I didn't go to one of the approved testing sites for my insurer. All of the approved sites were in Hawaii. At the time, you couldn't travel to Hawaii without proof of a negative COVID test.

So. The only way I could get the cost of a COVID test covered was if I went to an approved testing site, but in order to travel to any of the approved testing sites, I needed to show a negative COVID test.

Image credits: WatchTheBoom

#35

For my first pregnancy, everything was covered under my plan without issue. For my second on the same plan, I figured it would be the same. Turns out, the company decided that they would only cover "office visits", and any lab work was not covered in that. No blood work, no ultrasounds, nothing. When I called to get clarification, they were super vague and would just keep repeating "office visits are fully covered", "but what does an office visit include?" "Office visits are fully covered". I was directed to check my plan, which was just as vague. After paying for everything out of pocket, my child has the audacity to be born two months into the new plan year so we had to start all over with the deductible.

Image credits: Hidden_Pineapple

#36

Daughter was born prematurely around Christmas. Spent 3 weeks in the NICU. After a week and a half she was downgraded from NICU level 2 to NICU level 1. Nothing changed. She was in the same unit, in the same bed, she was just no longer on a feeding tube. Insurance counted her downgrade from NICU 2 to NICU1 as a new admission rather than a continuation of care. Because we had crossed calendar years her "new admission" was subject to a new calendar year of copays, deductibles, and max out of pocket expenses. That meant that for a single 3 week NICU visit we were charged max copay, max deductible, and max out of pocket expenses against two years of coverage.

Fought it for over a year before the hospital threatened to take it to collections so we eventually gave up and paid it off. We had a good policy and the max out of pocket for each year was only $4500, for $9000 total for a NICU bill that exceeded $350,000, but that extra $4500 for a SECOND YEAR we knew we shouldn't have been required to pay sure stung...

Image credits: cyclejones

#37

I’ve gone 10+ years with a rotting wisdom tooth since I haven’t been able to afford the extraction.

Got denied at my last muni job, ended up finding another where I would qualify…

…after 6 months probation.

Image credits: DiggingUpTheCorpses

#38

Wife was working for a non-profit using insurance a. She worked for 3-4 years with this insurance a, meeting requirements for length of time to apply towards future maternity leave and what not. About 6 months before she got preggo for the first time, her company switched to insurance b. She asked questions and was assured that the time she had put in towards qualifying for certain maternity leave standards would count.

Cut to the birth, insurance b says she has not been on this plan for long enough to qualify for the benefits that she was assured she would receive. Ended with her being paid half of what she thought and only for 4 weeks because insurance b basically denied her full maternity leave benefits due to the switch made by her employer.

We are lucky to have supplemental income which enabled her to take the full 12 weeks and were pretty frugal folks in general, but it was a total assache and really highlighted the need for universal maternity leave guarantees for employees.

#39

Just spent $1.2k on a routine annual physical with bloodwork because I switched insurances 3 months ago due to job loss and my policy requires 6 MONTH waiting period for anything preventative. Should’ve read the fine print but when I went to go look for it, it was a single line item in a 50 page document

My 5 payments of $50 just went to 27 payments of $50.

Image credits: Daschief

#40

I worked in billing and the amount of patients scammed by Medicare regarding their yearly physical. Yes it's free, but if you deviate on anything it's not free and you're charged for it. So don't tell your doc your knee hurts or you have a hang-nail during that visit. Also check your insurance for colonoscopies. If you do the Cologard at home test, and it comes back positive so you have to go in and have an actual colonoscopy, it may not be covered as "preventative" and you'll get charged.

Image credits: DevonHexe

#41

I’ve been lucky enough to have decent insurance my whole life *except* between October 2016 and February 2017

Lo and behold with my c**p insurance in that five month period, I caught shingles. After spending $200 for my office visit to confirm I had shingles, I was given a prescription for an ointment safe to put on shingles to soothe the burning sensation.

The ointment cost $250. I couldn’t afford it. I cried leaving the pharmacy because I was in so much pain.

I was fully employed, and my boss yelled at me for not doing work from home while I was in agony.

To this day, I make sure my family and I have the best insurance offered. I reluctantly play the game, but I hate it.

