Four weeks after Advanced Micro Devices issued a sales warning, all eyes are on the quarterly sales guidance the chip supplier is expected to share in its latest earnings report.

Among analysts polled by FactSet, the consensus is for AMD to report third-quarter revenue of $5.65 billion (up 31% annually, with an assist from AMD’s acquisition of Xilinx) and non-GAAP EPS of $0.69 (down 6%). The top-line figure is close to AMD’s preliminary forecast (issued on Oct. 6) for Q3 revenue of roughly $5.6 billion.

For the fourth quarter, AMD’s revenue consensus stands at $5.95 billion (up 23%), and its EPS consensus stands at $0.80. The company typically shares quarterly and full-year sales and gross-margin guidance in its earnings reports.

Eric Jhonsa, Real Money’s tech columnist, will be live-blogging AMD’s report, which is expected shortly after the close on Tuesday, along with an earnings call expected to feature CEO Lisa Su and CFO Devinder Kumar that’s scheduled for 5 P.M. Eastern Time.

Please refresh your browser for updates.

6:12 PM ET: AMD's call has ended. Shares are up 4% after-hours to $62.06 after AMD posted Q3 results that were roughly in-line with the numbers it pre-announced on Oct. 6 and guided for Q4 revenue of $5.5B (+/- $300M), below a $5.95B consensus but perhaps better than feared.

On the call, CEO Lisa Su noted AMD's server CPU sales to cloud clients more than doubled Y/Y in Q3, and that enterprise server CPU sales fell Q/Q. She also noted AMD expects its Data Center and Embedded segment sales (benefiting from strong server CPU and FPGA demand) to be up modestly Q/Q, and that its Client and Gaming segment sales are expected to be down modestly Q/Q, with channel inventory reductions continuing to weigh.

CFO Devinder Kumar indicated AMD is looking to carefully manage expenses/hiring in the current environment, with Su suggesting AMD will invest more aggressively in the Data Center and Embedded segments than it will in more consumer-centric businesses.

Thanks for joining us.

6:03 PM ET: A question about Q4 Data Center market demand.

Su notes some Data Center markets are much stronger than others. North American cloud is strong, while China cloud is weak and enterprise is seeing some softness. Adds that AMD has good visibility about its cloud clients' future spending plans.

A follow-up question about 2023 console SoC demand.

Su says AMD think there's still some pent-up console demand. Suggests console SoCs will follow normal seasonal trends next year.

5:59 PM ET: A question about how much pricing impacted PC CPU sales versus units.

Su says the Q3 decline was driven more by units. Adds that as Q3 progressed, there was more pressure in the high-end PC CPU market due to inventory-clearing, and that AMD doesn't see a longer-term mix change to its PC CPU sales.

A follow-up question about the Q4 GM guide.

Su notes the Client market is expected to remain weak in Q4. Also says that a mix shift in Data Center revenue towards North American cloud clients has a margin impact, and that new capacity being added is also a factor.

5:56 PM ET: A question about the impact of new China regulations.

Su says there's a minimal impact on AMD's sales in the near-term. Notes the majority of AMD's China business is non-data-center.

A follow-up question about whether the PC CPU run-rate is improving.

Su says AMD drained a good amount of PC CPU channel inventory in Q3, and that its Q4 guide assumes it will drain more in Q4.

5:53 PM ET: A question about AMD's CPU share-gain expectations over the next 12 months.

Su says AMD expects to keep gaining server CPU share across both cloud and enterprise, while adding AMD is "more under-represented" in enterprise. For desktop and notebook CPUs, she says AMD is focused on premium and gaming segments, and is well-positioned in the DIY desktop market.

A follow-up question about whether AMD would be willing to give up some CPU share due to pricing.

Su says AMD's strategy is to not lead on price in the data center, but to differentiate in other ways. Notes the PC CPU market is more price-sensitive, and that AMD will make sure it only goes after profitable business in the space.

5:49 PM ET: A question about the Genoa ramp.

Su says Genoa shipments to "strategic customers" began in Q3, and that this has continued in Q4. Reiterates Milan and Genoa will coexist for a while. Expects both to continue ramping in 2023.

A follow-up question about cloud demand. How much of it is driven by consumption growth vs. share gains?

Su says that while some customers are doing optimization work, they're telling AMD they need more compute capacity, in part to upgrade from older systems.

5:46 PM ET: A question about whether AMD (compared with Intel) was over-shipping PC demand for a while, and one about the impact of tougher pricing.

