With a market cap of $85.9 billion, American Tower Corporation (AMT) is one of the world’s largest REITs and a leading independent owner, operator, and developer of multitenant communications real estate. It manages a global portfolio of nearly 149,000 communications sites and a highly interconnected footprint of U.S. data center facilities.

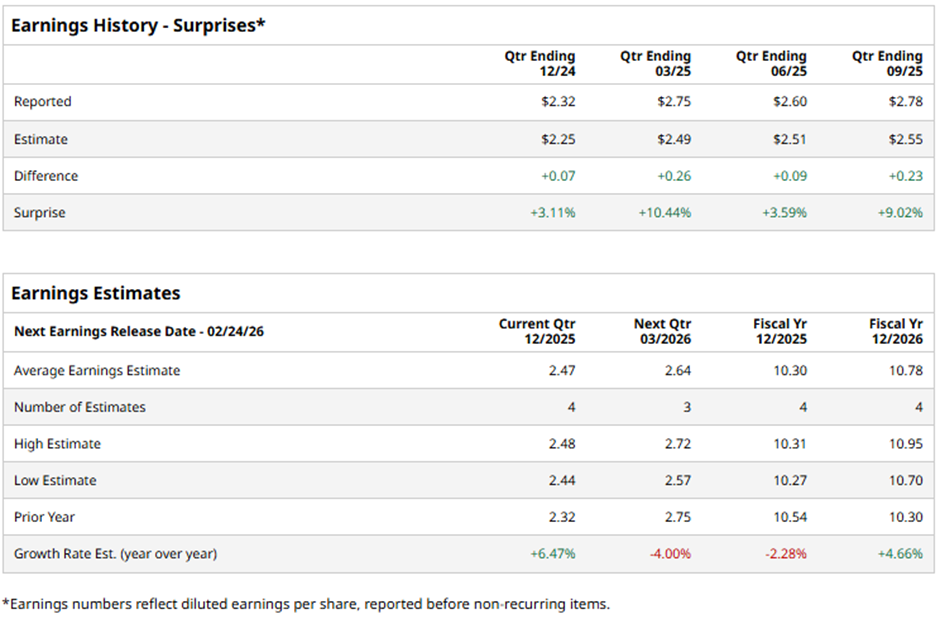

The Boston, Massachusetts-based company is expected to release its fiscal Q4 2025 results soon. Ahead of this event, analysts project AMT to report an AFFO of $2.47 per share, a 6.5% rise from $2.32 per share in the year-ago quarter. It holds a solid track record of consistently surpassing Wall Street's bottom-line estimates in the last four quarterly reports.

For fiscal 2025, analysts forecast the wireless infrastructure provider to report an AFFO of $10.30 per share, down 2.3% from $10.54 per share in fiscal 2024. However, AFFO is expected to grow 4.7 year-over-year to $10.78 per share in fiscal 2026.

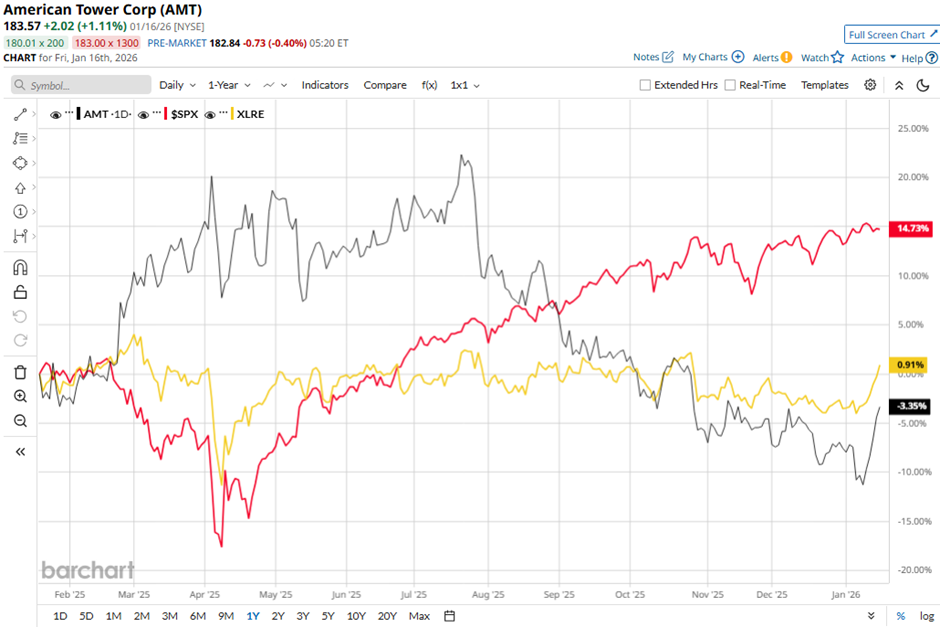

Shares of American Tower have declined 3.4% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 16.9% gain and the State Street Real Estate Select Sector SPDR ETF's (XLRE) 2.7% rise over the same time frame.

Despite reporting better-than-expected Q3 2025 AFFO of $2.78 per share and revenues of $2.72 billion, American Tower’s shares fell 3.7% on Oct. 28 as investors focused on flat U.S. and Canada property revenue and only a 6% overall property segment increase. While the company raised 2025 property revenue guidance to $10.21 billion - $10.29 billion, management disclosed $30 million in revenue reserves related to ongoing legal disputes in Latin America and with DISH.

Analysts' consensus view on AMT stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 22 analysts covering the stock, 14 suggest a "Strong Buy," one gives a "Moderate Buy," and seven recommend a "Hold." The average analyst price target for American Tower is $219.25, indicating a potential upside of 19.4% from the current levels.