#42

Definitely not as bad as others for sure, but being a T1 diabetic, you basically are at the mercy of d**g prices. South Dakota also only has two (if you're not on a corporate plan) health insurance companies which, ironically, are part of the two health systems in the state (Avera and Sanford). My insulin copay seems to change constantly.

The real issue that's stuck in my craw is my blood work. I went to a small clinic/ hospital to get work done and was charged $800+ for routine blood work that typically costs me around 30. Called the clinic and asked why it was so expensive, they said it was because the test was taken in the hospital and not the clinic; that's just their policy. This is awhile ago so I'm not entirely sure if it was a policy of the medical side, or insurance side, but since Avera is both the healthcare AND insurance company....I guess it doesn't much matter.

Months later I mentioned this to my endocrinologist who then mentioned "quick labs." It's an unadvertised blood test that covers everything I need for $75. Of course this is unadvertised.

Anyway, my fellow South Dakota diabetics, ask for Avera quick labs if your current blood work is ungodly expensive. No appointment necessary at participating facilities.

Image credits: littleithephi

#43

Not murican, Canadian here.

2 years ago we rented a house near a beach in northeast usa.

we have 3 kids and our youngest, was 1 year old at that time. she couldn't stop crying it was insane, we tried tylenol and everything we could but at a point we said let's go to the hospital.

I was NOT happy about spending 12 hours in an emergency room during our vacations but whatever to. turns out it took LEGIT 15 minutes in and out of the hospital; she had an ottitis.

I couldn't believe how fast and efficient it was and everyone was happy.

6 months later we received a letter from a collection agency, we owed 18 000$ USD for that 15 minutes visit lol.

we had insurance and we never paid it, but had to fight until recently to get a final letter from them saying we owe nothing.

our insurance company was not happy with how the hospital billed them and decided to request a revised invoice, hospital basically said f**k off and charged us instead.

Image credits: anon

#44

This is super tame and not a terrible ending, but it does show how f****d up the system is. I'm diagnosed ADHD, take adderall. Been using adderall (specifically the name brand) for like 2 yrs, and my 30 day supply costs me $10. I received a notice from my provider that they were dropping adderall from their covered medications. I forget this, and order my meds, and the pharmacist says "that'll be $630"....holy s**t, okay, is there generics? "Yes, but your 'scrip is 15 mg dosage, generics are only 10 mg, you'll need an updated 'scrip from the doctor to get your supply as 1-1/2 10 mg pills." I got it taken care of within a week, but just shows how at the drop of a hat my meds went from covered and 10 bux to not and 600+ dollars.

#45

My company decided not to auto renew our health insurance this year -- and only let us know by email that they were doing this. I came to find in mid December that me, my wife and my four kids will have no insurance in 2025.

They've auto renewed every year except this one and did it because "plans had changed significantly". The plan i had in 2024 is available at the same cost in 2025.

FUN!

#46

Not mine but I was speaking to a doctor who was talking about how he had considered quitting after having to fight insurance about giving people life changing migraine treatments with proven efficiency instead of cheaper minimal to no evidence based medicines that did jack s**t.

#47

Not much of a horror story but more of a "how the f**k is this a thing it doesn't make any sense" type of story. I had to get a type of scan. It was actually cheaper to pay out of pocket than to go through my insurance. It would've cost me an extra $50ish ($250ish vs $300ish) if I went through my insurance.

Image credits: PJ_lyrics

#48

In a place where getting a new cardiologist is a 3 month wait, my mom got a letter from the heart failure clinic saying they no longer accept her insurance. Now it’s up to her GP to monitor until she can get into a new one at the other hospital.

#49

Son was born with a 9mm hole in his heart.

Insurance denied the surgery request from the doc

We found out a day later it was because the doctors office requested the wrong code. But......oooooh boy. There were some dark thoughts that day.

#50

In 2018, our insurer, Optima Health (subsidiary of Sentara) tripled individual market rates in our area after realizing they had a monopoly. Monthly premiums for our family for the cheapest Bronze plan with a $7k deductible jumped to over $2,900/mo.

Our area earned the distinction of having the highest premiums in the country. At the end of the year, we learned that Optima’s premiums were not warranted by cost, resulting in the highest overcharge in the history of the ACA.

The story was [covered nationally](https://www.c-ville.com/out-of-pocket) and an investigation is ongoing.