Su notes Q3 is historically a seasonally strong quarter for PC CPUs, and that this year was different. Also says there were "temporal dynamics" related to aggressive pricing and OEMs choosing to cut inventories. Reiterates that she thinks the PC CPU business is well-positioned.

A follow-up question about wafer capacity agreements.

Kumar says the capacity agreements give AMD visibility for product availability, while adding the company has some "flexibility" to adjust agreements that it will make use of.

5:43 PM ET: A question about Q/Q segment growth.

Su says Client and Gaming sales are expected to be down modestly Q/Q, while Data Center and Embedded are expected to be modestly up.

A follow-up question about opex. How aggressively will AMD spend?

Kumar says AMD will keep investing in "strategic" Data Center and Embedded areas, as well as in its product roadmap. Adds that AMD has slowed hiring and is trying to manage expenses carefully.

Su suggests AMD will be "more conservative" about spending in the more consumer-facing parts of its business than it will be with Data Center and Embedded.

5:39 PM ET: A question about Xilinx visibility.

Su says Xilinx has been "performing extremely well." Notes the business is very broad-based. Says there was some Embedded weakness in consumer products and test/measurement, but that demand was strong elsewhere. Adds that there are still some supply constraints for Embedded, with more supply arriving in Q4, and that AMD thinks it gained some FPGA share.

5:37 PM ET: Another question about Data Center demand. How does demand look outside of cloud?

Su reiterates cloud server CPUs revenue more than doubled, while enterprise server CPUs faced pressures. Says AMD has a very strong cloud position and feels very good about its enterprise competitive positioning as it deals with softer end-demand.

A follow-up question about better monitoring inventory levels going forward.

Su says AMD expected the PC market would be weak in Q3, but that it proved to be weaker than expected, particularly in the consumer segment. Says OEM customers have become more cautious about their inventory levels. Thinks the market will continue to be volatile, but feels good about AMD's position in it.

5:32 PM ET: A question about future gross-margin recovery. Are there actions AMD can take to boost GMs if Client sales don't recover?

Kumar notes there were $160M worth of charges in Q3, and that GM would've been 52% (rather than 50%) if not for them. Says he's optimistic about the ability of new products to provide a margin boost. Think AMD can grow GM from the 51% it expects for Q4.

5:30 PM ET: Another question about PC CPU sales.

Su says AMD is guiding for Client and Gaming sales to be modestly down in Q4, and that the company is under-shipping consumption. Adds that AMD now expects PC units to be down a high-teens % in 2022, and is taking a cautious approach to modeling 2023 PC demand.

5:28 PM ET: AMD's stock is now up 6.8% AH.

5:28 PM ET: A question about the impact of an extra week in Q4.

Su says the extra week AMD will have in Q4 isn't expected to have a material impact on sales.

A follow-up question about PC CPU pricing.

Su says PC CPU ASPs fell Q/Q in Q3, but were still up Y/Y. Says AMD will stay disciplined about pricing. Notes the company saw some "pricing dynamics" in PC CPUs in Q3 and chose not to take some unprofitable sales.

5:26 PM ET: Regarding GM headwinds, Kumar notes that Client sales weakness is a margin headwind, as is the growth of some non-CPU Data Center products and investments to grow supply.

5:24 PM ET: A question about 2023 Data Center growth expectations.

Su says it's early to issue precise guidance for 2023. Notes all of AMD's segments face some macro pressures, while adding the North American cloud market is very resilient. Says that while there could be some near-term "optimization" work by NA cloud clients, demand will grow in 2023.

Su adds that China cloud demand is weak, and that AMD isn't expecting a recovery. Notes enterprise demand is seeing some choppiness due to firms pushing out buying decisions, but reiterates AMD is confident it can take share here.

5:21 PM ET: The Q&A session has started. First question is about when PC CPU sales will bottom.

Su notes the Q4 guidance assumes PC CPU sales will be down again, and says this will be a significant step towards clearing inventory.

A follow-up question about server CPU supply constraints. Su says AMD has made progress towards eliminating supply constraints, and that it expects Genoa won't be supply-constrained when it formally launches.

5:19 PM ET: Kumar says AMD will take several near-term cost-cutting measures, while continuing to invest in long-term priority areas.

5:18 PM ET: Regarding inventories, Kumar says the Q/Q growth was primarily driven by Client products (PC CPUs) and the ramp of new products.

For the Q4 sales guide, he says Y/Y growth is driven by Data Center and Embedded, partially offset by declines in Client and Gaming. Likewise, Data Center and Embedded sales are expected to be up Q/Q, while Client and Gaming are expected to be down.

5:15 PM ET: Kumar is recapping AMD's Q3 financial performance. Notes the top and bottom-line impacts of soft Client demand amid large customer inventory corrections.

5:12 PM ET: CFO Devinder Kumar is now talking. Shares are now up 3.5% AH.

5:11 PM ET: Q3 PC CPU sales are said to have trailed end-user consumption, with Su adding desktop sell-through increased Q/Q.

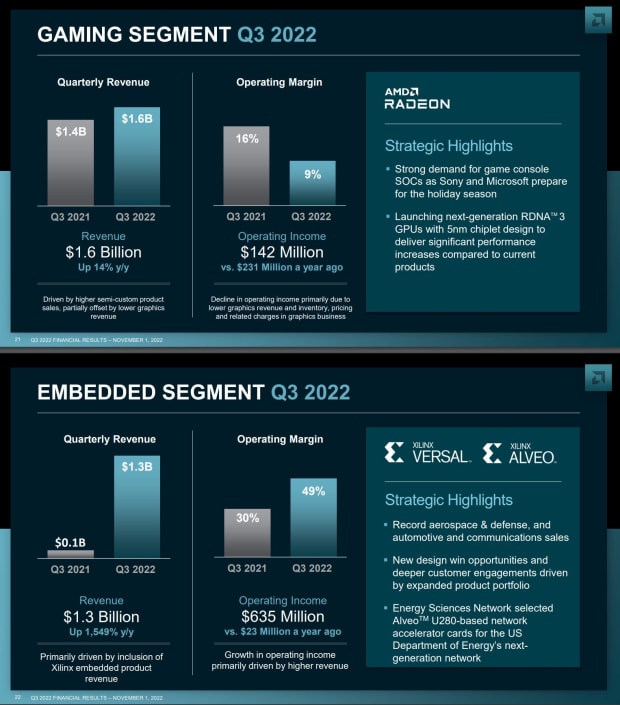

Game-console SoC sales hit a record, and console demand is said to still be strong. Gaming GPU sales were once more hurt by channel inventory reductions ahead of the pending launch of AMD's RDNA 3 gaming GPU line.

Embedded (Xilinx) demand is said to remain strong across end-markets. Communications embedded sales are said to have hit a record. Su says "deeper engagements" with embedded clients that involve both AMD and Xilinx products are driving new design wins.

5:07 PM ET: Su notes AMD's Epyc lineup will broaden in 2023 with the launch of its Bergamo and Siena lines. The former targets cloud giants, and the latter targets telco/edge workloads.

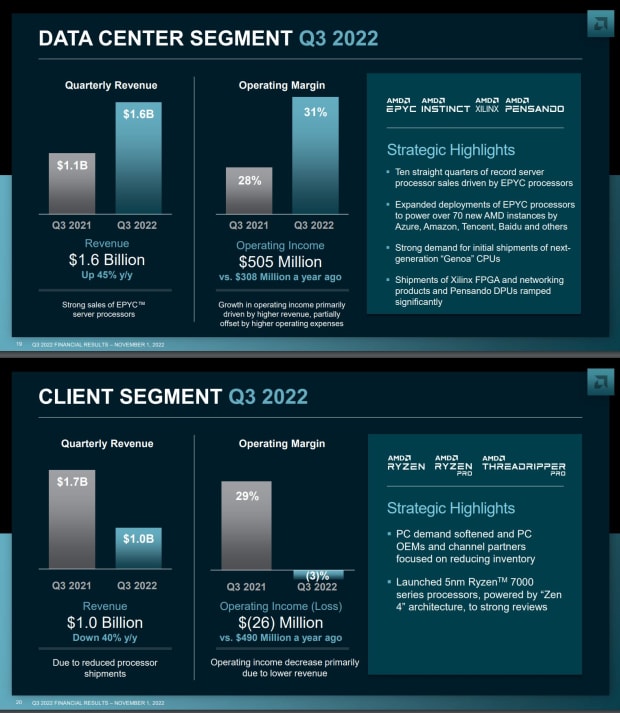

5:05 PM ET: Su reiterates Q3 sales were hurt by weaker PC demand and related inventory cuts. Notes server CPU sales hit a record for the 10th straight quarter, and that cloud server CPU sales more than doubled Y/Y. More than 70 Epyc-powered cloud computing instances launched.

OEM server CPU revenue fell Q/Q due to match-set supply issues and some enterprises slowing orders. Server GPU sales were down significantly Y/Y, due to large year-ago sales related to the Frontier supercomputer. FPGA and networking data center product sales hit records, as did Pensando sales.

5:03 PM ET: CEO Lisa Su is talking.

5:01 PM ET: The call is starting. AMD's stock is up 3% AH going into it.

4:58 PM ET: AMD's earnings call should kick off shortly. Here's the webcast link, for those looking to tune in.

4:57 PM ET: AMD's own inventories totaled $3.37B at the end of Q3, up from $2.65B at the end of Q2. AMD had been making large purchase commitments to suppliers in recent quarters (particularly TSMC), albeit not to the same degree as Nvidia.

4:53 PM ET: A small correction: AMD's original Q3 guidance (issued in its Q2 report) was shared in early August, rather than July.

4:51 PM ET: AMD spent $617M on stock buybacks in Q3, after having spent $920M in Q2.

Q3 free cash flow was $842M (up from $764M a year ago), and AMD exited the quarter with $5.6B in cash/equivalents and $2.5B in debt.

4:48 PM ET: Of note: AMD's Q3 non-GAAP operating expenses came in at $1.52B, up 47% Y/Y (boosted by both the Xilinx deal and organic investments) but below its original guidance of ~$1.64B.

For Q4, AMD is guiding for opex of ~$1.55B

4:41 PM ET: Q3 slides for the Gaming and Embedded segments. With Xilinx having reported revenue of $936M in its September 2021 quarter, Q3 Embedded revenue of $1.3B suggests Xilinx's sales grew strongly Y/Y.

It's worth noting Embedded also includes AMD's sales of embedded CPUs. But on the flip side, it doesn't include Xilinx's data center FPGA sales, which are counted by the Data Center segment.

4:36 PM ET: AMD's Q3 slides for its Data Center and Client segments. Client posted a small op. loss as sales tumbled, while Data Center saw op. income grow 64% amid 45% revenue growth.

Also: AMD says it made initial shipments of its next-gen Epyc CPUs (Genoa), which will be formally announced on 11/10, and that shipments of Pensando DPUs and Xilinx data center FPGAs "ramped significantly."

4:33 PM ET: AMD remains moderately higher: Shares are up 1.3% to $60.44.

4:31 PM ET: Also in-line with the preannouncement: AMD's Q3 non-GAAP gross margin (hurt by $160M worth of charges) was 50%, down from 54% in Q2 and up from 48.5% a year ago.

The company is guiding for a Q4 non-GAAP GM of 51%. The full-year GM guidance has been lowered by 2 points from July levels to 52%.

4:28 PM ET: In line with the Q3 preannouncement, Data Center revenue totaled $1.6B (+45% Y/Y, boosted by strong cloud demand and share gains).

Client (PC CPU) revenue totaled $1B (down 40% amid weak PC demand and large inventory reductions). Gaming revenue totaled $1.6B (+14%, console SoC sales up, gaming GPU sales down). And Embedded revenue (mostly Xilinx) totaled $1.3B.

4:24 PM ET: Here's the Q3 report, for those interested.

4:22 PM ET: Also perhaps helping: AMD says it expects its Data Center (server CPU) and embedded (Xilinx) segments to grow both Q/Q and Y/Y in Q4.

4:20 PM ET: AMD's stock is now up 2.8% AH. Though the Q4 sales guide was light, informal expectations were clearly below consensus.

4:18 PM ET: The full-year revenue guide, which takes into account Q3 results and Q4 guidance, has been cut to $23.5B (+/- $300M) from July levels of $26.3B.

4:17 PM ET: Shares are down 0.8% AH for now.

4:16 PM ET: Results are out. Q3 revenue of $5.57B is close to a preliminary forecast of ~$5.6B. Non-GAAP EPS of $0.67 is slightly below a $0.69 consensus.

AMD guides for Q4 revenue of $5.5B, plus or minus $300M. That's below a $5.95B consensus.

4:10 PM ET: Still waiting for the Q3 report to come out.

4:00 PM ET: AMD closed down 0.7% to $59.66. The Q3 report should be out soon.

3:57 PM ET: Expectations appear subdued: AMD’s stock is down 58% YTD going into its Q3 report. With PC sales known to be weak, AMD’s guidance/commentary for server CPU demand will likely get a lot of attention.

3:52 PM ET: The FactSet consensus is for AMD to report Q3 revenue of $5.65B and non-GAAP EPS of $0.69. But with AMD having already warned on Oct. 6, the company’s Q4 guidance is bound to have a bigger impact on how its stock moves post-earnings. The Q4 sales consensus is currently at $5.95B.

3:50 PM ET: Hi, this is Eric Jhonsa. I’ll be live-blogging AMD’s Q3 report and call.